Nvidia’s results helped propel the stock and broader market indexes to new all-time highs. Like it or not, investors are betting the farm on the generative AI “tipping point” in fear of missing out on future gains. Let’s see what you missed. 👀

Today’s issue covers a new high in new highs, AT&T suffering a major outage, Reddit readying for its IPO, and a bull case for Alibaba. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

10 of 11 sectors closed green. Technology (+3.27%) led, & utilities (-0.77%) lagged. 💚

The Chicago Fed activity index showed that economic growth in the region fell in January, while initial jobless claims fell to a five-week low. The S&P Global survey also showed that U.S. business activity cooled in February, but prices paid for inputs fell to their lowest level in nearly 3.5 years. 🏭

Existing home sales rose 3.10% YoY in January, with the median existing home price rising 5.10% YoY to $379,100. That represents a new all-time high for the month of January, which is seasonally a slow period for the housing market. 🏘️

Vaccine maker Moderna rose 14% after beating fourth-quarter revenue expectations, with deferred revenue and cost cuts buoying its performance. Novavax also rose 23% after settling a dispute with nongovernmental global vaccine organization Gavi, which centered around a canceled COVID-19 vaccine purchase agreement. 💉

And it’s a big day for several beaten-down tech stocks, with Carvana, Block, Talkspace, and others rallying sharply following better-than-feared earnings reports. 📈

Other symbols active on the streams: $ROOT (+53.29%), $NEM (-7.60%), $GCT (+27.27%), $RIVN (-25.60%), $BZFD (+58.10%), $ICU (-23.45%), $RXRX (+21.26%), & $AMP.X (+45.82%). 🔥

Here are the closing prices:

| S&P 500 | 5,087 | +2.11% |

| Nasdaq | 16,042 | +2.96% |

| Russell 2000 | 2,014 | +0.96% |

| Dow Jones | 39,069 | +1.18% |

Stocks

A New High In New Highs

Nvidia earnings re-ignited the animal spirits in the market, causing the stock and major indexes to reach several new milestones. Let’s check’em out. 👇

