Advertisement|Remove ads.

Yatharth Hospital Shares: SEBI RA Rajneesh Sharma Sees 25% Upside Potential

Yatharth Hospital shares have rebounded nearly 45% from their March lows, even as the stock trades at a valuation discount to larger peers.

SEBI-registered analyst Rajneesh Sharma observes that this stock is showing a strong blend of technical momentum and fundamental strength as it expands into underpenetrated tier II and III cities in India, such as Faridabad, Jhansi, and Noida Extension.

According to Sharma, growth triggers include a robust oncology vertical contributing 10% of revenue and a net cash position of ₹500 crore to support growth initiatives.

The company reported 31% growth in revenues at ₹880 crore in FY25, while net profit rose 14% to ₹130.6 crore. Growth and margins have held despite expansion, indicating capital efficiency.

Strategically, Yatharth is consolidating hospital assets in the ₹100 to ₹160 crore range and scaling high-ARPOB specialties post-acquisition, while avoiding heavy debt to preserve operating cash flows.

On the technical charts, the stock price has broken above a 6-month descending trendline in April and held above the ₹495–505 support zone.

Sharma sees the next visible hurdle at ₹538.35, with the potential to rise to ₹630–₹640 by September, if the momentum holds.

He adds that a decisive close below ₹480 would break the rising trendline and negate the current structural thesis.

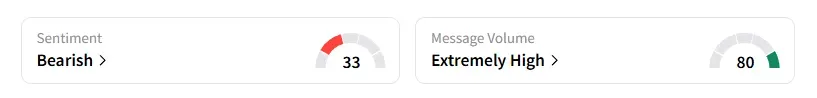

Data on Stocktwits shows retail sentiment flipped to ‘bearish’ from ‘extremely bullish’ a week ago, amid very high message chatter.

Yatharth shares have fallen 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)