Stocks trended lower today as economic news subsided and earnings retook the center stage. Let’s recap what you missed on this wild Wednesday. 👀

Today’s issue covers the state of retail brokerage Robinhood, Disney’s first quarterly results with Iger back at the helm, and what drove Uber’s ‘strongest quarter ever.’ 📰

Check out today’s heat map:

Every sector closed red. Real estate (-0.27%) led, and communication services (-3.14%) lagged. 🔻

In crypto news, stock tokenization is beginning as the Blackrock S&P 500 ETF (CSPX) can now be traded on Uniswap as a token on the Ethereum network. An ex-Coinbase employee pled guilty to insider trading. And Deutsche Bank’s asset management explores a stake in two crypto firms. ₿

Other symbols active on the streams included: $MULN (-5.71%), $KPRX (+52.53%), $AI (+6.77%), $CELZ (+101.04%), $XELA (-2.56%), $GNS (+0.32%), and $BTB (+9.18%). 🔥

Here are the closing prices:

| S&P 500 | 4,118 | -1.11% |

| Nasdaq | 11,911 | -1.68% |

| Russell 2000 | 1,943 | -1.52% |

| Dow Jones | 33,949 | -0.61% |

Bob Iger returned in November as Disney’s captain to “right the ship.” And just one quarter into his efforts, the company looks to be turning in the right direction. 🚢

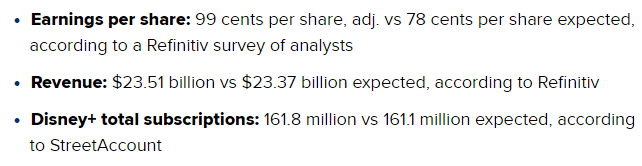

Today Disney reported better-than-expected fiscal first-quarter results. CNBC has the breakdown:

Iger’s first order of business has been reducing expenses and putting the creative power back in the hands of its content creators. As part of that effort, he announced thousands of job cuts and cost-cutting measures of $5.5 billion. The restructuring will leave a company with three distinct divisions: Disney entertainment (most of its streaming and media operations), ESPN (TV network and ESPN+), and Parks, Experiences, and Products. 💰

The bright spot remains its parks, experiences, and products divisions, which saw a 21% YoY increase in revenue during the quarter. Its streaming business remains in the negative, but losses are narrowing. The price hikes it implemented last quarter helped buoy revenue, and fortunately, more subscribers stuck around than initially expected. It originally forecasted Disney+ subscriber losses of 3 million due to the price hikes. Yet it only saw a 2.4 million decline. 📺

Lastly, Iger will ask the board to reinstate the dividend by the end of the calendar year. And while it will be a modest dividend initially, he expects the company will build on it over time.

Investors appear to share in Iger’s optimism, as $DIS shares were up roughly 6% on the news. 👍

Sponsored

Struggling in this market? These 3 chart patterns have worked for 40 years!

These days the market can break up or down without warning. That’s no fun for traders on the wrong side of these sudden moves. But profits add up quickly when you’re positioned correctly.

In fact, that’s how Chris Brecher is turning this historic market volatility into consistent income.

What’s his secret? He’s just using the same 3 simple chart patterns that have worked for over 40 years! They keep working because one thing never changes – human emotions drive the market.

Chris discovered these chart patterns back when he was a CBOE floor trader in the 80s. They helped him spot big moves before they happened. That’s how Chris catches breakouts that many other traders miss. The good news is they’re working even better in this highly volatile market.

If you day trade or swing trade stocks, options, ETFs, futures, or even Crypto, watch Chris’s free training tonight at 7pm central!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

All Good In The $HOOD?

It’s been a rough time for Robinhood recently, with falling markets pressuring trading activity among retail investors. With that said, its share price is sitting near the same level as a year ago, leading many to question whether a turnaround is in the works. 🤔

Today the company reported its eighth straight quarterly net loss. However, its loss per share of $0.19 improved from last year’s $0.49 per share loss. Meanwhile, revenues rose 5% YoY to $380 million as net interest revenue surged 165% to $167 million. 🤑

Other stats investors were watching included:

- Net Cumulative Funded Accounts rose by 50k QoQ to 23 million

- Monthly Active Users (MAUs) fell by 800,000 QoQ to 11.4 million

- Assets Under Custody fell 4% QoQ to $62 billion

- Net Deposits grew at a 30% annualized rate to $4.8 billion

- Average Revenues Per User (ARPU) up from $63 to $66 QoQ

The company’s efforts to cut costs and further monetize its user base created mixed results. It’s safe to say a rising rate environment was the company’s saving grace. The higher yield it offers on uninvested brokerage cash helped attract additional customers to its premium “Gold Tier” offering. And net interest revenue accounted for roughly 44% of its total revenue.

Overshadowing the results was the board of directors’ decision to buy back the 55 million shares bought by Sam Bankman-Fried last year via the FTX subsidiary Emergent Fidelity Technologies. That represents roughly 7% of the company’s outstanding shares. However, there’s limited precedent for this situation, so the timeline and share price of the repurchase remains to be seen. 💰

So far, investors appear pleased with the results. $HOOD shares are up roughly 4.20%. 👍

Earnings

Uber’s ‘Strongest Quarter Ever’

Uber was back in the headlines today after the company reported its ‘strongest quarter ever.’ 💪

Below are the company’s key stats vs. expectations:

- Earnings per share: $0.29 vs. ($0.18)

- Revenues: $8.6 billion vs. $8.49 billion

- Mobility gross bookings: $14.9 billion vs. $14.8 billion

- Delivery gross bookings: $14.3 billion vs. $14.3 billion

While Uber’s delivery business drove most of its pandemic-era growth, its mobility segment revenue was back on top during all four quarters of 2022. Meanwhile, the company’s third segment, Uber freight, also booked $1.5 billion in sales this quarter.

