The crypto market must think bad news and FUD are the newest Girl Scout cookie flavors because crypto is eating up dips and short positions like a fat kid in a candy store on a buy 1 get 10 free sale. 🍪

Today’s Litepaper covers a variety of intriguing topics, including XRP’s remarkable surge, the fluctuating fortunes of Galaxy Digital, a brief summary of the alleged crimes committed by SBF, and a Technically Speaking article that delves into a crucial time cycle for the cryptocurrency market.

Green across the board today, with Cardano taking the lead – which is a little different than what we’ve been used to seeing this year. Let’s see how long it lasts as a top mover.

Here’s how the market looked at the end of the trading day:

| Cardano (ADA) |

$0.387

|

7.33% |

| Chainlink (LINK) | $7.38 | 6.40% |

| XRP (XRP) | $0.553 | 6.02% |

| Stellar (XLM) |

$0.102

|

5.45% |

| Filecoin (FIL) |

$5.75

|

4.76% |

| Litecoin (LTC) | $92.55 | 4.59% |

| Polygon (MATIC) | $1.12 | 3.90% |

| Dogecoin (DOGE) | $0.076 | 3.64% |

| Bitcoin (BTC) | $28,331 | 3.59% |

| Avalanche (AVAX) |

$17.33

|

3.30% |

| Altcoin Market Cap |

$604 Billion

|

2.39% |

| Total Market Cap | $1.152 Trillion | 3.11% |

Crypto

XRP Surging Higher

$XRP, Ripple Labs’ digital asset, boarded the U.S.S. Pampy McPampy Pamp and just keeps on pamping. How much pamp? 🚢

+50.28% so far for March and +30.56% this week. 🤯

There are some rumors Ripple Labs is now discussing a resolution with the SEC. If a settlement occurs, it would likely boost confidence and demand for XRP by clarifying its legal status.

Hell, at this point, even a loss might be considered bullish in the crypto space – it would be a resolution to a nearly two-and-a-half-year legal struggle.

The SEC has been in a legal battle with Ripple Labs since December 2020, claiming that XRP is a security and was sold without proper registration. The lawsuit led to a substantial drop in XRP’s price, from $0.60 to $0.18 within days, and resulted in U.S.-based exchanges removing XRP from their platforms.

Many crypto-focused attorneys on Twitter, who follow the XRP case, predict a summary judgment may be handed down between the end of this week to mid-April. 🗓️

