Hawkish central bank statements from Europe and England couldn’t stop U.S. stocks from continuing their party. Investors took some profits in mega-caps, with money flowing into small-cap stocks and other laggards. Let’s see what else you missed. 👀

Today’s issue covers consumers cutting costs at Costco, Jabil continuing its hot streak, and palladium joining the catch-up rally. 📰

Here’s today’s heat map:

7 of 11 sectors closed green. Energy (+2.96%) led, & consumer staples (-1.45%) lagged. 💚

The Bank of England and European Central Bank kept rates unchanged but maintained a hawkish tone because inflation remains too high. Across the globe, Brazil’s central bank cut interest rates by 50 bps for the fourth straight time as Latin America’s biggest economy hopes to spur growth. ⏯️

November retail sales rose 0.3%, topping estimates for a 0.1% decline and October’s 0.2% drop. Initial jobless claims also fell to two-month lows as a strong labor market buoys consumer spending and confidence. And business inventories fell 0.1% in October, with the ratio of inventories to sales remaining elevated at 1.37 ahead of the holiday shopping season. 📊

In automotive news, Rivian jumped 14% after AT&T agreed to purchase electric vehicles starting early next year as part of its program to reduce fleet emissions. Meanwhile, General Motors’ shares popped 7% after it laid off 24% of workers in its robotaxi startup Cruise. ⚡

Moderna rebounded 9% after midstage trials showed the cancer vaccine it co-developed with Merck reduced the risk of death or relapse in melanoma patients. 💉

Shares of Shift4 Payments rose 5% on news that its peer Global Payments Inc. is considering acquiring the company. 💳

Other symbols active on the streams: $CVNA (+12.31%), $LCID (+14.48%), $RKT (+13.29%), $SOFI (+5.93%), $UPST (+5.92%), $ADBE (-6.35%), $CCCC (-9.07%), & $BONK.X (+38.83%). 🔥

Here are the closing prices:

| S&P 500 | 4,720 | +0.26% |

| Nasdaq | 14,762 | +0.19% |

| Russell 2000 | 2,001 | +2.72% |

| Dow Jones | 37,248 | +0.43% |

Earnings

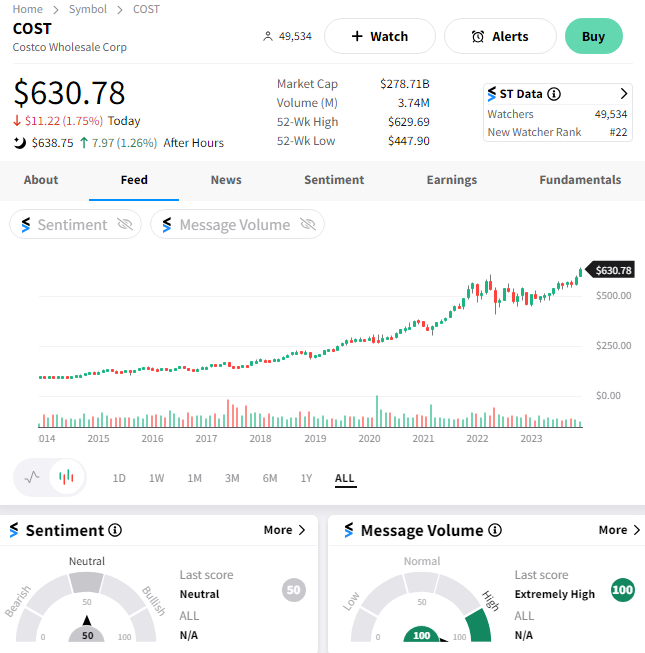

Consumers Cut Costs At Costco

One of the critical data points investors are watching into next year is consumer spending. So, what better place to check in on that than Costco? Let’s dive into their first-quarter results. 👇

The membership-based warehouse club operator reported adjusted earnings per share of $3.58 on $57.80 billion in revenues. Earnings topped expectations by $0.17, while revenues aligned with estimates. Higher gross margins helped drive the beat, rising 43 bps YoY to 11.04%. 📊

Here’s how its 3.8% comparable sales, which matched estimates, broke down:

- U.S. +2.0%

- Canada +6.40%

- Other international +11.2%

- E-Commerce +6.3%

Membership revenue was up 8% YoY as more consumers flocked to its private-label brand Kirkland Signature and shopped for consumables and necessities in its stores. Like other retailers, its discretionary categories remain under pressure, but the retailer remains an attractive place to shop as consumers search for bargains. 🛒

Executives remain optimistic heading into 2024, saying the store’s value proposition will continue to attract and retain customers. The company is also rewarding its shareholder base by announcing a special cash dividend of $15 per common share, even as shares sit near all-time highs. 🤑

$COST shares are up marginally after the bell as investors digest the news. 🔺

Stocktwits’ Trading Competition lets you compete with traders from across the country. Watch as you rise in the ranks towards the top spot on the leaderboard! Do you have what it takes to be #1?

