The market expected an eventful week because of Powell and the Federal Reserve. Little did we know that two other banks would cause a market meltdown into the weekend. 😮

Let’s recap what happened and prep you for the week ahead. 📝

What Happened?

🔻 It was a wild week across all asset classes, with several events driving prices.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

💬 Federal Reserve Chair Jerome Powell spoke in front of Congress on Tuesday and Wednesday. His initial message hinted that the Fed was open to increasing its pace of hikes, which spooked markets and sent stocks lower. He tried to walk it back on Wednesday, but the damage was already done. This week’s employment data remained strong, keeping upward pressure on inflation.

🏦 The unexpected event of the week was in the banking sector. First, Silvergate Capital told investors it would shut down its operations and liquidate the bank. Then, Silicon Valley Bank tried to raise capital to shore up its financial position but failed miserably as confidence in its health fell. This led to a run on the bank and ultimately ended with the second-largest bank failure in U.S. history on Friday. Bonds became a safe haven again as the market looked to understand the broader fallout.

📉 The tech sector’s revenue slowdown continued, with JD.com, DocuSign, MongoDB, and others falling on earnings.

🤢 Lordstown Motors investors continued their wild ride after the company missed expectations again. And United Natural Foods saw its profits spoiled due to rising costs and operational missteps.

🥰 Despite the market’s broader weakness and earnings declines, several stocks pleasantly surprised investors. Those included Sea Ltd., Dick’s Sporting Goods, and Brazilian airline Azul SA.

🔥 Several names were on the Stocktwits trending tab for most of the week, including $MYO, $NVOS, $TRKA, $XELA, and $KALA.

Here are the closing prices:

| S&P 500 | 3,862 | -4.55% |

| Nasdaq | 11,139 | -4.71% |

| Russell 2000 | 1,773 | -8.07% |

| Dow Jones | 31,910 | -4.44% |

Bullets

Bullets From The Weekend

🛬 Amazon’s drone business remains grounded. A decade after Prime Air’s launch, rising regulatory hurdles and falling appetite from consumers are keeping a lid on the project’s potential. The company started drone deliveries in two small markets last year, recently kicking off durability and reliability testing, a key federal regulatory requirement. To receive approval from the Federal Aviation Administration (FAA), it must complete several hundred hours of flying without any incidents. That may prove difficult, as the few households eligible for delivery have shown a lack of appetite for the service, prompting Amazon to offer them incentives for placing orders. CNBC has more.

✂️ Meta is reportedly planning new job cuts that match last year’s numbers. The company could cut as much as 13% of its workforce again this week in its second round of mass layoffs in a few short months. The new cuts are reportedly expected to hit non-engineering roles the hardest, with the Facebook-parent company shutting down some projects and teams as it reprioritizes its resources. More from Reuters.

📝 Y Combinator starts petition calling on Congress to address SVB collapse. Three months into his new job as CEO of Y Combinator, serial entrepreneur and venture capitalist Garry Tan faces his first crisis. As the Silicon Valley Bank failure sends shockwaves through the startup landscape, Tan wrote a petition to Treasury Secretary Janet Yellen and other government officials, asking “for relief and attention to an immediate critical impact on small businesses, startups, and their employees who are depositors at the bank.” The petition has currently been signed by over 600 CEOs and founders from companies across the startup ecosystem. TechCrunch has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

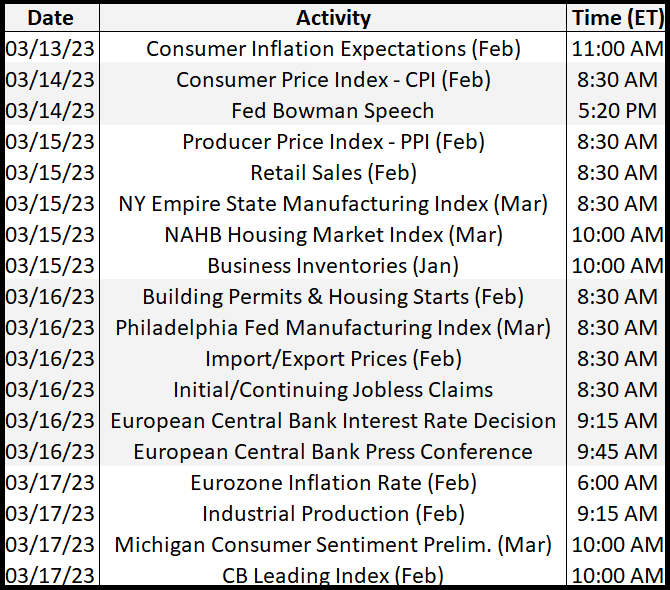

Economic Calendar

The world will be focused on the Silicon Valley Bank situation this week, but eyes will still be on the U.S. inflation data and European Central Bank’s interest rate decision. In addition to the above, check out this week’s complete list of economic releases.