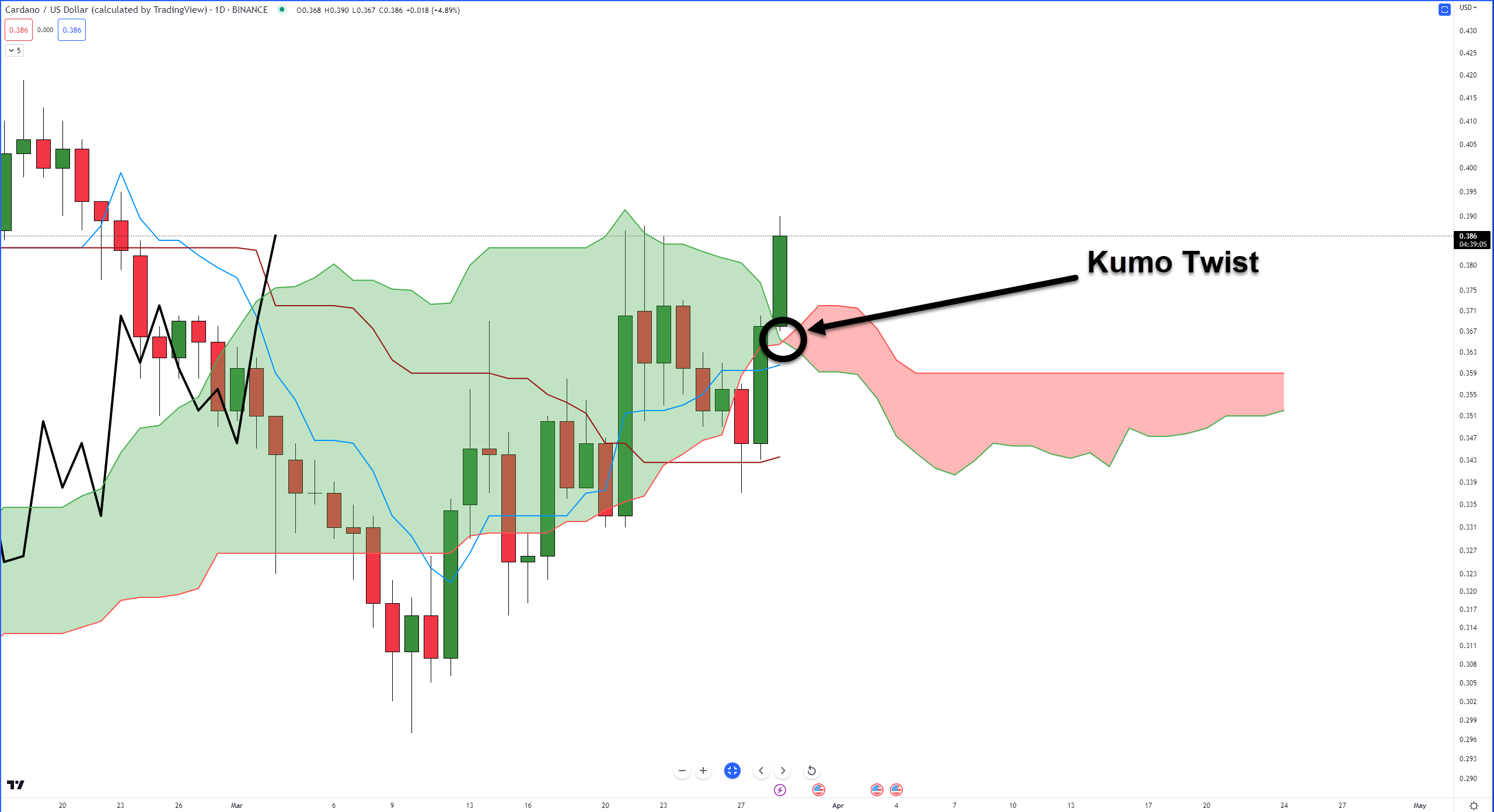

Most of the top 25 cryptocurrencies by market cap are close to approaching a Kumo Twist on the daily chart, and most are at swing lows. 🌋

What are Kumo Twists? Take a look at Cardano’s chart below:

Kumo Twists are when Senkou Span A crosses Senkou Span B and can indicate likely changes in trend. Sometimes a Kumo Twist is the most immediately visible sign of a trend change.

In other words, if something is trending strong up or down and it approaches a Kumo Twist, that market can have a high probability of finding a major/minor swing/high that results in a major trend change or a correction.

What makes Cardano’s chart interesting from an Ichimoku perspective is how the current daily candlestick seemingly shot through the Cloud. It’s a phenomenon within the Ichimoku Kinko Hyo system.

When price is near the point of Senkou Span A crossing Senkou Span B, instead of expecting resistance, it almost acts as an accelerant for price to move through, like hitting a speed buff in F Zero or Mario Cart. 🏎️

Like Cardano, many altcoins are at or near a Kumo Twist on their daily charts.

The cryptos with (above) indicate that they are above the Cloud; everything else is below the Cloud.

- $ADA – March 30

- $ATOM – March 29

- $AVAX – March 30

- $AXS – March 28

- $BNB – March 29 (above)

- $BTC – April 4 (above)

- $COTI – March 28

- $DOGE – March 28

- $DOT – April 1

- $ETH – April 4 (above)

- $FTM – April 1

- $LINK – March 31

- $LTC – April 1

- $SHIB – April 1

- $SOL – April 2

- $XLM – March 31 (above)

- $XTZ – April 2

Using Cardano’s chart again as a reference, the majority of cryptocurrencies are at or near the end of one of the most important time cycles in Gann Analysis: the 90-day cycle.

The 90-Day cycle is one the most important in Gann’s Cycles of the Inner Year. Gann wrote this about the 90 Day Cycle:

- Most powerful division of the one-year cycle.

- High probability of support or resistance being found.

- 90 days up or down will usually start a countertrend movement or reverse the trend.

- 90 days from all significant highs or lows must be watched for trend changes.

- Against extreme momentum and/or pitch, it can go 99 days.

Does this mean things are about to get uber-bearish? No. Historically, when a new bull run begins after a bear market, $BTC moves higher for 4+ months – but that’s something we’ll visit next week.