Earnings

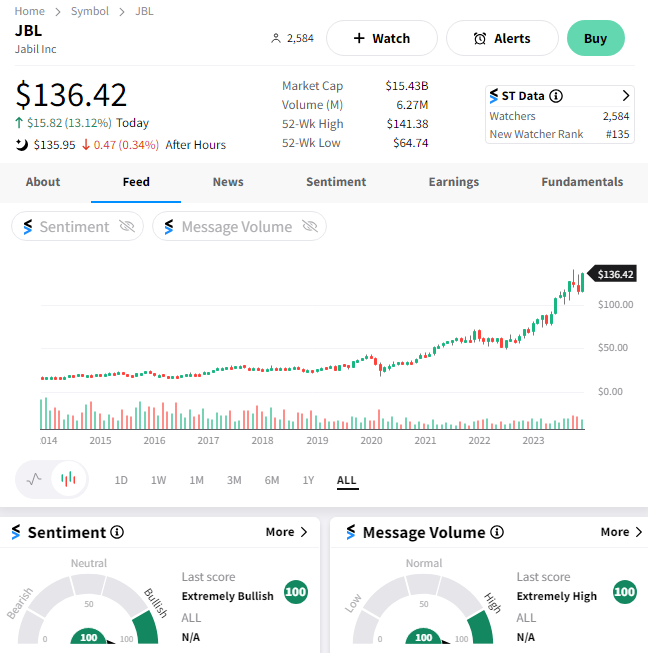

Jabil’s Hot Streak Continues

The tech sector continues to lead the market higher, with those that can deliver strong results being rewarded handily by investors. 💸

Electronic supplier and manufacturer Jabil is the latest to beat first-quarter earnings and revenue expectations. Its adjusted earnings per share of $2.60 on $8.39 billion in revenues narrowly beat forecasts of $2.58 and $8.35 billion. 🔺

Executives saw a broad-based softening in demand during the last few weeks of the quarter, but the company was able to drive core margin growth through cost management. The weak demand environment has been telegraphed, so the market was happy to see its revenues fall about the same amount it expected.

Looking ahead, management remains cautious on demand but optimistic on earnings. Their fiscal second-quarter adjusted earnings guidance of $1.73 to $2.13 per share should easily top analysts’ $1.85 consensus view. 🔮

$JBL shares were up over 13% on the day as investors assessed the report.

Commodities

Palladium Pops In “Dash For Trash”

One of the key themes we’ve discussed since early November is money looking for a new home in beaten-down areas of the market. That theme continued today with the Federal Reserve confirming the market’s rate cut bets with a dovish statement and projections. 💸

We saw significant rallies in stocks like Carvana, Upstart, SoFi Technologies, Lucid Group, Rocket Companies, and many more highly-shorted names. But it’s not just happening in the stock market. Assets across the board rallied, including one of this year’s worst performers, palladium.

Below is a chart of palladium futures, which jumped 12% today. That type of move would typically be more than enough to grab people’s attention, but where it’s taking place amplified the importance among traders. 🧭

Palladium’s been in a clear downtrend for the last eighteen months, with a clear downtrend line, keeping a lid on prices. However, prices are now testing that downtrend line again. And they’re doing so while also breaking above its previous price low, something they’ve been unable to do all year. 🤔

Technical analysts say a decisive breakout above this level would confirm that its trend has shifted from down to sideways or up, depending on who you ask. With animal spirits taking hold of the market this week, bulls say this is when palladium and other laggards have their best chance to meaningfully change their trends.

We’ll have to wait and see who is right. But palladium bulls are coming out of the woodwork for the first time in years, and that’s notable to us. 👀

Bullets

Bullets From The Day:

🛑 Lawmakers draft rule that could help stop drunk driving. The National Highway Traffic Safety Administration is looking to make technology that prevents drunk and impaired driving a standard feature in all new vehicles. The advance notice of proposed rulemaking is a preliminary stage of the process, allowing regulators to collect information about the current state of technology used for this purpose. More than 13,000 people were killed in drunk driving crashes in 2021, placing it as one of the top causes of death on the road. NPR has more.

🎧 AI could curate your next Spotify playlist. A few months ago, it was rumored that the streaming giant was developing a new feature allowing users to create playlists using artificial intelligence (AI) technology and prompts. Now, some users are seeing the feature in the wild, whose description reads, “Turn your ideas into playlists using AI.” So far, the company has only confirmed that it is a test, seemingly downplaying it to users while talking up AI’s business potential to its shareholders. More from TechCrunch.

⚔️ Disney activist fight escalates with Nelson Peltz’s board nominations. Former CFO Jay Rasulo, once seen as one of Bob Iger’s potential heirs at the company, has been nominated for a seat on the company’s board by Trian Partners. The activist investment firm also nominated its founder, Nelson Peltz, for a board seat as it officially kicks off a new proxy battle with the company. Rasulo has been quoted saying, “The Disney I know and love has lost its way.” making it clear where he stands on the company’s current trajectory. The Hollywood Reporter has more.

🏭 Temu sues Shein, alleging intimidation of its manufacturers. The online shopping giant Temu says the fast fashion retailer Shein is using “Mafia-style” intimidation tactics on its merchants. The lawsuit alleges these aggressive tactics were used to illegally interfere with its business by intimidating merchants who list products on both platforms and issuing thousands of illegitimate copyright takedowns. This isn’t the first lawsuit between the two companies, but it comes at a time when Shein is under strict watch as it prepares for a 2024 U.S. IPO. More from The Verge.

🧑🏫 Tax filings reveal Musk is building a university in Texas. Filings for the billionaire’s new charity, “The Foundation,” outline his plans to create a STEM-focused K-12 school in Austin, Texas. He’ll initially fund the project with just over $100 million, with the school ultimately intending to expand its operations to create a university “dedicated to education at the highest levels.” Musk moved to Austin during the pandemic and outlined a plan to reshape Central Texas, where he’s moved Tesla’s headquarters and built a ten million-square-foot factory. This project is an extension of that vision. Axios has more.

Links

Links That Don’t Suck:

😓 More Americans over 65 are working — here’s why

📉 Manhattan median rent falls for the first time in over two years

🕳️ There’s a big hole in China’s plan to boost the economy in 2024

😡 Broken wings: Complaints about U.S. airlines soared again this year

🙃 Colorado thieves ask for lesser charge because items they stole were on sale