Advertisement|Remove ads.

Wynn Resorts' Largest Shareholder Loads Up On Shares As Stock Tracks 2-Year Low

Wynn Resorts Ltd's (WYNN) largest shareholder, Tilman Fertitta, has increased his stake in the hotel and casino operator amid recent weakness in the company's shares.

Fertitta bought shares worth $27.87 million in a series of transactions, according to an Investing.com report, which cited securities filings.

At $66.10, the company's shares are at their lowest level in over two years.

Fertitta, who also owns a stake in Golden Nugget casinos, became the largest shareholder in Wynn in November 2024 when he increased his stake to nearly 10%.

Last month, he bought over $1 million worth of shares.

Insiders and shareholders bumping up their stakes typically shows their confidence in the business and is positive for the company.

Wynn is a luxury hotel and casino operator with strong holdings in Las Vegas and Macau. It is also developing its first property in the UAE, which will open in 2027.

The U.S. hospitality sector has shown robust post-pandemic recovery, driven by high leisure and business travel demand, though rising operational costs and economic uncertainty pose challenges.

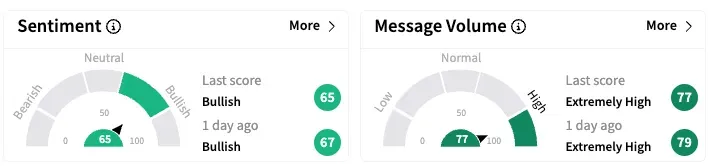

On Stocktwits, retail sentiment held in the 'bullish' territory and message volume was 'extremely high'.

Ahead of Fertitta's latest purchase, some Stocktwits users had flagged the possibility of insiders buying more shares given the recent fall in the price.

However, one user recently expressed frustration over the lack of price appreciation.

Wynn shares are down 23.3% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)