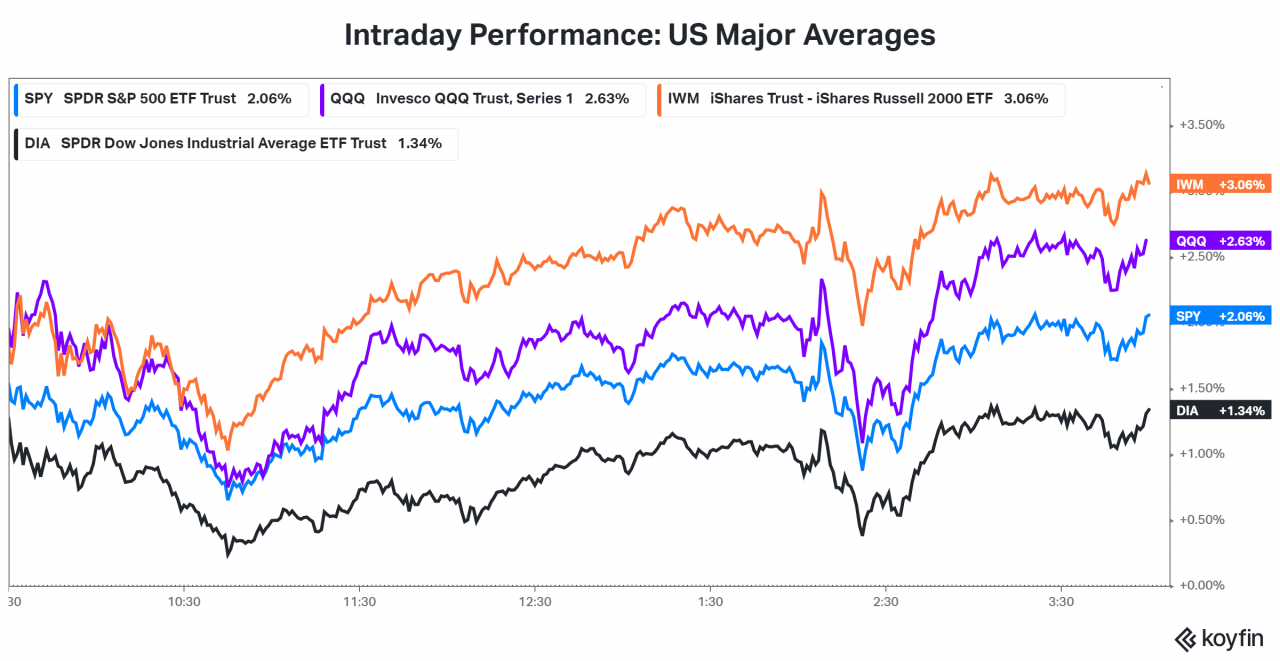

Happy Tuesday, folks! It was a green day on Wall Street and beyond — here’s what you missed.

After a brief pause to start the week, the major U.S. indexes continued their rebound. 🔼

10/11 sectors closed green, led by the risk-on areas: technology (+2.93%), materials (+2.83%), financials (+2.71%), and discretionary (+2.54%).

The health of American shoppers *consumed* today’s news cycle as April Retail Sales data, which rose 0.9% MoM, shed light on how inflation is impacting consumers’ habits. 💰

Walmart slumped after cutting its profit outlook, while Home Depot issued more upbeat guidance but failed to hold its early gains. Read more in our main story.

