After initially opening well in the green, stocks, bonds, and crypto all trended lower throughout the day to close in the red. Let’s recap what you missed on this turnaround Thursday. 👀

Today’s issue covers the rift in Lyft shares, when PayPal’s CEO is peacing out, and other earnings Wynners and losers. 📰

Check out today’s heat map:

Every sector closed red. Consumer discretionary (-0.18%) led, and communication services (-2.18%) lagged. 🔻

In economic news, U.S. weekly jobless claims jumped to 196,000, and continuing claims rose to 1.688 million. Tech layoffs continued, with GitLab, GitHub, and Yahoo laying off 7%, 10%, and 20% of their respective workforces. Mortgage refinancing applications rose 18% WoW on the back of falling interest rates but are still down 75% YoY. 🧑💼

Nelson Peltz is apparently happy with Iger’s turnaround efforts at Disney, abandoning his proxy fight with the company. 🐁

In electric vehicle (EV) news, Ford sold its majority stake in Rivian after its $7.3 billion write-down. Redwood Materials secured a $2 billion conditional loan from the Department of Energy as the administration looks to ramp up the U.S.’s domestic supply chain. And EV pricing competition heats up as Lucid joins the discounting trend. ⚡

In crypto news, Kraken agreed to shutter its crypto-staking operations and pay $30 million to settle its charges with the U.S. Securities & Exchange (SEC) commission. Meanwhile, Coinbase CEO Armstrong publicly denounced rumors that the SEC may ban U.S. crypto staking. ₿

Other symbols active on the streams included: $MULN (-7.85%), $GFAI (-21.23%), $AI (-14.13%), $BE (-1.05%), $AFRM (-17.04%), $GNS (-10.54%), and $HPCO (+482.78%). 🔥

Here are the closing prices:

| S&P 500 | 4,082 | -0.88% |

| Nasdaq | 11,790 | -1.02% |

| Russell 2000 | 1,915 | -1.40% |

| Dow Jones | 33,700 | -0.73% |

Earnings

A Rift Swallows $LYFT Shares

Yesterday we discussed Uber’s strongest quarter ever. Today we heard from its competitor Lyft, which did not fare nearly as well…and that’s putting it lightly. 😬

The ridesharing company reported an adjusted loss per share of $0.74. Revenues rose 21% YoY to $1.18 billion and outpaced the $1.16 billion expected.

While those numbers beat expectations, its guidance was where things fell apart. 👎

It now expects $975 million in revenue during its fiscal first quarter, below the $1.09 billion expected. Additionally, its adjusted EBITDA should fall between $5 and $15 million. The company said that guidance reflects seasonality and lower prices, including less “Prime Time.” Prime Time is where demand from passengers exceeds available drivers, which allows it to charge more per ride.

Additionally, ridership has still not recovered to its pre-pandemic highs of 22.9 million active riders. It reported 20.3 million active riders this quarter, reflecting zero growth QoQ. 🔻

Unlike Uber, Lyft has been unable to adequately diversify its business segments to drive growth. Instead, it’s undergoing restructuring to reduce operating costs as the macroeconomic environment remains challenging. ✂️

Given the poor outlook and lack of a turnaround plan, $LYFT shares are down 30% after hours. 📉

Open a brokerage account with at least $250 by Feb 10, 2023, to be automatically entered to win a 5-day / 4-night stay for yourself and a guest at the all-inclusive Hyatt Ziva Rose Hall resort in Montego Bay, Jamaica.

You’ll also receive roundtrip airfare to Montego Bay and roundtrip transportation between the resort and Montego Bay airport.

The contest is open to US residents only and ends on Feb 10, 2023, so don’t delay! Here are the official rules.

P.S. Want to increase your odds? Receive an additional entry for every $250 deposited into your account during the contest period (maximum 20 additional entries).

Earnings

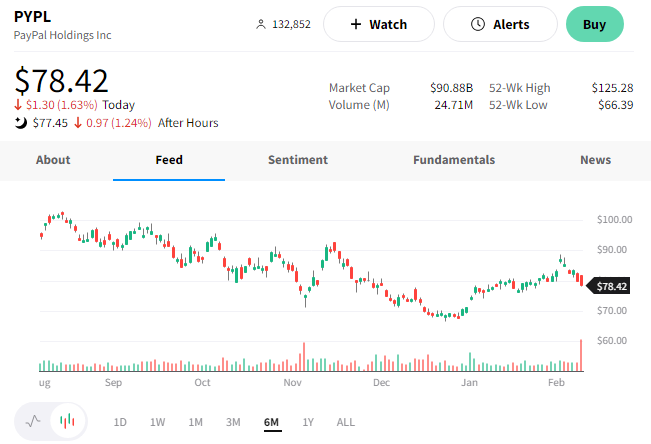

PayPal CEO Is Peacing Out

PayPal reported fourth-quarter earnings and revenue that beat expectations. However, total payment volumes were lighter than expected. 🤷

The company’s adjusted earnings per share came in at $1.24 on $7.4 billion in revenue. Estimates were for $1.20 in earnings on $7.39 billion in revenue. Total payment volume processed rose 5% YoY to $357.4 billion, about 1% shy of the $360.38 billion expected.

For full-year 2023, executives expect earnings in the midpoint of its guidance at $4.87 per share. To the analyst community’s surprise, they did not provide revenue or total payment volume guidance. Consensus expectations are for full-year earnings of $4.79 per share, revenues of $29.89 billion, and total payment volume growth of 9.5% to $1.49 trillion.