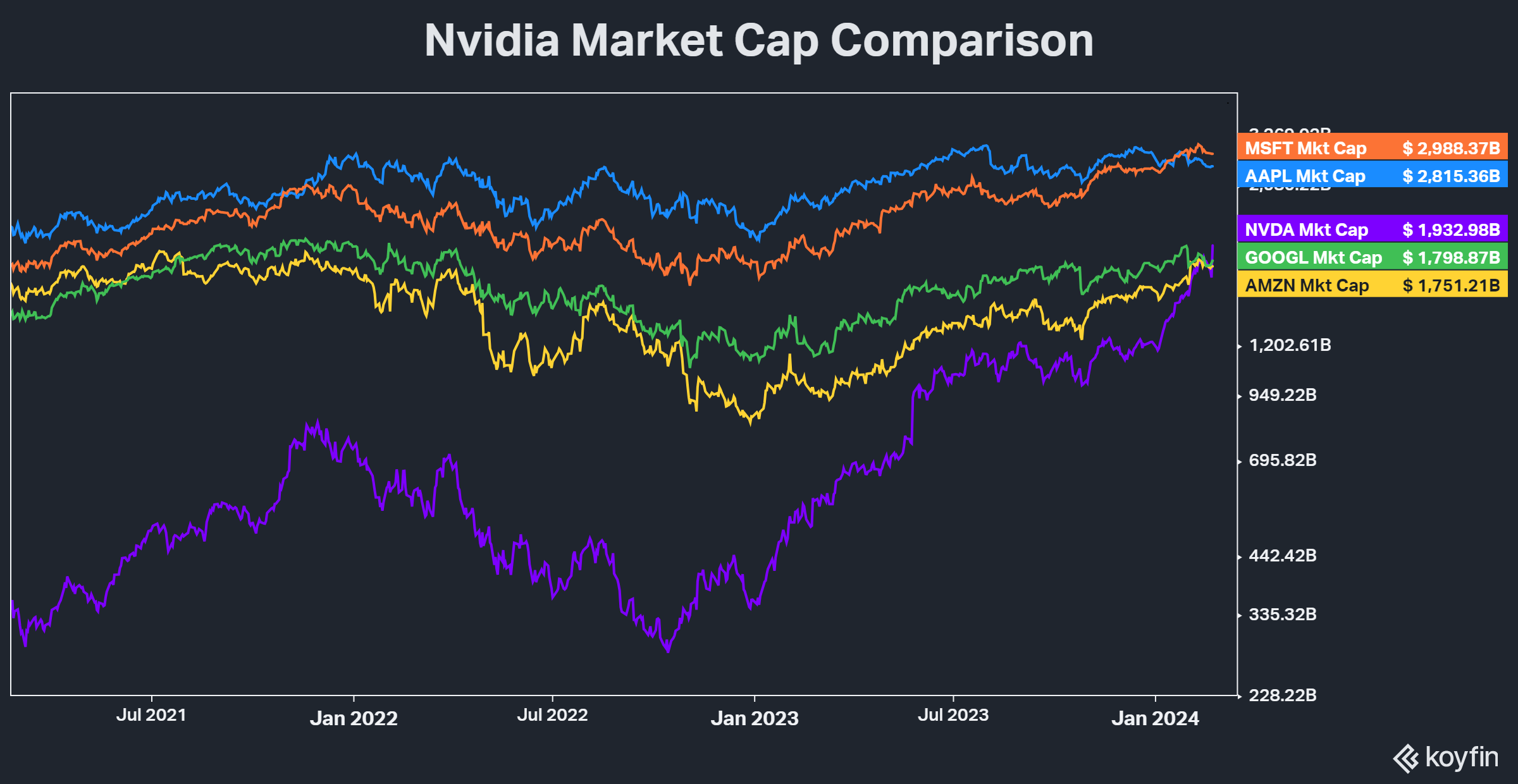

Firstly, a 16% rise in the stock today caused its market cap to rise $277 billion, the largest one-day increase of any stock in history. Secondly, today’s move put it firmly ahead of Google and Amazon as the fourth-largest stock in the world (Saudi Aramco not pictured below). It also moved it a stone’s throw away from $2 trillion. 🤩

The strength in Nvidia also helped push the Nasdaq 100 and S&P 500 to new all-time highs. But it’s not just the U.S. indexes experiencing a major bull run. 🌏

One of the markets we’ve been talking about for well over a year is Japan’s Nikkei 225. After 34 years, the index has made a new all-time high as low interest rates continue to drive the country’s currency lower and its stock market higher. 💴

In addition, India’s Nifty 50, Germany’s DAX, France’s CAC 40, and several other global stock market indexes made new all-time highs. While the bears continue to argue about the stock market’s valuation and breadth, the global bull market continues to rip-roar higher. 🐂

Eventually, it will come to an end; it always does. But for right now, there doesn’t seem to be a clear catalyst to stop this runaway bull market. Especially if tech stocks continue to deliver the goods… 🤷

Stocktwits Presents “Trends With Friends”

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends and special guest Chris Camillo discuss:

- Humanoids: Chris’ big bet on how AI will manifest in the physical world 🤖

- Markets: Apple’s fall from grace and the group’s highest-conviction trades 💰

- Health: Practical advice on embracing less in the age of overabundance 🚫

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

Company News

AT&T Suffers Major Outage

Those who work at AT&T today did not have a great day, but those who use their services had a pretty good excuse to chill out at work today. That’s because the telecom giant experienced a nationwide cellphone outage that impacted tens of thousands of its customers today. 📵

While the nation’s largest carrier said it restored wireless service to all impacted customers by midday, no reason has been given for the outages. With T-Mobile and Verizon’s networks unaffected, regulators quickly questioned whether AT&T experienced a hack or other cyberattack. 📡

Despite that suspicion, U.S. cyber officials tracking the outage said there’s no indication of malicious cyber activity so far. As a result, regulators, customers, investors, and other stakeholders are left to wonder how this could happen and worry that it might happen again.

It’s been a rough few years for telecom stocks, with this event adding to a slew of bad news impacting the companies and their stocks. 📰