According to analysts, the likely bullish scenario(s) for the next two weeks is for cryptos above the Ichimoku Cloud to pull back a little or consolidate while the rest of the altcoin market responds to the swing lows and plays catchup with everyone else.

For the bears, their ideal scenario is a violent continuation move south, with the Kumo Twist and 90-day Gann cycle acting as a source of resistance in time to the trend in force.

Galaxy Digital ($BRPHF) announced a net loss of $1 billion for 2022 but has bounced back with a pre-tax profit of $150 million in the first quarter of 2023. 💵💵💵

Galaxy Digital experienced a significant loss in 2022 compared to a profit of $1.7 billion in 2021. The company also reported a net loss of $288 million for the last quarter of 2022, in contrast to a net income of $521 million for the same period in the previous year.

The main contributors to this loss were unrealized losses of $659 million on digital assets and $496 million on investments in the firm’s Principal Investments Portfolio, driven by the substantial decline in digital asset prices throughout 2022.

By the way, if you want the nitty-gritty on how substantial 2022’s declines were, read our review of 2022 here.

In contrast, 2023 has started positively for Galaxy Digital, with the company reporting a pre-tax income of $150 million and maintaining a strong liquidity position through March 24, 2023. In addition, the firm anticipates further profits in its operating businesses, bolstered by gains from digital assets on its balance sheet.

Additionally, Galaxy Mining has doubled its capacity since the beginning of 2023 – they might need to step that up because $BTC‘s hash rate had the biggest 3-month spike in 5 years. ⛏️

SBF has different counts of breaking nearly every rule in the financial book. But do you want to go through the first 45 pages, followed by another chunk of pages from yesterday on the bribery charge?

Of course you don’t. And now that I have gone through it, I don’t want to do it again, either.

Bullets

Bullets From The Day:

🤥 MetaMask dispels airdrop misinformation. The popular ETH wallet and browser extension has warned its users about circulating false rumors of an airdrop. The company has clarified that there is no such event planned and advises users to be cautious and avoid falling for scams.

🤦 EU imposes a €1,000 cap on anonymous crypto transactions. This move aims to curtail money laundering and terrorism financing while ensuring better transparency in the crypto space. Because everyone knows that caps on anonymous crypto transactions will stop anyone trying to circumvent reporting their crypto transaction. No one told the EU about $XMR then.

🤬 The EU put a 1,000 Euro cap, but the U.S. responded with ‘Hold My Beer’. The Restrict Act has been introduced in the United States, proposing a 20-year jail term for individuals found guilty of using cryptocurrencies for illegal activities. In other words, if TikTok is banned and you’re caught twerking on TikTok, the U.S. Government will pull an Iran and throw you in prison for 20 years.

🤖 Fetch.ai ($FET) daises $40 million for decentralized machine learning. AI-focused blockchain protocol Fetch.ai has raised $40 million in a funding round. The funds will be used to deploy decentralized machine learning, aiming to revolutionize industries with secure and autonomous data and AI solutions.

🏃♂️ Binance users are withdrawing big time after legal and regulatory FUD. Users have started withdrawing their funds from the exchange after the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against the company, a little over $1.6 billion so far. The lawsuit alleges that Binance violated regulations by allowing U.S. residents to trade on the platform without proper registration, among many other allegations.

🕵️♀️ Polygon combats NFT scams through Web3 iInfrastructure partnership. Polygon ($MATIC), an $ETH scaling solution, has partnered with Web3 infrastructure protocol Wakweli to address NFT scams in the market. The collaboration aims to enhance security and protect users from fraudulent NFT transactions.

🕹️ Maybe $ATVI will bring back the Diablo III auction house for Diablo IV for tokenized items? Web3 gaming is becoming increasingly popular among serious gamers, offering unique and immersive experiences. The integration of blockchain technology in gaming allows for decentralized ownership and a whole new level of engagement. Web3 gaming activity exploded between 2021 and 2022 by 2,000%.

Links

Links That Don’t Suck:

🌚 Gate.io suspends withdrawals of SafeMoon following public burn bug exploit

⚒️ US CFTC Chief reinforces that Ethereum is a commodity

🚬 SEC chief Gary Gensler to face Congress grilling over crypto policy

😱 Shocking revelation: Binance concealed links to China for years, company documents reveal

😖 Voyager Digital sale on hold as Binance.US faces market manipulation charges

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: