Big tech is asking for the rest of the market to follow it higher, with the S&P hitting 8-month highs. However, market participants remain suspect of the current rally. Let’s see what you missed. 👀

Today’s issue covers Walmart’s grocery gains, MSG’s entertaining earnings, and why Canada Goose was cooked. 📰

Check out today’s heat map:

7 of 11 sectors closed green. Technology (+2.05%) led, and real estate (-0.63%) lagged. 💚

In economic news, existing home sales fell 3.4% MoM and 23.2% YoY in April as tight housing supply and high rates weigh on the market. The Philadelphia Fed manufacturing index stayed in contraction territory for the ninth straight month in May, despite improving from -31.3 to -10.4. Initial jobless claims fell to 242,000, with the prior week’s claims adjusted for an uptick in fraudulent filings. 🔻

Semiconductor maker Applied Materials beat earnings expectations but offered a lighter-than-anticipated outlook for the current quarter. This has been a common theme in the semiconductor industry, where most executives believe a turnaround is likely in the second half of 2023. 📆

Dallas Fed President Lorie Logan added to the doubt about a June rate pause, saying, “The economic data points so far don’t justify skipping a rate increase at the next meeting.” ⏯️

Chinese e-commerce giant Alibaba missed earnings and revenue expectations but approved its cloud unit spinoff as investors focus on the conglomerate’s breakup into six distinct units. 🛒

Luxury e-commerce fashion company Farfetch soared 20% after reporting a narrower-than-expected loss and an 8.1% revenue jump. 📦

Bath & Body Works jumped 11% after improved margins led to an earnings beat. Sales were flat, but the company said its loyal consumers have been receptive to its “innovative” soaps, fragrances, and men’s grooming products. 🧼

Netflix shares rose 9% after the streaming giant reported having 5 million monthly active users for its ad-supported option. Roughly 25% of its new subscribers signed up for this cheaper tier. 📺

Other symbols active on the streams included: $XELA (-4.51%), $PLTR (+14.54%), $AABB (-19.49%), $ENVB (+136.18%), $SONN (+24.95%), $CDTX (-5.93%), $IFBD (+19.84%), and $ALIM (+19.42%). 🔥

Here are the closing prices:

| S&P 500 | 4,198 | +0.94% |

| Nasdaq | 12,689 | +1.51% |

| Russell 2000 | 1,785 | +0.58% |

| Dow Jones | 33,536 | +0.34% |

Earnings

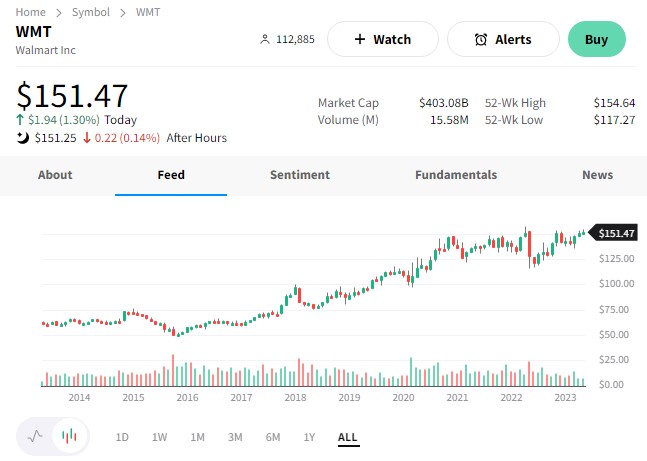

Walmart Wins With Groceries

America’s largest retailer did what Home Depot and Target couldn’t…beat Wall Street’s expectations.

Walmart reported adjusted earnings per share (EPS) of $1.47 on revenues of $152.3 billion. That topped the expected $1.32 and $148.76 billion. 💪

As for what’s driving that strength? Groceries and essentials. Nearly 60% of its annual U.S. sales come from groceries. And although that weighs on the company’s gross margins, its “always low prices” keep cash-strapped consumers returning. 🥑

Same-store sales excluding fuel rose 7.4% YoY at Walmart U.S., rising 7% YoY at Sam’s Club. Meanwhile, those brands saw e-commerce sales jump 27% and 19%, respectively.

Despite the solid overall results, executives said spending trends weakened as the quarter progressed. Persistently high prices on everyday items are leaving consumers with less discretionary income. And although consumers are still buying higher-margin merchandise, they typically wait for sales to do so. They’re also trading down to smaller pack sizes. 📉

Overall, economic indicators suggest a strain on the consumer, but their resilience has surprised Walmart execs. They believe that’s in part due to healthy consumer balance sheets. That said, stubborn inflation is a key factor contributing to executives’ uncertainty about the year’s second half. 📆

Despite those factors, Walmart held its fiscal-year earnings firm while raising revenue guidance. It’s expecting a 3.5% increase in consolidated net sales and adjusted EPS of $6.10 to $6.20, both in line with expectations. However, its second-quarter forecast did fall just shy of analysts’ view.

Investors took the mixed messaging in stride. $WMT shares rose 1%, just below all-time highs. 🔺

The cautious tones about the U.S. consumer continue. Whether it’s the biggest players like Walmart or a small mall-based retailer, executives are concerned that consumers will eventually run out of ammunition. So far, that hasn’t been the case, but their expectations reflect that fear. 😩

On the flip side, stock market bulls argue if the U.S. economy holds up better than many anticipate…that could set us up for some significant upside surprises in the back half of the year. Time will tell…

Earnings

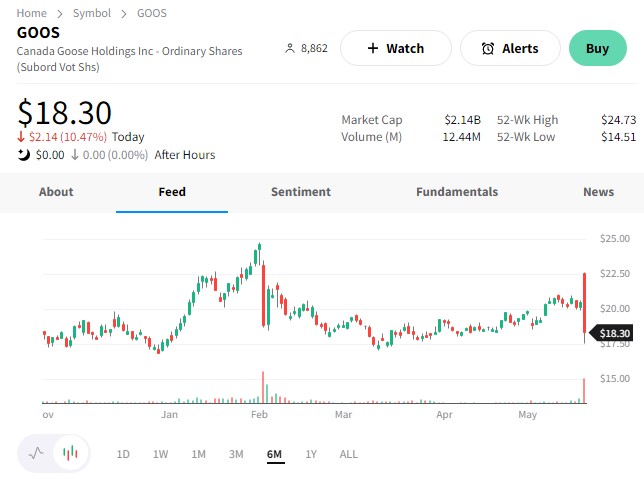

Canada Goose Is Cooked

Shareholders took up arms today after Canada Goose Holdings reported fourth-quarter results. 😠

The winter clothing manufacturer, famous for its puffy luxury jackets, topped estimates but shared a cautious outlook.

Starting with the positives, adjusted earnings per share of C$0.14 doubled analysts’ estimate. Revenue also jumped to C$293.2 million, above the C$258.5 million expected. Driving those results were strong growth from the Asia Pacific region. However, European and Middle East growth of 65.4% and 27.3% also played a significant role. 🌏

While investors were happy to see a strong rebound in China and Europe / Canada staying resilient, they remain concerned about U.S. demand. Executives share that concern, with CFO Jonathan Sinclair saying, “We’re not being super ambitious for this year in the U.S…the market is going to be a bit more challenging in the U.S. because of the macroeconomics.”⚠️

Executives cited improving momentum in North America early in the current quarter. However, their first-quarter earnings and revenue estimates did come in below analyst expectations. With that said, they expect strength in other regions to accelerate throughout the year as their full-year fiscal-2024 earnings and revenue forecasts both topped estimates.

$GOOS shares initially jumped 10% at the open but faded throughout the day to close down 15%. Investors remain frustrated with performance as the company treads water near its IPO price from early 2017. 🙃

Meanwhile, fellow Canadian company and point-of-sale system / e-commerce software provider Lightspeed Commerce also fell 13% today. Executives expect lower revenue growth and higher costs in fiscal 2024 as they launch a new unified payment and point-of-sale system. 💳

Both results add to the many “cautious” outlooks about the U.S. consumer we’ve heard so far this earnings season. We’ll have to wait and see if that balance changes going forward.

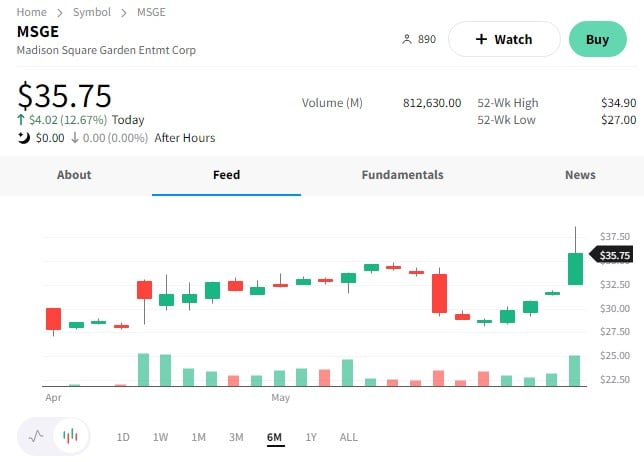

MSG shareholders are celebrating after it reported better-than-expected results. But first, let’s all get on the same page about how MSG is structured. ⏸️

Madison Square Garden Sports Group ($MSGS) is the leading professional sports company that owns the New York Knicks and New York Rangers. It also owns two development league teams and operates a professional sports team performance center. Meanwhile, Madison Square Garden Entertainment Corp ($MSGE) is a leader in live entertainment. It owns world-renowned venues like New York’s Madison Square Garden and Radio City Music Hall, among others.