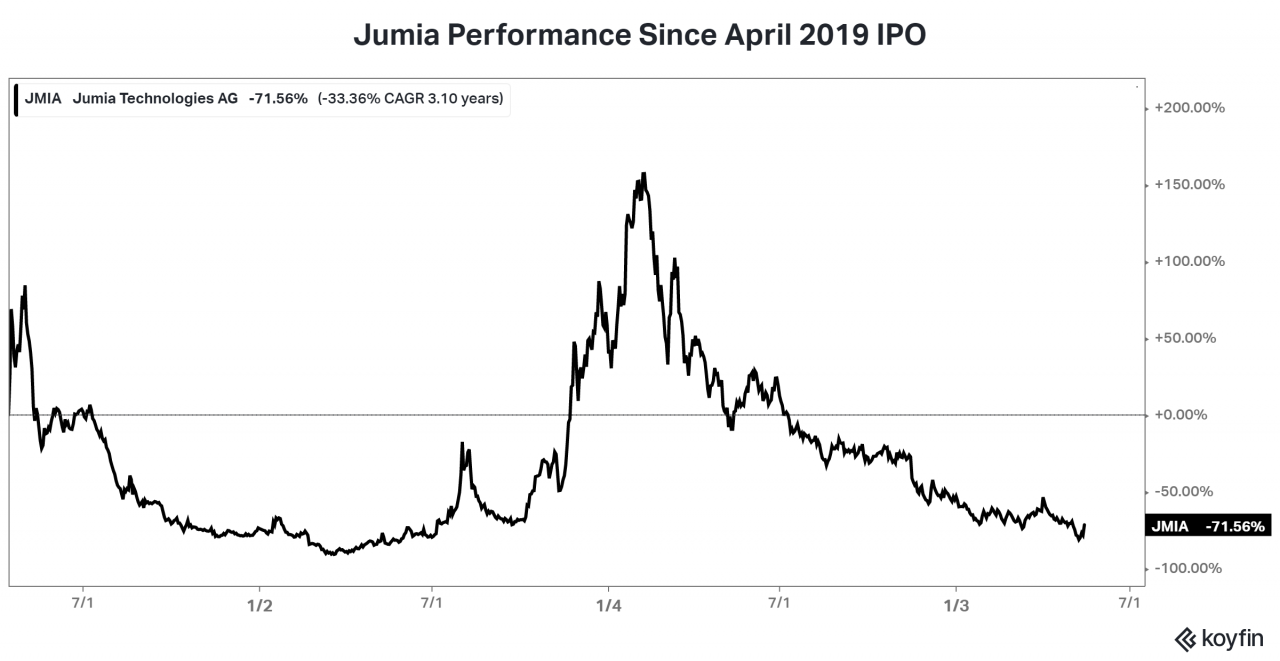

Meanwhile, $JMIA jumped nearly 30% today on strong earnings. 📈 We break it down below.

Other notable earnings include:

Home Depot ($HD) | EPS: $4.09 vs. $3.68 expected | Revenue: $38.91 billion vs. $36.72 expected | Link to Report

Sea Ltd ($SE) | EPS: ($1.04) vs. ($1.23) expected | Revenue: $2.90 billion vs. $2.76 expected | Link to Report

Here are the closing prices:

| S&P 500 | 4,089 | +2.02% |

| Nasdaq | 11,985 | +2.76% |

| Russell 2000 | 1,840 | +3.19% |

| Dow Jones | 32,655 | +1.34% |

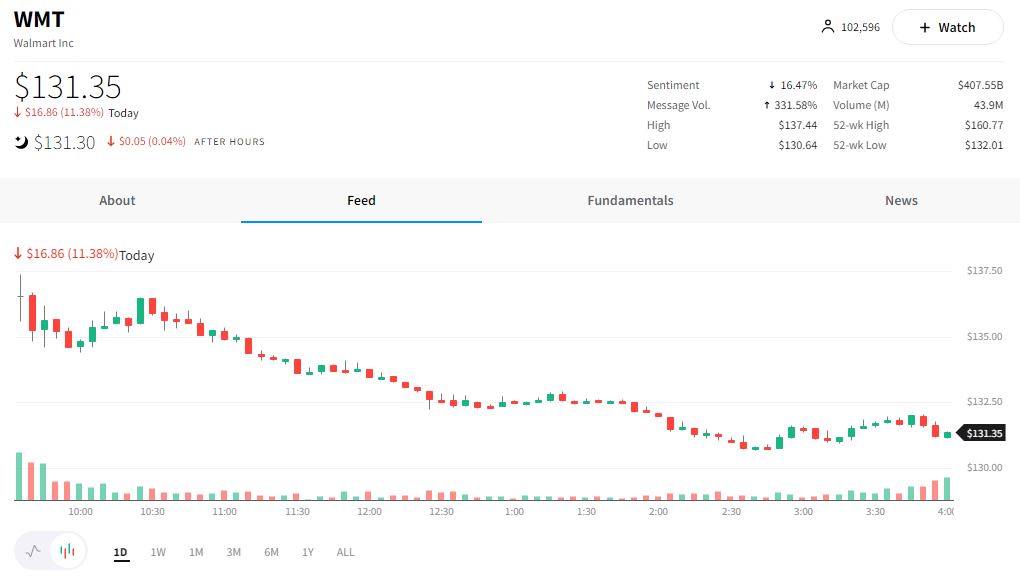

Walmart, the largest U.S. retailer, reported mixed Q1 FY23 results before the opening bell. 🤷

Its adjusted earnings per share missed the $1.48 expected by analysts, coming in at $1.30. However, revenues beat expectations at $141.57 billion vs. $139.09 billion.

Chief Financial Officer Brett Biggs noted that the primary drivers of the EPS weakness were rising fuel prices/supply chain costs, high inventory levels, and overstaffing issues…all of which the company is working to address for future quarters.

