Advertisement|Remove ads.

XPeng Stock Soars To Best Day In Over 2 Years As Analysts See Profit Coming Early — Retail Calls It ‘Ahead Of Tesla’

- Analysts now expect XPeng to turn a profit in the third quarter, moving up earlier forecasts that had predicted profitability in Q4.

- Strong October deliveries, margin expansion, and cost discipline have fueled optimism ahead of the company’s Nov. 17 earnings release.

- Retail traders on Stocktwits compared XPeng’s progress to Tesla’s, citing its rapid growth in EVs, flying cars, and humanoid robots.

XPeng's U.S.-listed stock recorded its best session in over two years on Monday after analysts predicted the Chinese electric-vehicle maker could post a profit as soon as this quarter, earlier than previously expected.

Meanwhile, the company’s Hong Kong-listed stock jumped 15% in early Asian trading on Tuesday.

Bocom International analyst Angus Chan said XPeng is now expected to turn a profit in the third quarter, ahead of earlier projections that forecast profitability in the fourth quarter. Chan attributed the optimism to robust sales momentum, improving margins, and disciplined cost management. October deliveries reached a record 42,013 vehicles, while second-quarter gross margin rose to 17.3% from 14.0% a year earlier, driven by efficiency gains and a better product mix, according to a report by Dow Jones.

The company is scheduled to release its Q3 financial results on Nov. 17.

XPeng Expands Into Robotics And AI

Investor sentiment has also been boosted by XPeng’s aggressive push into advanced technology. The company’s recent showcases, from its IRON humanoid robot to new robotaxi prototypes, have sparked enthusiasm about its potential beyond traditional electric vehicles. While these innovations are still in early stages, they are helping reshape market perceptions of XPeng’s valuation.

“XPeng can expand into new verticals beyond its core battery-electric vehicle business, including extended-range EVs, robotaxis, eVTOL aircraft, humanoid robotics, and AI semiconductors,” said Eugene Hsiao, head of China equity strategy at Macquarie Capital, as per a Bloomberg report. “Investors have started to factor in the potential upside optionality if one of these bets succeeds.”

A Growing Rivalry With Tesla

The company’s growing focus on robotics and AI has also fueled comparisons with Tesla. Last week, XPeng CEO He Xiaopeng posted on X minutes after Elon Musk shared footage of Tesla’s Optimus humanoid robot. “Let this stand as the final proof: the robot that mastered the catwalk is built by a Chinese startup,” He wrote, referencing XPeng’s Iron humanoid revealed at its 2025 AI Day.

The Iron robot features a humanoid spine, flexible skin, bionic muscles, and 22 degrees of hand movement. Powered by XPeng’s Vision-Language-Action model and three in-house Turing AI chips, it can walk, talk, and perform interactive tasks, with commercial rollout expected by late 2026.

Stocktwits Users Compare XPeng To Tesla

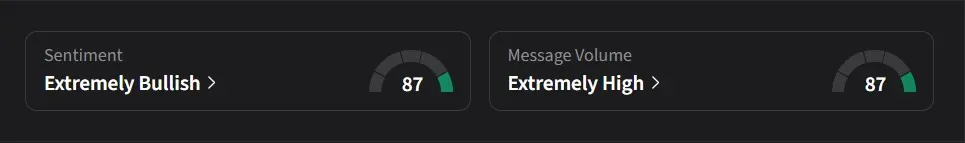

On Stocktwits, retail sentiment for Xpeng was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said XPeng’s rise showed how an EV maker hitting consistent monthly sales records while expanding globally into flying cars, robotaxis, and humanoid robots could outperform expectations, calling it a company that looked “ahead of Tesla” but without the baggage of a trillion-dollar CEO.

Another user said XPeng is “basically a Tesla that delivers actual functional products and has actual fundamentals.”

A third user noted that XPeng had already achieved its 350,000-vehicle sales target for the year and was benefiting from enthusiasm around its robotics projects, adding that investors were betting on strong Q3 results.

A fourth user predicted the rally could keep going at least until December, expressing confidence that the Nov. 17 earnings would “show great results.”

Xpeng’s stock has surged 120% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)