April’s consumer price index (CPI) was better than expected, continuing its positive trend. However, as we saw in March, core consumer prices remain sticky. 🔺

Here’s a breakdown of the numbers:

- Headline prices +0.4% MoM and +4.9% YoY

- Core prices (ex: food & energy) +0.4% MoM and +5.5% YoY

- Super core prices (ex: food, energy, & shelter) +0.4% MoM and +3.7% YoY

Driving the headline number was a rebound in energy prices, up 2.7% MoM. Food prices were flat, with food at home -0.2% and food away from home +0.4%. 📰

Getting into the core numbers, used car and truck prices rebounded sharply at +4.4% MoM. That’s its first uptick since June 2022, renewing fears that used vehicles will continue their longer-term upward trend. 🏘️

Shelter growth continues to decelerate at just +0.4% MoM. However, it still accounted for over 60% of the total core inflation reading. As a result, investors have begun looking at a “super core prices” index, which includes food, energy, and shelter. That rose 0.4% MoM and just 3.7% YoY. 🔻

Investors are making this adjustment because the CPI calculation includes a significant lag in shelter prices. Real-time data has indicated that housing costs are coming down, so the actual inflation reading is lower than the official numbers state. That theory will continue to work as long as current shelter prices don’t begin ticking up again… 🤷

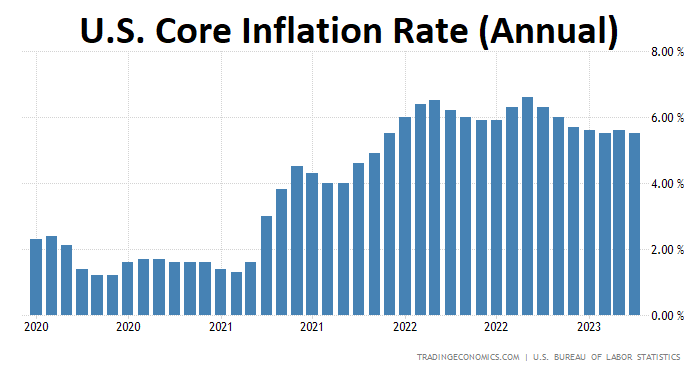

For now, the official core inflation number has plateaued in the mid-5% range. Stalling progress with inflation still a far cry from the Fed’s 2% annual target is not what they want to see. 🥵

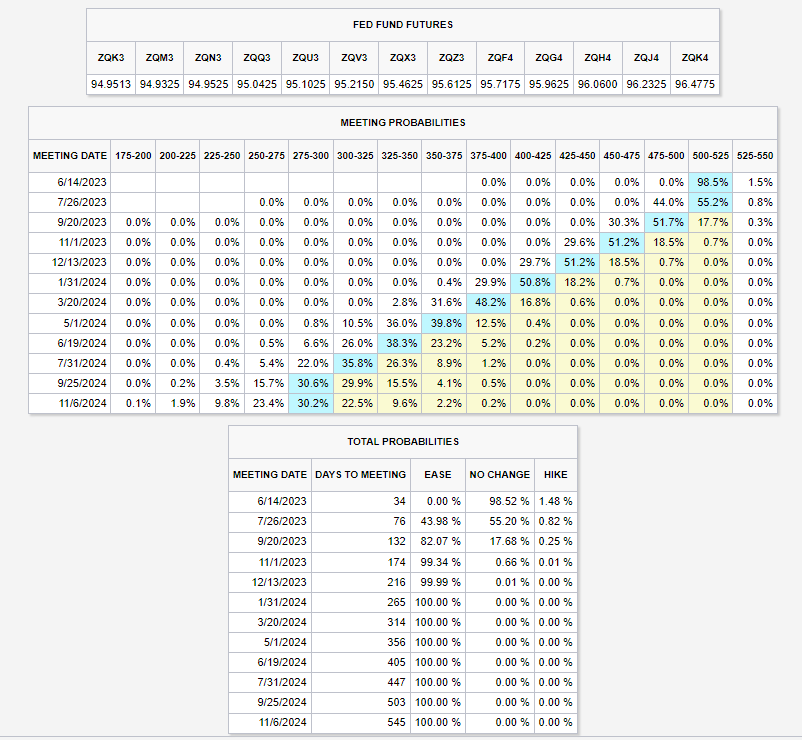

With that said, the bond market continues to think that the Fed has tightened enough and is ready for a change of pace. As of 2:00 pm ET, the CME Fedwatch Tool showed a 98.5% probability of a pause in June, with a nearly 50/50 shot at no change or a 25 bp cut in July. 🔮

We’ll see if that changes with tomorrow’s producer price index (PPI) data. 👀