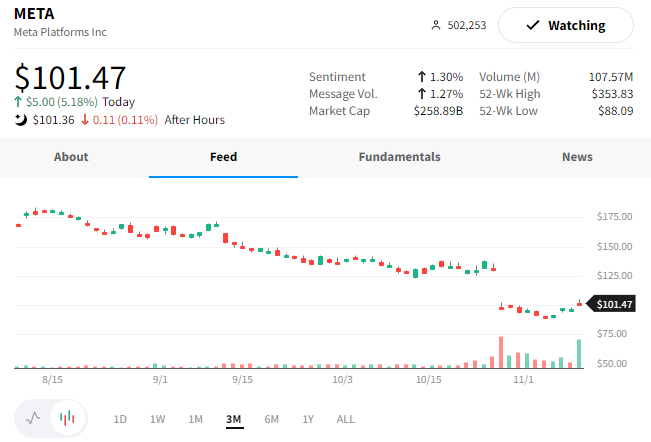

It’s been less than two weeks since Mark Zuckerberg reported that there was trouble in the Metaverse. After a nearly 80% decline over the last year, it looks like he’s finally met his match in angry shareholders.

Analysts and investors alike have not bought into the Metaverse vision. They’ve argued that the company needs to make significant cuts after allowing expenses to balloon 19% YoY to $22.1 billion. Especially as its core business continues to slow and the macro environment weakens further.

So, today, Zuckerberg finally succumbed to the market’s wrath and made the tough call to expand his cost-cutting efforts by reducing headcount. Meta had already frozen hiring and made some reductions, but escalated its efforts by letting go of 11,000 employees (13% of its workforce).

The decision is a difficult one for the CEO. But it’s one that’s already being applauded by investors. $META was one of the few stocks in the green today. 😮

How this turnaround story will ultimately play out remains to be seen. However, many expect today’s cost reductions to be part of a much broader effort by the company to lean down and maintain its profitability while it invests in its long-term Metaverse bet. For now, all we can do is wait and see. 🤷