Other highlights included:

- Gross profit fell by 87bps to 23.8%

- Total U.S. comparable sales ex-gas were +4.00%, vs. 2.26% expected

- Change in U.S. e-commerce sales +1%, vs 1.84% expected

Given most numbers were broadly in line with expectations, investors are focusing on the company’s updated full-year guidance. The company lowered its earnings-per-share expectations from a mid-single-digit increase to a 1% decline 🔻 and raised revenue expectations from 3% to 4% on a constant currency basis.

The stock gapped down in pre-market trading and trended lower throughout the day, closing off 11.38%. 📉

Today’s news from Walmart provided an important perspective on how retailers and consumers alike are dealing with inflation pressures. 🛍️

Supply chain costs remain a significant headwind on the retail side, with elevated fuel prices and wages. ⛽ Additionally, as the product mix shifts to lower-margin items like grocery, retailers may have to increase promotions to entice buyers of higher-margin items like electronics and apparel.

Meanwhile, consumers continue to shift their spending habits as residual effects from stimulus checks wear off, and inflation remains near 40-year highs. 🔥 The U.S. Retail Sales data reported today also suggested consumers are buying more services than goods as the weather improves and people spend more time outside their homes.

As long as inflation remains elevated, Walmart and the entire retail industry will need to walk a fine line between keeping prices low while not letting profits slip further. ⚖️

We’ll watch what Target’s earnings call adds to the conversation tomorrow before the market opens. 🎯

Jumia shares jumped 31% today after the company reported Q1 earnings. 💸

Here are the highlights:

- Revenue: +44% YoY to $47.6 million

- Orders: +40% YoY to 9.3 million

- Gross Merchandise Value (GMV): +27% YoY to $252.7 million

- Quarterly Active Customers: +29% YoY to 3.1 million

- JumiaPay Total Payment Value (TPV): +36.7% YoY to $70.7 million

Although investors are cheering these developments, growth comes at a cost. The company noted that it continues to spend heavily as part of its growth acceleration strategy. 💰

Adjusted EBITDA loss was $55.3 million for the quarter, up 70% YoY, due to the company’s investments in the areas of sales/advertising and technology/content.

The company’s guidance outlines that it expects an adjusted EBITDA loss of $200 to $220 million for FY 2022, with YoY losses expected to begin decreasing in 2023. 🔮

Even after today’s rally, the stock remains well below its April 2019 IPO price of $14.50.

So is this another failed rally attempt?💩 or the start of a more significant turnaround? 📈

Join the debate on the $JMIA stream!

Bullets

Bullets from the Day

👛 Robinhood looks to diversify away from stock trading by expanding its crypto offerings. The company has announced a new stand-alone app, which will be available in the U.S. and internationally and it will allow users to hold and custody their crypto/NFTs. The move puts Robinhood in direct competition with Coinbase and private companies like MetaMask. Read more from CNBC.

🍞 Soaring wheat prices leave many around the globe hungry for relief. Wheat prices hit new all-time highs this week, caused by war and extreme weather, among other factors. Bread plays a critical role in maintaining stability worldwide, and protectionist measures are on the rise as countries look to protect their food supplies. With Russia’s invasion of Ukraine cutting off nearly a quarter of the world’s supply, the world is desperate for alternatives before it becomes a full-blown crisis. Axios has more details.

📉 Jerome Powell says the Fed will act “without hesitation” to lower inflation. In a live-streamed interview with The Wall Street Journal, the Federal Reserve Chair re-emphasized his commitment to bringing inflation down, saying he will back interest rate increases until prices are back to healthy levels. Powell acknowledged that “there could be some pain involved to restoring price stability” but notes that the labor market is historically strong and would remain so even amid an uptick in unemployment. CNBC outlines his comments.

🤝 Allianz to pay $6 billion fine in U.S. fraud case. The settlement related to the firm’s “Structured Alpha” funds is among the largest in corporate history. Prosecutors claim the fund understated its risks, had significant gaps in oversight, and inflated performance to boost its performance fees — as far back as 2014. The problems came to light after COVID-19 rattled markets, and the funds lost more than $7 billion. More details in Reuters.

Links

Links That Don’t Suck:

👨🚀 Billionaires sent to space weren’t expecting to work so hard on the ISS

🥳 The Fed has a new plan to avoid recession: Party like it’s 1994

🤖 Musk: Twitter deal “cannot move forward” until spam questions answered

🕯️ Scoop: Candle Media acquires digital publisher ATTN: for $150 million

✈️ Biden to expand flights to Cuba, resume family reunification policy

🛸 U.S. official says Pentagon committed to understanding UFO origins

👩🎓 Federal student loan interest rates will increase for the 2022-23 academic year

🦷 Tooth from Laotian cave sheds light on enigmatic extinct humans