The fourth quarter is off to a scorching hot start — let’s recap what you missed. 👀

Today’s issue includes several high-profile headlines, the labor market’s first JOLT, and the chart heard around Wall Street. 📰

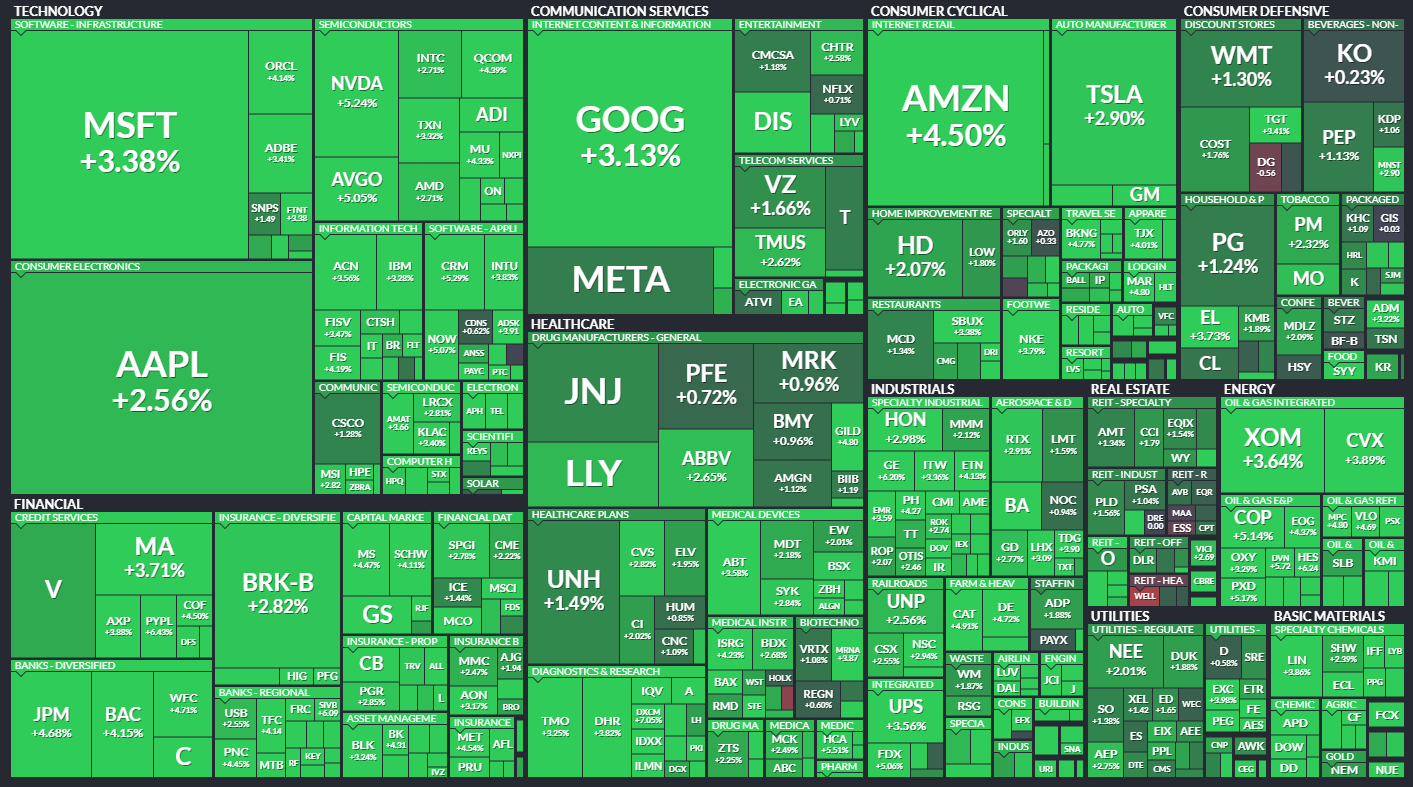

Check out today’s heat map:

Every sector was green, with Energy (+4.30%) leading the charge. 💚

In global news, the Reserve Bank of Australia created hopes of dovish central bank pivots by raising rates by a smaller-than-expected 25 bps. Meanwhile, tensions continue to rise as North Korea launched a long-range missile over Japan, as Putin threatened the West with nuclear action. 🗺️

European lawmakers approved a new law requiring electronic devices to use a common charger (USB Type-C) by the end of 2024. This is highly relevant for Apple, which relies significantly on its unique accessories for additional revenue streams. 🔋

In semiconductor news, many expect U.S. lawmakers to announce new measures restricting Chinese companies from accessing technologies enabling high-performance computing. Meanwhile, Samsung revealed plans to produce the world’s most advanced chips within five years. Lastly, Micron said it would spend up to $100 billion over the next two decades to build a computer chip factory in New York. 🏭

In crypto news, the Treasury’s financial stability watchdog warned cryptocurrencies could threaten the safety of the U.S. economy. Mastercard is pushing deeper into crypto with a new tool for combating fraud. And European Parliament members voted in favor of crypto and blockchain tax policies. ₿

Other symbols active on the streams included: $APE (+12.29%), $AMC (+13.81%), $APRN (-5.06%), $DWAC (-5.26%), $FNGR (+5.54%), $MULN (+9.63%), $AVCT (+9.17%), and $CS (+12.22%). 🔥

Here are the closing prices:

| S&P 500 | 3,791 | +3.06% |

| Nasdaq | 11,176 | +3.34% |

| Russell 2000 | 1,776 | +3.91% |

| Dow Jones | 30,316 | +2.80% |

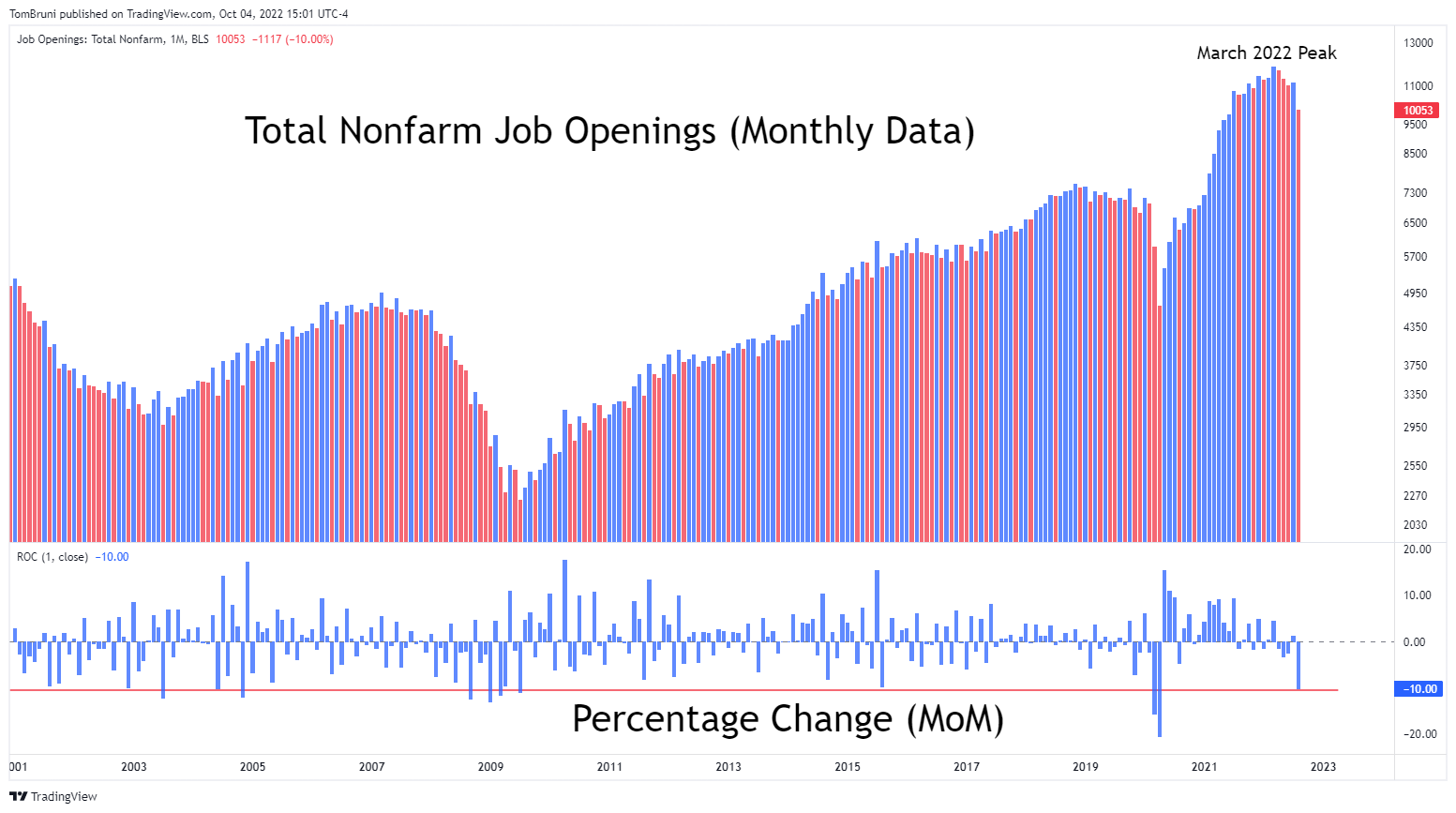

While the global economy and markets have softened throughout the year, the labor market has remained a bright spot. We’ve written extensively about the subject because it’s hard to talk about the Federal Reserve’s war on inflation without discussing how a tight labor market keeps upward pressure on wages and overall inflation measures.

Additionally, it seems that every day there’s a new headline about labor unions demanding more for workers and companies in the service industry raising incentives to attract talent. On the other hand, technology companies continue to cut jobs and freeze hiring as their growth slows. So it indeed remains a “tale of two labor markets.”

With that said, today’s JOLTs data (Job Openings and Labor Turnover Survey) was the first significant sign suggesting that strength may be waning. ⚠️

Today’s report showed that U.S. nonfarm job openings fell about 10% from July to August, from 11.17 million to 10.05 million. As we can see from the chart below, the 10% MoM decline is one of the largest on record dating back to the early 2000s. It also shows that job openings peaked in March of this year at around 11.85 million and have been slowly falling since.

So why is this relevant? Well, job openings tend to be a leading indicator of other employment data to come.

Let’s think about this logically. 🤔

If you’re a business that’s preparing for an economic downturn, you’ll likely start your cost-cutting efforts by making do with the employees you have. In other words, you’ll hire fewer people and ask your current employees to take on more tasks. If your business prospects continue to decline, you’ll reduce staff through layoffs or firings. That will show up in the initial and continuing jobless claims data and, eventually, the unemployment rate. And if your business continues to decline, you might find yourself shutting down and becoming an unemployment statistic yourself.

So what we’re really looking at in this data is the tip of the proverbial iceberg. While the drop is a major one, and we’re trending lower from March’s peak, the number of job openings vs. available workers remains very elevated at around 1.7:1. Additionally, the quits rate remains elevated, and the other measures of labor market stress remain historically low. 🔻

By most measures, the labor market remains stronger than it’s been in a very long time. With that said, today’s data may be an indication of further softening to come.

The Federal Reserve has told us it will not stop until inflation nears its 2% long-term target. It’s aiming to bring down demand by tightening financial conditions, with Powell specifically noting the housing and labor markets as its primary targets in recent speeches. 🎯

What this all means for the stock market remains to be seen. But what’s clear is that the U.S. labor market is cooling as demand softens across the global economy.