Like other tech firms, the company recently laid off 7% of its workforce as it looks to cut costs. It also has a $15 billion share buyback program that’s still outstanding. ✂️

Lastly, PayPal announced that its CEO, Dan Schulman, will retire at the end of 2023. He became PayPal CEO in 2015 after its split from eBay but will remain a board of directors member after retiring. The company is currently searching for his successor.

$PYPL shares initially rallied on the news but are sitting with a 2% loss after hours. 🔻

Earnings

You Wynn Some, You Lose Some

It was another big earnings day, so we’re here to recap some of the biggest movers.

First up is Wynn Resorts, which reported a wider-than-expected loss but beat on revenues. Its loss of $1.23 per share was $0.06 larger than estimates, while revenues of $1 billion beat the $940 million expected. The company has been awarded a new 10-year gaming concession in Macau, where it believes its well-positioned for growth. $WYNN shares were up around 5% on the news. 🎰

Its competitor, MGM Resorts International, reported yesterday after the bell. Its earnings per share of $0.69 beat the $1.60 loss expected, and revenues of $4.56 billion beat estimates by 7%. Meanwhile, shares of Entain PLC fell 13% on news that MGM is abandoning its pursuit of a potential deal with the British gambling firm. $MGM shares rallied roughly 7% today. ♥️

Swiss bank Credit Suisse posted a massive annual loss of 7.3 billion Swiss francs. Executives expect another substantial full-year loss in 2023 as it continues its restructuring efforts before returning to profitability in 2024. Its CEO said that 2022 was a crucial year for the bank and that it’s been “executing at pace” to create a simpler, more focused bank. $CS shares were down 15% on the day. 🏦

IT service management company Cloudflare reported better-than-expected results. Its earnings per share of $0.06 beat by $0.01, and revenues of $274.7 million beat by $600,000. The company’s guidance for full-year 2023 also topped estimates. It now expects earnings per share of $0.15-$0.16 and revenue of $1.33-$1.34 billion. $NET shares were up 10% after hours. 🌤️

Toymaker Mattel’s shareholders were not playing around after its holiday quarter failed to deliver. Adjusted earnings per share of $0.18 missed the $0.29 expected. Meanwhile, revenues of $1.40 billion beat the $1.68 billion expected. Despite a strong outlook at the beginning of last year, the company underperformed its own full-year outlook. Now, heading into 2023, it expects continued sales declines in the first half of the year as retailers reduce inventory levels further. The macroeconomic environment is expected to remain a challenge. $MAT shares fell nearly 11% today. 🧸

Bullets

Bullets From The Day:

🥪 Chick-fil-A chooses cauliflower as its plant-based meat alternative. While fast-food restaurants have choices like salads for those who don’t eat meat or fish, plant-based options have emerged as a new angle to entice customers. Some fast food giants like Dunkin Donuts and McDonald’s have tried plant-based burgers and meats, but few have tried cauliflower. That is until today, as Chick-fil-A begins testing its new Cauliflower Sandwich in three different markets. The new offering is modeled exactly like its classic chicken sandwich…with one substitution. USA Today has more.

🤝 General Motors inks deal with GlobalFoundries to secure semiconductors. The automaker signed a long-term agreement to establish exclusive production capacity of U.S.-produced semiconductor chips. After the pandemic strained overseas supply chains and severely impacted the automobile market, more and more companies are looking to secure their labor and parts closer to home. The companies did not disclose details of the arrangement but expect it will offer better quality and predictability, in addition to higher production volumes. More from CNBC.

📝 Everyone hates expense reports, but AI could make them much less painful. ChatGPT and its impact on search are getting all the headlines this week, but there are many more use cases for the technology than that. One of those is dealing with the difficult task of filing and auditing corporate expense reports. Today, Microsoft and American Express announced a partnership to tackle that issue using Microsoft Cloud and AI technologies to automate expense reporting and approvals. The new system will not just replicate what other tools can already do but instead have an AI-powered decision engine that understands the company’s travel and expense policy and how it applies to submitted expenses. TechCrunch has more.

📉 Globus Medical plummets after announcing its offer for NuVasive. The company’s shares were down roughly 18% on the news that it’s acquiring peer NuVasive in an all-stock deal worth $3 billion. NuVasive shareholders will receive 0.75 of Globus shares, representing a 26% premium to yesterday’s closing price. The company hopes the deal will help it build scale in the competitive market for spinal devices. Analysts point out that similar deals in the space have not fared well, and the strategic direction the company is taking perplexed some investors. However, the companies say there is minimal customer overlap, and the complementary nature of their products makes them a good fit. More from Reuters.

⚖️ Environmentalists sue Shell’s board of directors in a first-of-its-kind climate lawsuit. The environmental law firm ClientEarth filed a lawsuit against the company’s board at the high court of England and Wales. The suit claims the eleven board members are mismanaging climate risk, breaching company law by failing to implement an energy transition strategy that aligns with the 2015 Paris Agreement. The firm says they have the backing of institutional investors who hold over 12 million shares in the company. This is the first case in the world seeking to hold a board of directors liable for failure to prepare for the energy transition properly. CNBC has more.

Links

Links That Don’t Suck:

📈 Manhattan rents hit an all-time high in January

☢️ Several universities to experiment with micro nuclear power

🆘 Twitter suffers major outage, prompting emergency fix and apology

😮 Third Point becomes latest activist investor to take stake in Salesforce

🕵️ Mystery surrounding a fatal Tesla crash with no one behind the wheel is solved

🚀 As record rocket launches crowd airspace, the FAA fights to limit travel disruptions

🏘️ What is a good income to buy a house? You’ll need at least 100,000 in nearly 40% of markets