Overall monthly active platform consumers rose 11% YoY to 131 million, with 2.1 billion trips completed (+19% YoY). CEO Dara Khosrowshahi said that the pandemic’s impact on the company’s mobility business is “now well and truly behind us.”👍

Although executives said they’re not seeing any signs of consumer weakness, active drivers also hit an all-time high during the quarter. Potentially driving that trend is the rising cost of living, as they’ve noticed that inflation is a factor for 70% of the drivers on its platform. 🤔

Overall, investors are happy to see both of the company’s main segments firing on all cylinders. $UBER shares were up roughly 5% on the day.

Earnings

Sell Now, Buy Later?

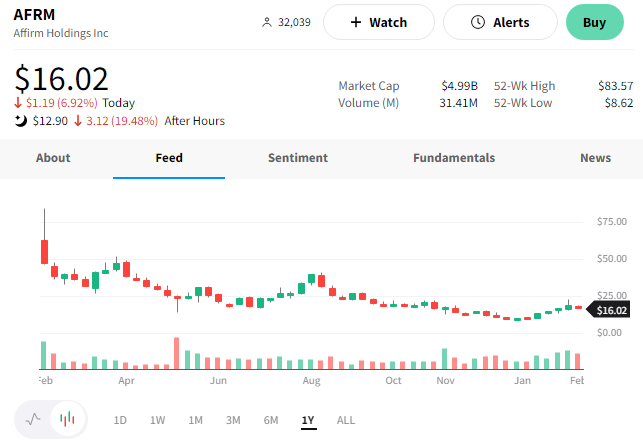

Buy Now Pay Later (BNPL) company Affirm is falling sharply after reporting worse-than-expected second-quarter results. 😩

Its loss per share of $1.10 was above the $0.98 loss expected. And revenues of $400 million fell short of the $416 million expected. 🔻

More importantly, Founder and CEO Max Levchin announced that the company would cut 19% of its workforce. The firm hired ahead of the revenue required to support the size of the team, using its pandemic-era growth to justify the strategy. However, that all changed when interest rates began rising in mid-2022. He says the Fed’s actions“dampened consumer spending and increased the company’s cost of borrowing dramatically.”

Like other technology CEOs, he says the responsibility falls on him, noting, “The root cause of where we are today is that I acted too slowly as these macroeconomic changes unfolded.”

Moving forward, he expects Affirm’s headcount to be flat for the foreseeable future. Additionally, the company is redirecting the majority of its R&D efforts to margin-improving projects, repeat consumer engagement and Debit+ for the next several quarters. Hopefully, those efforts can help stabilize its business in the current, more challenging environment.

$AFRM shares are down roughly 20% on the news as investors run for the exits. 🏃

Bullets

Bullets From The Day:

⚖️ A landmark case sets a powerful precedent for NFT creators. After several days of deliberation, a jury sided with Hermes in its copyright infringement suit against non-fungible token (NFT) artist Mason Rothschild. He created MetaBirkins NFTs, which the jury claimed profited off of the design house’s goodwill by using its Birkin bags and awarded $133,000 in damages to Hermes. More importantly, the jury decided NFTs were not protected under the First Amendment of the U.S. Constitution. This sets an important precedent for the framework applied to intellectual property (IP) law as it relates to digital creations. Coindesk has more.

⚒️ Nevada lithium mine wins ruling against environmentalists. A U.S. judge ordered the government to revisit a part of its environment review of a lithium mine planned in Nevada, denying opponents’ efforts to block it. This is a significant victory for Canada-based Lithium Americas Corp. at its subsidiary’s project. This is the latest in a series of high-stakes legal battles between environmentalists and companies trying to mine or build the items necessary to support the world’s “green energy” push. More from NBC News.

🤔 Have recommendation algorithms gone too far? In today’s age, algorithms are used to determine what television show you’d like to watch next, what you want to order online, and almost every other decision you make daily. But those suggestions are only as good as the data they’re based on, and some companies are beginning to realize that. For example, Spotify now lets users select which playlists they’d like to impact their recommendations less than others. If successful, this could be the start of an interesting shift in the input companies give users regarding their algorithmic suggestions. TechCrunch has more.

🔐 What’s actually happening with Netflix’s new password-sharing rules? The company is expanding its paid password sharing to subscribers in Canada, New Zealand, Portugal, and Spain this week. The new rules would require users to pay more if they want to add access for people that don’t live in their households. However, the number of people you can add depends on your plan and your country. Whether or not the “primary location” setting leaked last week will be included in this policy remains to be seen. More from The Verge.

🤖 Live by the bot, die by the bot. Artificial intelligence (AI) remains this year’s hottest topic, with companies rallying significantly just by announcing their projects to the public. But as Google found out today, if you make big promises, you must also deliver on them. The company’s shares fell close to eight percent today after its new artificial intelligence chatbot, Bard, made a factual error during its first public demo. This likely won’t be the last issue we see as companies roll out this technology and traverse into the unknown. CNBC has more.

Links

Links That Don’t Suck:

🏖️ Stocktwits is giving you a chance to win an all-inclusive Jamaica getaway with just a few clicks

👎 Half in U.S. sat they are worse off, highest since 2009

📝 Elon Musk to unveil Tesla’s ‘Master Plan 3’ at first investor day

🏬 Bed Bath & Beyond is closing 150 more stores. Here’s where they are.

📈 Chinese tech giant Alibaba working on a ChatGPT rival; shares jump

🛑 Turkey’s stock market halted after earthquake leads to sharp selloff

📺 Discovery+ to remain standalone streaming platform while still combining with HBO Max