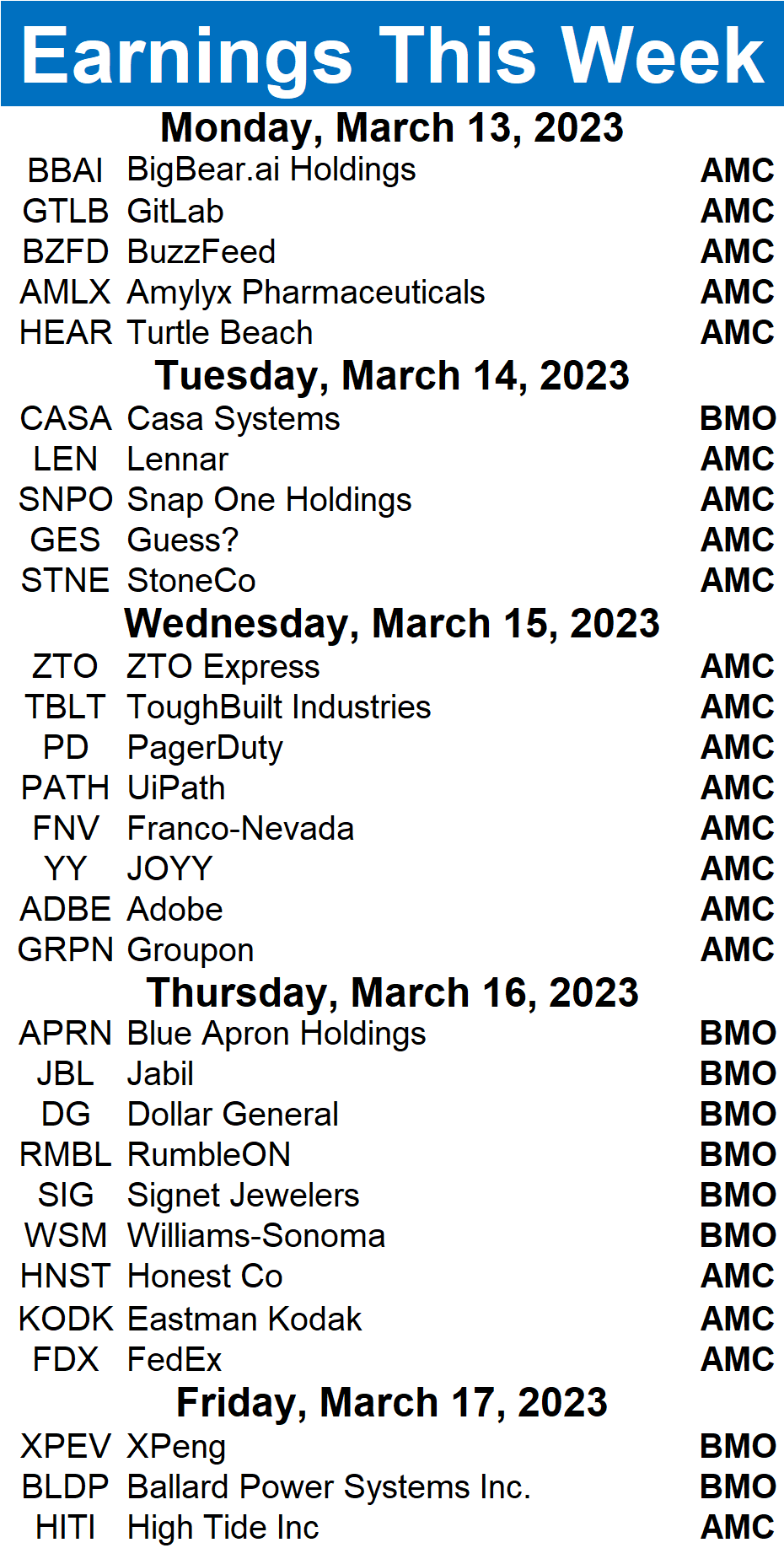

Earnings This Week

Earnings season is slowing down a bit, with 244 companies reporting this week. Some tickers you may recognize are $BZFD, $HEAR, $BBAI, $ADBE, $GRPN, $FDX, $WSM, $DG, $XPEV, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

📉 Luxury home sales plunge 45%, with Miami and the Hamptons hit hardest

😮 William Lauder revealed as buyer of Rush Limbaugh’s $155M Palm Beach estate

🤖 Why ChatGPT and AI are taking over the cold call, according to Salesforce leader

🧑💼 Millennials to Baby Boomers: Why workers of all ages are adding to the labor shortage

🪙 Crypto exhales as USDC stablecoin rebounds toward peg after being roiled by SVB exposure

🏠 The top 3 U.S. cities where new rental apartments have gotten smaller – and NYC isn’t one of them