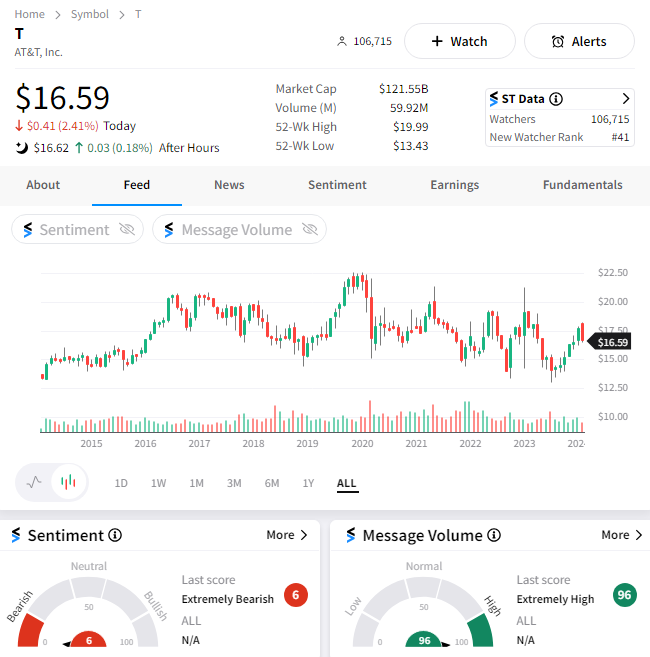

AT&T shares fell roughly 3% on the day, but the Stocktwits community is not looking to bottom-fish the troubled stock. Sentiment is currently in “extremely bearish” territory as investors look elsewhere for opportunity. 👎

The return of the unprofitable initial public offering (IPO) has us feeling like it’s 2021 all over again. With animal spirits roaring, social media giant Reddit hopes the current market environment will help it successfully make a public market debut. 🤑

Late today, the company filed to list on the New York Stock Exchange (NYSE) under the ticker $RDDT. Its S-1 filing boasts 100k+ active communities, 73 million average daily active unique, 267 million average weekly active unique, and over 1 billion cumulative posts.

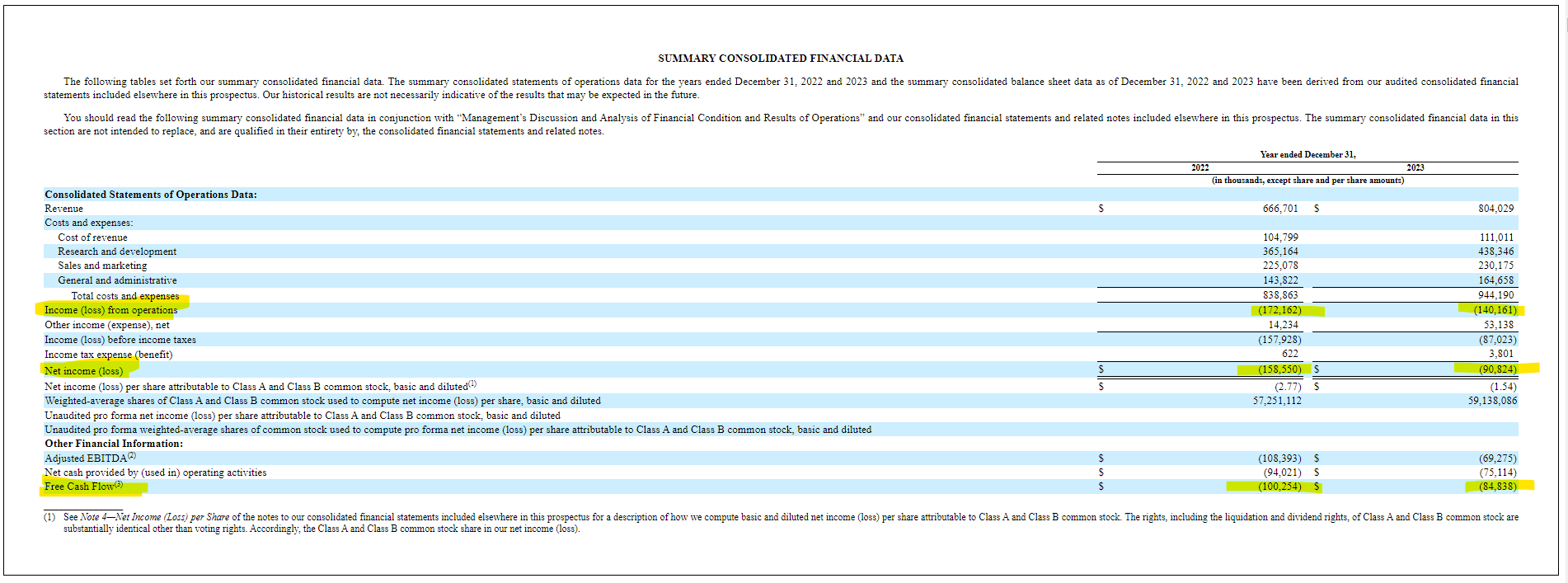

However, the bears were quick to point out that the stats that matter are its financials, which leave a lot to be desired. The summary of its financial data shows the company posted losses from operations and negative free cash flow for the last two years. And if a company can’t generate cash from operations…it’ll get it from investors (or debt). 💸

Overall, details like its offering price and exact trading date have yet to be determined, but the filing shows that the company is close. We should see this happen within the next month, if not sooner. In the meantime, it’s cutting deals left and right to help bolster its revenue numbers. Its latest is with Google to use its data for AI training purposes. 🤝

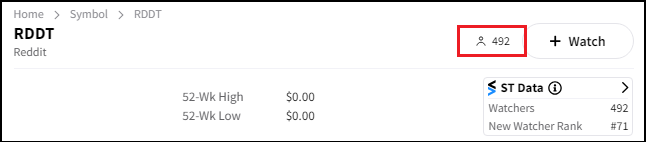

The conversation around the company is already picking up around the interwebs. With an already active stream, it’s gotten nearly 500 followers on our platform so far.