And if we needed any more confirmation than the four million articles we’ve referenced in our past issues, check out a couple of headlines from today: Amazon Freezes Corporate Hiring in Its Retail Business and Facebook to purge thousands of workers as part of ‘quiet layoffs’: report. 📰

Company News

Some High-Profile Headlines

There were some major Wall Street players in the news today; let’s find out why. 👀

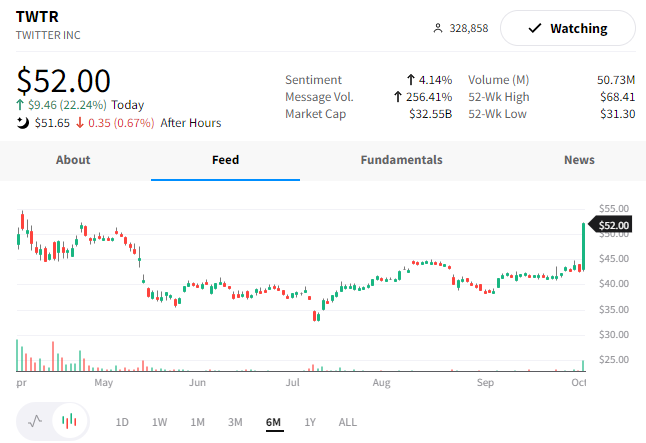

The first is Elon Musk, who revived his deal to buy Twitter at the original $54/share price just days before they were due in court. The news sent shares soaring towards that buyout price before they were halted for about three hours, opening again briefly before the market closed. Twitter confirmed that it received Musk’s letter of intent to complete the transaction at $54.20/share and intends to close the deal with him.

After months of endless drama, the situation appears to be winding down. Some questions remain about the deal’s financing, but overall, the stock market seems to think that the transaction will go through as expected. $TWTR shares closed at $52/share today, reflecting that confidence. 👍

Next up was famous hedge fund titan Ray Dalio, who handed over control of Bridgewater Associates to a new generation of investors. Dalio transferred his majority stake to the board but remains a “meaningful” owner of the $150 billion hedge fund. The 73-year-old billionaire will be a member of the operating board, senior investor, and mentor to the firm’s CIOs.

Additionally, he made headlines today with his view of cash as an asset. In early 2020 he encouraged investors to diversify their portfolios away from cash, coining the phrase “cash is trash.” Today, despite massive routs in stocks and bonds over the last nine months, he’s changing his tune. With interest rates rising and risk assets stumbling, he now sees cash as an attractive alternative. 💵

Some market participants suggest this is a contrarian signal for risk assets, pointing to his past forecasting mistakes.

The market will ultimately decide who is correct, as it always does. But for now, those are the big boys and their big headlines. 📰

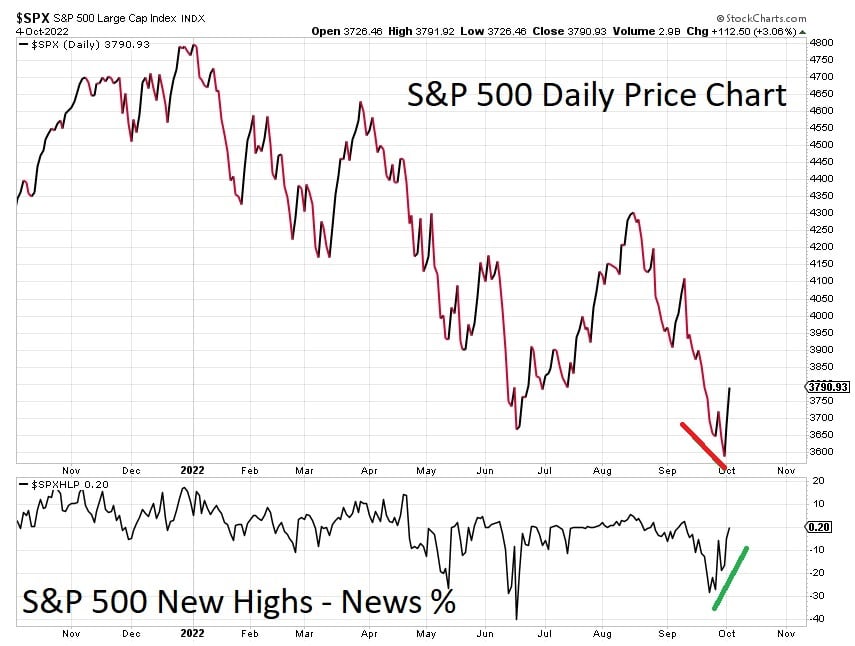

The rally over the last two days has gotten a lot of people excited on Wall Street, specifically some technical analysts. 👀

The reason is that there was an improvement in the “breadth” of the market.

