Advertisement|Remove ads.

Xiaomi Stock Snaps 3-Day Losing Streak As EV Unit Turns First Profit And Nears Full-Year Delivery Target — All In Just 18 Months

- Xiaomi’s EV business posted its first quarterly operating profit on stronger SU7 sales and efficiency gains.

- Deliveries accelerated in Q3 and October, putting the company on track to meet its full-year target as early as this week.

- The company highlighted progress in autonomous driving and AI as core to its long-term EV strategy.

U.S.-listed shares of Xiaomi snapped a three-day losing streak on Tuesday after the company reported a breakthrough quarter for its electric-vehicle business, which posted its first operating profit and moved closer to its full-year delivery goal less than two years after entering the auto market.

The stock rose 0.2% to $26.75 on Tuesday after hitting its lowest level in nearly seven months on Monday, a drop that followed Barclays’ decision to cut the stock’s price target to $40 from $43 ahead of its third quarter (Q3) report.

On the company’s earnings call, Xiaomi said its Smart EV, AI and new initiatives segment delivered its first quarterly operating profit of 700 million yuan in Q3, helped by rising sales of the SU7 lineup and stronger factory efficiency.

Deliveries Surge Toward Full-Year Target

The company delivered 108,796 EVs during the third quarter, bringing total deliveries for the first three quarters to 265,967 units. October stood out, with deliveries topping 40,000, and the company said that momentum should be enough to reach its full-year goal of 350,000 units as early as this week. They added that wait times for the SU7 Pro and Pro Max have come down noticeably due to factory upgrades and smoother supply chains, and Xiaomi is continuing to ramp production for both models. The company expects deliveries to keep rising into 2026.

A ‘Young’ Carmaker Scaling Fast

Xiaomi described itself as a “young company” in autos, noting it has been delivering cars for only about 18 months, yet volumes continue to rise on the back of quality reforms and a tighter production cycle. The company has expanded its retail footprint, operating 402 EV sales centers across 119 cities and 209 service locations across 125 cities in Mainland China as of September.

Autonomous Driving Becomes A Core Battleground

Xiaomi said autonomous driving sits at the center of its long-term EV strategy. Its latest EVs use LiDAR-equipped setups supported by major leaps in training data that have expanded from 3 million to 10 million clips, which Xiaomi said has improved driving performance.

The company is deploying its MiMo large AI models, including multimodal and language-based models, to provide intelligent computing capabilities for autonomous driving and improved in-car cabin experiences. The company has also been rolling out updated versions of its autonomous-driving software, highlighting recent improvements and new capabilities.

The Road Ahead

Xiaomi said its EV unit remains focused on scale rather than margins in a market that produces more than 22 million vehicles a year, though the company added that the division’s gross margin is healthy and should be supported by ongoing efficiency gains. It also expects improved operational efficiency to help soften the impact of subsidies and vacancy taxes.

Stocktwits Users Flag Xiaomi’s EV Momentum

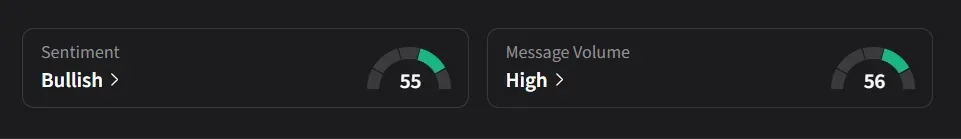

On Stocktwits, retail sentiment for Xiaomi was ‘bullish’ amid ‘high’ message volume.

One user said Xiaomi’s strong revenue, profit, and EV growth were being overlooked by the market, adding that “fundamentals are screaming upside” and the company could look “massively undervalued” if its EV momentum continues into 2026.

Another user said, “$XIACY is going to be what $TSLA claims to be!”

Xiaomi’s U.S.-listed stock has declined 22% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)