A lot will be happening in the weeks ahead. So, to stay on top of everything ahead of its IPO, follow the $RDDT symbol page on Stocktwits. We’ll see you over there! 👍

Stocktwits Spotlight:

Given the current bull run, most stock market investors and traders are focused on the many names and indexes hitting all-time highs. However, others are looking through the beaten-down areas of the market to identify names that could play “catch up” in the latest buying spree. 🤔

Stocktwits user Professor shared his chart of Alibaba above, showing an “inverse head and shoulders” pattern potentially forming. This type of chart setup comes after a decline and can signal a trend reversal should prices break above the “neckline” created by either a downtrend line or horizontal level of support/resistance. 🤔

Putting all the technical jargon aside, its development is a sign that buyers could be beginning to retake control of the stock. However, prices need to close above the $77-$78 level to confirm the trend reversal and target the low 90s.

With Chinese stocks trying to stabilize and broader sentiment remaining bearish toward the country’s market and economy, we’ll be keeping a close eye on this one. 🕵️♂️

In the meantime, if you like these types of technical setups you need to be following Professor on Stocktwits. We’re constantly finding gems on his page. 👀

Bullets

Bullets From The Day:

🌽 U.S. farmers face harsh economics amid record corn supply. Farmers who did not sell their corn crop last summer when the Midwest’s drought drove prices up are facing troubling conditions. Rains resumed and saved the crop, sending prices tumbling and leaving farmers with storage bins filled to the brim with corn. Corn, being the world’s most traded commodity crop, often sets the tone for other crops like Soybeans. The unique combination of issues has put American farmers in a challenging position going into the 2024 season. Reuters has more.

🆘 Google scares Gmail users with a confusing update email. A fast-spreading online hoax purports to show an email from Google saying, “The journey of Gmail is coming to a close,” sending the internet into momentary chaos. However, users can rest easy knowing that Gmail isn’t going anywhere, but one way of accessing it is. While most people have defaulted to the “new” Gmail view a long time ago, those still on the “basic HTML” version will need to make the switch as Google sunsets the product. More from TechCrunch.

✂️ Yahoo lays off the leaders of Engadget. Ten people at the outlet are losing their jobs, with the editorial staff being split into two sections, “news and features” and “reviews and buying advice.” The switch comes as it looks to optimize traffic and revenue growth, hoping to emphasize commerce revenue. The nearly 20-year-old tech publication has not been immune to the media industry’s current headwinds and hopes the drastic changes will help turn things around. Staff said the changes came swiftly and without notice, blindsiding most. The Verge has more.

🥤 Dunkin’ is gambling on caffeine-spiked drinks despite Panera deaths. The coffee and donut brand has introduced new fruit-flavored energy drinks that contain slightly less caffeine than Panera Bread’s Charged Lemonades, which remain the subject of lawsuits over customer deaths. The booming energy drink category has continued its epic run, with the 18 to 34 male demographic driving consumption. The SPARKD’ Energy line was rolled out nationwide this week after being tested at some Florida and Vermont locations last fall. More from Axios.

🚫 FTC bans antivirus company from selling users’ browsing data. The Federal Trade Commission (FTC) is banning antivirus giant Avast from selling consumers’ web browsing data to advertisers after Avast claimed its products would prevent its users from online tracking. Avast will also pay $16.50 million to settle the oh-so-ironic charges and will provide redress for its users whose sensitive browsing data was improperly sold to ad giants and data brokers. TechCrunch has more.

Link

Links That Don’t Suck:

💡 The top 3 favorite options trading strategies from a successful 8-figure trader, John Carter.*

😟 Vice Media faces uncertain future amid ownership changes

🏡 America’s housing affordability crisis makes a comeback

😬 A glimpse into post-entertainment society (it’s not pretty)

🙎 Restaurants across America are in crisis because of stubborn diners

🎓 SAT resurgence: Yale is latest elite college to drop test-optional policy

⚠️ Chart crime: Americans have not spent this much of their incomes on food since the Gulf War

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.