Both entities were part of Madison Square Garden, Inc. ($MSG) before it completed restructuring in mid-April. As a result of the spin-off, this $MSG symbol is no longer active in the public markets. 🪦

For this story, we’re referring to the venue-owning part of the brand ($MSGE). Let’s dive in. 👇

The company’s GAAP earnings per share (EPS) of $0.42 doubled the $0.21 estimate. Meanwhile, revenues rose 3.7% YoY to $201.23 million, beating the consensus view by roughly $9 million.

Some other key stats included:

- Arena license revenue with NY Knicks & NY Rangers +$11.7 million YoY.

- Food, beverage, and merchandise revenue +$10.1 million YoY

- Christmas Spectacular revenues +$3.5 million YoY

- Advertising sales commission -$9.6 million YoY

- Direct operating expenses of $115.1 million (+5% YoY)

- Selling, general, and administrative expenses of $44.1 million (-6% YoY)

It’s also nearing the sale of the “Theater at Madison Square Garden” for roughly $1 billion. The buyer is Italian developer ASTM Group who is currently renovating the famous Penn Station rail hub. However, it must demolish the 5,500-seat theater to continue its expansion plans. 💰

Executives remain optimistic about the new chapter as a standalone, pure-play live entertainment company. To reflect last month’s spin-off from Sphere Entertainment, they refined their fiscal year 2023 outlook. They’re now expecting $835 to $845 million in revenue, $85 to $95 million in operating income, and $145 to $155 million in adjusted operating income. 🔺

Investors appeared “entertained” by the results as $MSGE shares rose 13% to new highs. 👍

And speaking of entertainment, it’s worth noting some Sony news. The company is reportedly considering a partial spin-off of its financial business as it doubles down on entertainment and image sensors. Did somebody say a Sony shakeup??? 👀

Bullets

Bullets From The Day:

💾 Amazon makes a significant India investment to drive AWS growth. The tech giant plans to invest $12.7 billion in its India cloud business by 2030. The push comes as it tries to scale its AWS infrastructure in key overseas markets while pulling back some of its other service efforts that haven’t panned out. While it already maintains two data center regions in India, it says future spending will support 131,700 roles. Competitors Google, Microsoft, Apple, and others are also expanding into India as a longer-term growth driver. TechCrunch has more.

👎 The Supreme Court (SCOTUS) declines to address big tech’s liability for its users’ posts. America’s highest court issued an unsigned opinion declining to address the legal liability shield that protects tech platforms from being held responsible for their users’ posts. The decision leaves in place the broad liability shield that protects YouTube, Twitter, Facebook, and other social media platforms from being sued for what’s posted on them. SCOTUS vacated and returned the decision to the Ninth Circuit Court to reconsider its decision on a separate but similar case, Twitter vs. Taamneh. More from CNBC.

💊 Walgreens settles San Francisco opioid case for $230 million. A string of settlements continues as the battle to assign responsibility for the nation’s opioid crisis continues. This time it’s pharmacy-store giant Walgreens agreeing to pay the most significant sum awarded to a local government for opioid litigation. With that said, Walgreens said it disputed any liability and did not admit fault but would rather settle to focus on patients, customers, and communities. Last May, the company settled a similar case with Florida for $683 million. This is not the first, nor the last, of these settlements. CNN Business has more.

🗾 Micron diversifies into Japan with a $3.6 billion investment. The semiconductor player will invest up to 500 billion yen in next-generation memory chips over the next few years, with support from the Japanese government. Rising tensions between the U.S. and China have countries from Japan and India to France vying for companies to diversify their supply chains in their countries. The move comes after Japanese prime minister Fumio Kishida met executives from major chip manufacturers like Micron, TSMC, Samsung, and Intel. However, Micron is the only one to make a firm commitment so far. More from TechCrunch.

✂️ U.K. telecom giant BT joins Vodafone in cutting costs. Days after its competitor announced 11,000 job cuts, BT announced it would cut 55,000 jobs by the decade’s end. It estimates its U.K. employees and contractors will be impacted most, with a fifth of the downsizing coming as customer services staff related by artificial intelligence tools and other emerging technologies. The remaining cuts will come as it completes work on its U.K. fiber networks, upgrades systems to require less maintenance, and completes general restructuring to improve efficiency. BBC News has more.

Links

Links That Don’t Suck:

📈 Manhattan rents reach (another) record high

🖥️ YouTube is bringing 30-second unskippable ads to TVs

🥵 Buckle up because El Nino is almost here, and it’s going to get hot

💰 Deutsche Bank to pay $75 million to settle lawsuit by Epstein accusers

📰 Equity Residential mourns death of founder and chairman Samuel Zell

📻 Can AM radio in cars be saved? A bipartisan bill in Congress would force automakers to keep it

💽 FTC says popular fertility tracking app Premom shared sensitive data with Chinese analytics firms