Advertisement|Remove ads.

ZoomInfo, Teradata, Thoughtworks: Retail (Mostly) At Odds With Top Wall Street Downgrades

A stark divergence is playing out between Wall Street analysts and retail investors in the tech sector on Tuesday. While top-tier investment banks issued downgrades for three stocks, retail sentiment appears to be mostly defying the bearish narrative.

ZoomInfo (ZI): After a disappointing earnings report and a management overhaul, the company’s stock plummeted 18.27% to a record low of $8.01.

BofA led the charge with an Underperform rating and a price target cut from $23 to $8. Other Wall Street firms, including DA Davidson, Raymond James, and KeyBanc, echoed the bearish sentiment.

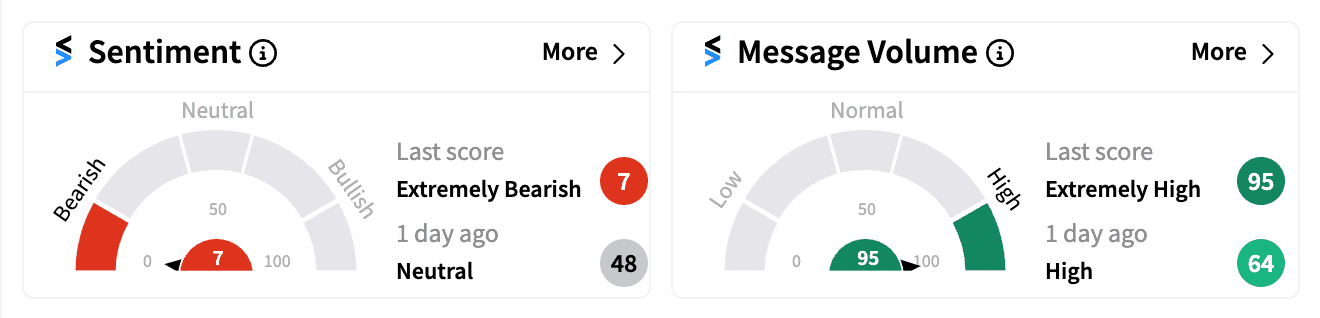

Stocktwits data reveals that retail investors are equally pessimistic, with sentiment plunging to an ‘extremely bearish’ level (7/100), the second-lowest reading this year amid extremely high message volume.

ZoomInfo missed estimates on both the top and bottom lines for the quarter and provided guidance that fell below expectations. Even after launching the AI-powered ZoomInfo Copilot, CEO Henry Schuck’s initiatives for long-term success have not yet convinced investors.

Teradata (TDC): The cloud data analytics company announced a major restructuring and delivered mixed Q2 results, sending its shares down over 13% to levels last seen in January 2021.

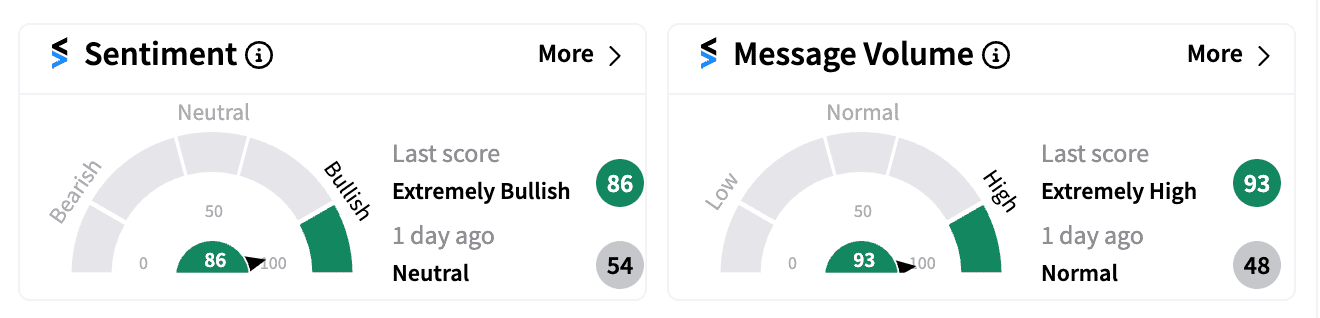

Stocktwits data, however, suggests retail investors are buying the dip, with sentiment swinging from ‘neutral’ to ‘extremely bullish’ (86/100).

Despite at least six other brokerages cutting price targets on TDC, they have maintained their previous ratings on the stock, which could be lending some support to bullish investors.

Thoughtworks (TWKS): JPMorgan downgraded Thoughtworks (TWKS) to ‘Neutral’ from ‘Overweight’ without a price target, following the announcement of a go-private transaction.

Shares of the Chicago-based computer-services company are up 0.12% at $4.32, levels last seen in February. They notched double-digit gains on Monday amid a sharp selloff in the broader market.

The gains came after Thoughtworks announced plans to be taken private by Apax Partners LP in a deal valued at $1.75 billion, for $4.40 per share.

Thoughtworks missed Q2 2024 adjusted EPS estimates but slightly beat sales estimates. Baird also downgraded Thoughtworks to ‘Neutral’ from ‘Outperform’.

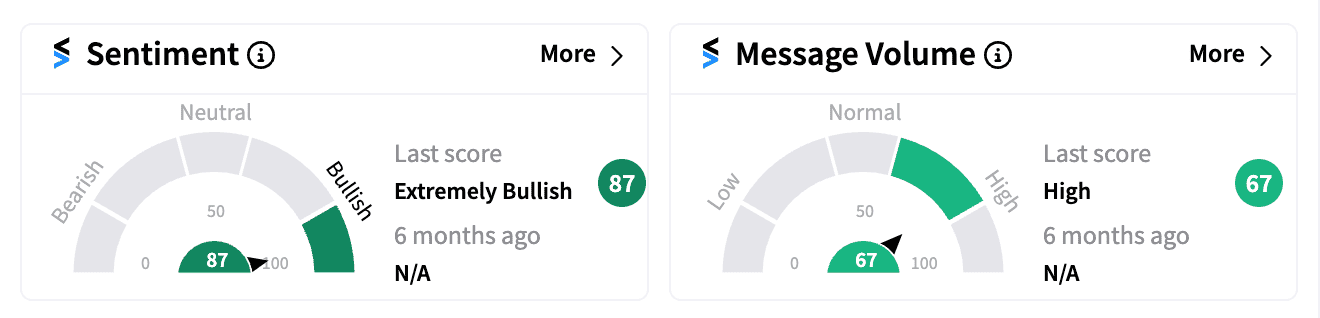

Interestingly, both retail investors and the broader market are unfazed by the analysts' tempered outlook. Stocktwits sentiment remains ‘extremely bullish’ (87/100) amid high message volumes.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)