After a confident rally over the last four weeks, markets are becoming skittish ahead of Wednesday’s highly-anticipated Fed meeting. Let’s see what you missed today. 👀

Today’s issue covers SoFi’s upbeat outlook, a truckload of auto industry news, and two charts that suggest 2023 could be better than expected. 📰

Check out today’s heat map:

Only one sector closed green. Consumer staples (+0.14%) led, and energy (-2.25%) lagged. 💚

In economic news, the Dallas fed manufacturing index rose from -11.6 to -8.4 in January as manufacturing activity remains weak. On the note of manufacturing, Boeing plans to add a new 737 MAX production line in Everett, Washington, as travel demand keeps its backlog strong. 🏭

Internationally, Germany’s GDP unexpectedly declined 0.2% QoQ, renewing recession fears in the eurozone. And the Dutch health technology company Philips is trying to regain profitability by trimming 6,000 jobs and enacting other cost-cutting measures. ❌

Ryanair shares lost 4% on the day despite posting a record holiday quarter and seeing ‘very robust’ summer demand. 🔻

Shares of Beyond Meat fell 11% on news that Impossible Foods is cutting 20% of its workforce. ✂️

NXP Semiconductors dipped 3% after reporting disappointing results. And Whirpool popped 2% after reporting better-than-expected numbers. 📝

In crypto news, the Birkin vs. MetaBirkin court case could set a precedent for the future of Web3. The missing ‘crypto queen’ Ruja Ignatova has been found alive after vanishing 5 years ago. And Binance is partnering with Mastercard to launch a prepaid crypto card in Brazil. ₿

Other symbols active on the streams included: $ABML (+15.05%), $AMC (-9.07%), $BBBY (+12.55%), $MULN (-0.12%), $GNS (+24.30%), $HLBZ (-12.59%), $GMVD (+80.33%), and $PBTS (+5.34%). 🔥

Here are the closing prices:

| S&P 500 | 4,018 | -1.30% |

| Nasdaq | 11,394 | -1.96% |

| Russell 2000 | 1,886 | -1.35% |

| Dow Jones | 33,717 | -0.77% |

Earnings

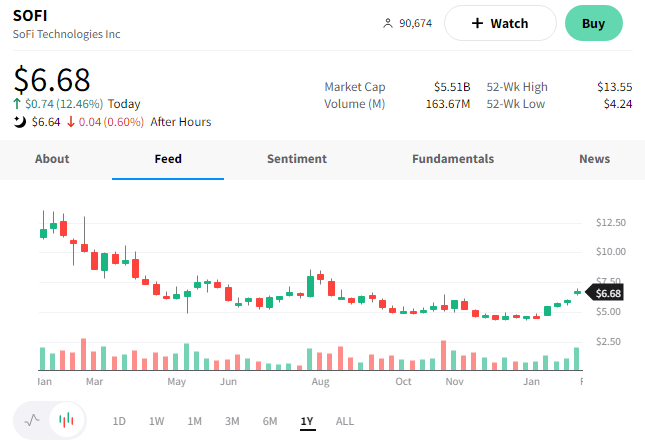

SoFi Soars On Sweet Outlook

SoFi Technologies has had a rough time since its IPO but received a boost today after reporting better-than-expected earnings. 🏦

The digital financial service company had a $0.05 per share loss vs. the expected $0.09 per share loss. Total net revenues of $456.7 million also beat the $423 million analysts expected. Its fourth-quarter adjusted EBITDA was up over 15x YoY to a record $70 million.

In addition to this quarter’s positive results, executives see the strength continuing into 2023. They now expect $260 to $280 million in adjusted EBITDA for the full year, well above analysts’ $246 million forecast. They also believe the company could generate positive GAAP net income in the fourth quarter of 2023. 💪

In terms of other stats, its total members rose 51% YoY to over 5.2 million. And total product adds were up 53% YoY to roughly 7.9 million.

Like other consumer-oriented financial services companies, it saw net interest income rise sharply and set aside additional reserves for credit losses as the economy softened. Additionally, personal loan originations are rising, offsetting weakness in their student loan and home loan segments. 💵

Overall, expectations were trending lower for the company and its stock price. But today’s beat and stronger outlook could be a turning point for its business and share price.

That’s at least what some investors are betting, as $SOFI shares were up 12% on the day. 📈

There are many reasons to be pessimistic about the economy and markets. But one money manager says that history suggests that’s the time to take a bullish stance. 🐂

Let’s look at two charts shared by Ken Fisher in this New York Post article.

The first is a chart of recession expectations, which have risen to their highest level in the survey’s history. Roughly 43.5% of the professionals participating in this survey expect a decline in the level of chain-weighted real GDP in the current quarter.