Market breadth analysis measures the health of the stocks that comprise the overall market indexes. The S&P 500 is a market-cap-weighted index, so breadth analysis looks to understand how well (or poorly) the 500 stocks within it are performing. 🔍

One of the most commonly used measures is the New Highs – New Lows Percentage Index. When the index we’re analyzing is in an uptrend or bull market, we generally want to see more stocks making new highs than new lows. However, in typically see the opposite in a bear market: more stocks make new lows than new highs.

Sometimes there can be divergences in the performance of an index vs. its constituents which analysts use as a contrarian indicator.

Let’s look at today’s example: Last week, the S&P 500 index made new lows in price, yet the New Highs – New Lows Percentage Index made a higher low. In other words, fewer stocks made new lows along with the index.

Technical analysts view this as a potentially bullish sign, particularly given the stock market’s strength over the last two days. They suggest that an improvement in market breadth is signaling the market could be undergoing a trend change. This thesis, however, is only valid if prices can stay above their recent lows along with the New High – New Low Percentage Index.

Breadth is a much broader topic that deserves a longer post, but we wanted to put out a quick explainer for those unfamiliar with the concept.

As always, we’ll have to wait and see how this develops in the days/weeks ahead. In the meantime, join the $SPY stream and share your thoughts on this theory. 💭

Bullets

Bullets From The Day:

⚡ Rivian is on pace to meet 2022 goals after strong Q3 production. Electric vehicle maker Rivian Automotive produced over 7,000 vehicles in the third quarter, its highest quarterly totals ever. It also confirmed it’s still on track to produce 25,000 vehicles in 2022. As other automakers struggle with supply chain issues and delays, Wall Street was happy to see some production numbers actually met, sending the stock up 14% today. CNBC has more.

📺 A bundle of streaming news. Services continue to bundle themselves as competition in the streaming wars heats up. However, industry experts say a mega bundle that looks similar to a cable TV-like package won’t happen anytime soon. They argue that larger bundles would likely limit the rate of subscriber cancellations, but it would also reduce the revenue companies make per user. As with anything, a major decision like this comes with its benefits and drawbacks, both for the companies and their customers. More from CNBC.

🥫 A new app to resell unused groceries? There’s an app for everything these days, including a new one that lets users resell food items. Recelery is a ‘grocery sharing’ app designed to help minimize food waste, as an estimated 1.3 billion tons of food items are wasted yearly at a $1 trillion loss. The pantry tracker app and online marketplace hopes that it can help its customers and the world tackle this problem one item at a time. TechCrunch has more.

📱 Instagram and other Meta products get new ads. As ad revenues decline across in a more challenging macroeconomic environment, Facebook is beginning to sell new types of ads on Instagram and Messenger. The announcements come just three weeks before Meta is scheduled to release its third-quarter earnings, where the company and analysts expect a second straight quarter of declining revenue. Long-term, it hopes that virtual reality and the metaverse will drive growth, but in the meantime, it’s exploring any and all ways to boost its advertising revenue. More from CNBC.

😴 FAA’s new rule gives flight attendants more rest. The airline industry has faced tremendous stress over the summer travel season, sparking several new rules from the Department of Transportation and other government agencies. Today, the Federal Aviation Agency announced new rules that airlines must provide flight attendants a 10-hour rest period after being on duty for 14 hours or less. This is up from nine hours and looks to improve the working conditions of airline service workers. CNN Travel has more.

Links

Links That Don’t Suck:

📈 Join IBD for a free online workshop and learn the fundamentals of smart investing. Sign up today!*

⚖️ Arizona AG announces $85 million Google settlement over location privacy lawsuit

🛒 Goodwill launches resale site featuring luxury brands like Gucci and Prada

💰 ‘Tax people in this room’ to help the poor, Shell CEO tells energy conference

🌊 Asteroid that killed the dinosaurs also triggered global tsunami

🍚 White rice is as bad as candy when it comes to heart health: study

📉 Manhattan apartment sales declined 18% in third quarter, as rates rose and markets fell

😮 Liquid Death canned water company is now worth $700 million

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.