In other words, they’re not optimistic about the economy. And the article argues that this widespread anticipation will lead to a mild downturn — or none at all. That’s because people are already taking steps to mitigate risk in their businesses and lives in anticipation of things worsening. 😨

The second reason for optimism is around historical prices. The article shows a series of data points that argue that the higher probability bet is to expect a strong year for stocks after the dismal year we just had. And based on this data, 2023 lines up with many of these characteristics that typically experience positive stock market returns. 🎯

While making an investment decision based on two data points alone is impossible, they at least offer some contrarian food for thought. 🤔

Company News

Auto Industry News

Auto stocks continue to trend heavily after last week’s earnings report from Tesla. As a result, there was a lot of auto news to recap today. 📰

First up, Toyota Motors managed to defend its title as the world’s top-selling automaker for the third straight year…despite falling sales. The company sold 10.5 million vehicles in 2022, with Volkswagen Group behind it at 8.3 million vehicles. 🏆

Next, Renault and Nissan agreed to a sweeping restructuring of the alliance they’ve had in place since 1999. Renault is set to transfer 28.4% of Nissan shares into a French trust, reducing its stake from 43% to 15%. While Renault would still receive the economic benefit of these shares, its voting rights would be discarded for most corporate decisions. The move equalizes the companies’ cross-share holdings and gives them each the ability to freely exercise the voting rights of their 15% direct shareholdings. 🗳️

Thirdly, Tesla continues to lead the charge in the electric vehicle space as competitors look to follow its lead. After Tesla’s recent price cuts, Ford is now increasing production and cutting prices on its electric Mustang Mach-E crossover to improve affordability and spur demand.

This likely isn’t the last time we see something like this, as the industry’s global players continue competing fiercely for customers. 🔻

Lastly, the short squeeze in Carvana continues, with shares rising another 28% today. 📈

Auto names like $LCID, $TSLA, $CVNA, $PEV, and more continue to trend regularly and will be a highlight of earnings season as they report. 👀

Bullets

Bullets From The Day:

🤖 China’s Baidu is launching a ChatGPT-style bot. The internet search giant plans to go head-to-head with OpenAI’s ChatGPT by launching a similar artificial intelligence chatbot service in March. While the initial plan is to establish the service as a standalone application, it will merge the technology into its search platform over time. The company has recently invested heavily in AI technology as it looks to diversify its revenue sources. Reuters has more.

❌ Court rejects J&J’s bankruptcy strategy for mass-dismissing lawsuits. The company had attempted to resolve a multi-billion dollar lawsuit over claims that its talc products caused cancer by using a commonly-used approach involving moving the liabilities to a subsidiary and filing bankruptcy. However, the U.S. 3rd Circuit Court of Appeals in Philadelphia removed the subsidiary from bankruptcy, leaving it to face more than 38,000 legal claims. Johnson & Johnson said it would challenge the ruling and maintained that its products are safe. More from CNBC.

🤑 The fintech industry’s $275 million all-cash deal. Marqeta is acquiring the two-year-old fintech infrastructure startup Power Finance for $223 million in cash, with an additional $52 million payment if an undisclosed milestone is met within the next 12 months. The purchase will allow Marqeta to expand and significantly accelerate the capabilities offered in its credit product. Upon the deal closing, Power Finance CEO Randy Fernando will lead the product management of Marqeta’s credit card platform. TechCrunch has more.

📵 China’s smartphone sales plunge to lowest in a decade. Hampered by COVID lockdowns and a slowing economy, the country’s smartphone sales fell 13% to their lowest volume since 2013. The total number of devices shipped was 286 million vs. 329 million in 2021. The top-selling brand commanding an 18.6% market share was Vivo, and its total shipments fell 25.1% YoY. Meanwhile, Apple was the third best-selling phone brand, with sales falling 4.4% YoY. With that said, the weakness wasn’t just China-specific. Global smartphone shipments fell more than 11% YoY to 1.2 billion. More from Reuters.

💻 Don’t come to work anymore, but keep your computer…? Twitter is trying to find cash wherever it can, even auctioning off office supplies and equipment from its San Francisco headquarters. Yet despite those efforts, the company has reportedly abandoned hundreds of thousands of dollars worth of company laptops with the employees it fired. That’s left some former employees to wonder why there hasn’t been an effort made to collect them, especially if there’s sensitive information on them or if they can be sold/reused. WIRED has more.

Links

Links That Don’t Suck:

🤩 Astronomers say they have spotted the universe’s first stars

🏆 Trader Joe’s 14th annual customer choice awards winners

🤦 New Zealand-bound plane flies 13 hours only to land where it took off

🧟 The zombie fungus from ‘The Last Of Us’ is real — but not nearly as deadly

☕ This 136-year-old London coffee store doesn’t need to move with the times

☄️ Meterotite containing material billions of years old discovered in Antarctica

🚗 Major insurers plan to drop coverage of two Kia and Hyundai models due to thefts

🧑💼 “Managers managing managers”: Mark Zuckerberg hints at more Facebook layoffs

😂 Fyre Fest fraudster Billy McFarland is back — and asking $1,800 an hour for ‘consulting’

😮 Three months ago, he was laid off from Twitter. Now, his competing app Spill is funded.