The forecast is cloudy, with a 100% chance of pain. Price action continues to ping-pong up and down with no clear direction. 🔴

In today’s Litepaper, we’re exploring Cardano’s booming DeFi sector, with a special focus on SNEK’s role in boosting Minswap’s volumes.

We’ll also delve into Cardano’s revolutionary no-code smart contract development, investigate Tether’s Bitcoin mining in Uruguay, and give you a snapshot of the current market in our ‘Technically Speaking’ segment.

Slightly red across the board today, with XLM the only major crypto showing some green on the screen.

Here’s how the market looked at the end of the trading day:

| Stellar (XLM) | $0.091 | 1.16% |

| TRON (TRX) | $0.076 | -0.51% |

| Cardano (ADA) | $0.375 | -0.68% |

| Dogecoin (DOGE) |

$0.072

|

-1.12% |

| Bitcoin Cash (BCH) |

$112.70

|

-1.41% |

| Polygon (MATIC) | $0.887 | -1.65% |

| Chainlink (LINK) | $6.48 | -1.70% |

| Ethereum Classic (ETC) | $17.98 | -1.75% |

| Ethereum (ETH) | $1,865 | -1.98% |

| Uniswap (UNI) |

$5.04

|

-1.99% |

| Altcoin Market Cap |

$572 Billion

|

-1.62% |

| Total Market Cap | $1.098 Trillion | -1.96% |

DeFi

Holy $SNEK

Betting on a Decentralized Exchange (DEX) on Cardano to break into the top 10, let alone the top 5 in traded volume, would have been considered a laughable gamble just a short while ago. Well, it’s time to wipe those smiles away. 😵

What a month it's been for Minswap and #Cardano🔥

It was the Highest Volume Month in the history of Minswap with over half a Billion $ADA (328% MoM increase!) and highest Monthly Daily Users (over 30k!)🎉

Month in Review Stats 📊 for May 2023 👇 pic.twitter.com/qlXeQ9jrlY

— Minswap Labs (@MinswapDEX) May 31, 2023

A New Record for Minswap

As we bid farewell to May, Minswap, the largest DEX on Cardano’s network, has experienced a spectacular leap in trading volume. It has breached the half-billion-ADA mark, setting a new record in Minswap’s young history with a staggering 530+ million $ADA, or nearly $200 million.

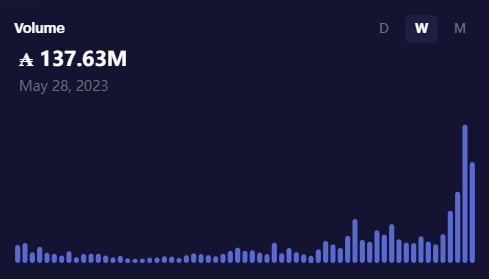

A week ago, Minswap saw nearly 190 million ADA ($68 million) in volume. Now, even though we’re only halfway through the current week, the traded volume is already edging close to 140 million ADA ($50 million).

The SNEK Factor

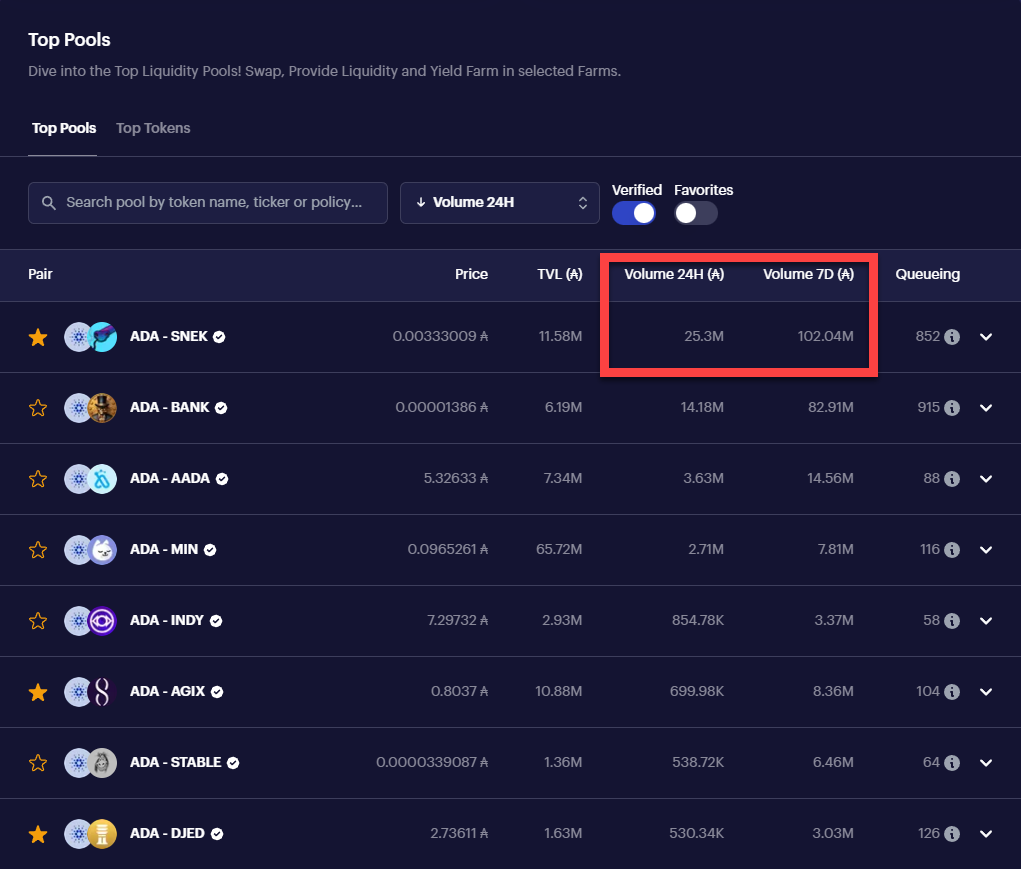

The dramatic surge in trading volume primarily boils down to the emergence of one key player: $SNEK.

This memecoin on Cardano has been generating considerable daily and weekly volume. 🐍

SNEK is not just causing ripples within the Cardano network. Much like Florida’s infamous python invasion, SNEK is spreading beyond the boundaries of Cardano’s DeFi and DEX scene.

It’s now making its way to centralized exchanges like CoinX and MEXC. 😲

SNEK/USDT trading will be live in 10 minutesss on @MEXC_Global 🚀🐍 $SNEK pic.twitter.com/igH8fWmnRq

— Snek 🐍 (@snekcoinada) May 31, 2023

Eyes on the Future

While some skeptics may shrug off the memecoin-induced volume and interest surge in Cardano as a fleeting trend, the introduction of Marlowe might alter that perception. 🤯

Hugenormous news for Smart Contracts and Cardano’s network in general: Marlowe is out.

1/ 🧵 Exciting news! #Marlowe is now available on mainnet for early adopters to start testing and providing feedback. It's a safe and intuitive way to create and deploy smart contracts on #Cardano. Let's dive into what makes Marlowe special.👇 pic.twitter.com/lp8AIRCEPr

— Marlowe (@marlowe_io) May 30, 2023

In the ever-evolving world of decentralized finance (DeFi), tools that simplify the process of creating and executing financial contracts are not just a luxury, but a necessity.

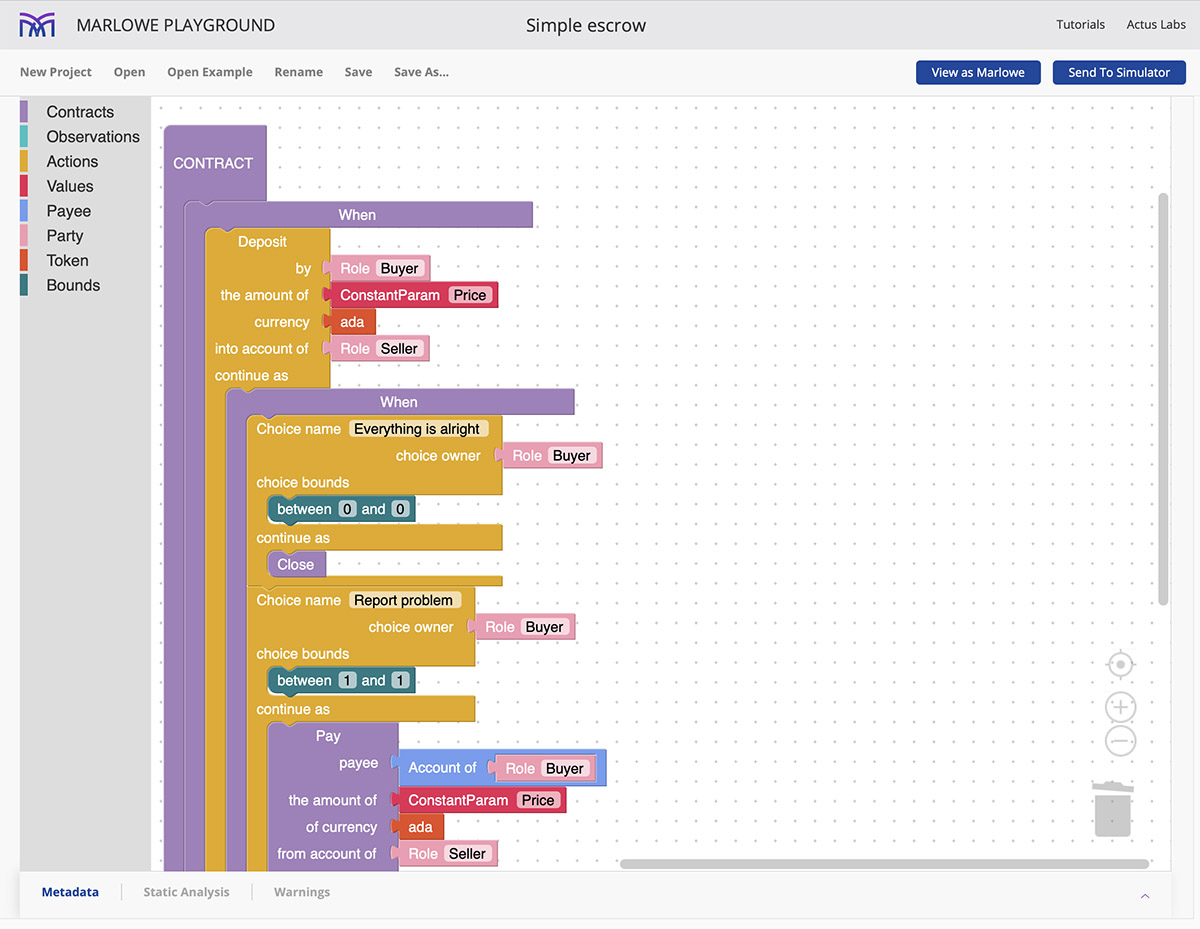

Enter Marlowe, a domain-specific language (DSL) embedded within Cardano’s blockchain ecosystem, designed specifically for handling financial smart contracts.

Let’s delve into what makes Marlowe a potential game-changer in the world of DeFi and its unique features that set it apart:

1. Built for Finance: Marlowe is explicitly designed to handle financial contracts, offering a suite of contract primitives commonplace in the financial industry. It’s the go-to tool for creating a broad array of financial instruments.

2. Embedded in Haskell: Marlowe takes advantage of Haskell, a functional programming language renowned for its precision and mathematical logic. This allows developers to leverage Haskell’s power to write and analyze Marlowe contracts.

3. Browser-Based Interface: With Marlowe Playground, users have a browser-based environment to write, simulate, and scrutinize their contracts—no software installation required.

4. Readability: Marlowe contracts are designed to be understood by all parties involved, meaning financial experts, lawyers, and others can comprehend a contract’s workings without a programming language knowledge prerequisite.

5. Safety: Marlowe ensures “safe” contracts, which means contracts will never go haywire—they won’t perform anything outside the standard behavior of blockchain transactions.

6. Analytical Tools: Marlowe Playground provides a plethora of tools for contract analysis, including static analysis for contract property checking, and simulation to observe contract behavior with varying inputs.

Marlowe’s versatility extends to contracts involving Cardano’s native token, ADA, and other tokens minted on the Cardano platform, making it a key player in Cardano’s DeFi ecosystem.

By addressing key challenges in the creation and execution of financial contracts on blockchain platforms, Marlowe positions itself as an essential tool in the DeFi landscape:

Accessibility: The complexity of smart contract programming languages often poses a barrier to entry. Marlowe breaks down these barriers, being easily readable and writable for individuals without a programming background, making it an ideal tool for financial experts, business owners, and legal professionals.

Security: Smart contracts can potentially harbor bugs and security issues, which can spell disaster when dealing with financial transactions. Marlowe minimizes these risks with its domain-specific language, which only permits the construction of valid contracts—dramatically reducing coding errors.

Predictability: The determinism of Marlowe contracts ensures the same outcome with the same inputs—a critical characteristic for financial contracts.

Compliance: Marlowe’s easy contract reading and verification process can facilitate regulatory compliance and mutual understanding of contract terms amongst all parties.

Analysis and Testing: Marlowe provides a suite of tools for testing and analyzing contracts, including Marlowe Playground, where users can simulate contract behavior under varying conditions—allowing users to understand potential contract outcomes before execution.

Interoperability: Being built on Cardano, Marlowe can work with ADA and other Cardano-based tokens, making it a flexible tool for building DeFi applications.

Cost-Efficiency: Marlowe reduces the time and cost of creating, testing, and deploying financial smart contracts by providing a high-level, domain-specific language.

In a nutshell, Marlowe is poised to transform how we create and execute financial contracts on the blockchain, democratizing access to DeFi and paving the way for a more inclusive, accessible, and secure financial future.

Despite a year fraught with setbacks and significant losses for $BTC, Tether remains undaunted, revealing its plans to invest in sustainable Bitcoin mining operations in Uruguay. ⛏️

At Tether, we understand the importance of energy in driving progress & enabling thriving communities. That's why we're dedicated to harnessing the power of renewable energy to mine #Bitcoin, the world's most open & secure monetary network.

Learn More 👉 https://t.co/LmBQptyobi pic.twitter.com/VrG20OnE1Z

— Tether (@Tether_to) May 30, 2023

This move is a bit left-field, considering Uruguay’s minor role in the global network hash rate compared to powerhouses like the U.S. Yet, with the country generating more than 98% of its electricity from renewable sources, $USDT sees an opportunity to champion a greener approach amidst the dwindling availability of Bitcoin.

And from their website, they seem pretty serious about it:

Despite the controversy surrounding Tether, they’re committed to Bitcoin, even pledging to use up to 15% of its monthly net operating profits to bolster Bitcoin reserves. 💎

A Red Month for Bitcoin

As we prepare to close the curtains on May, Bitcoin ($BTC) and the broader cryptocurrency market are painting a less-than-rosy picture. Unless there’s an unexpected twist in the tale, we’re looking at a month cloaked in red. 🔻

Bullets

Bullets From The Day:

🥹 Bye, Bybit. Crypto exchange Bybit has decided to halt its operations in Canada by May 31 due to recent regulatory changes, putting a stop to new account openings and allowing existing customers until July 31 to deposit funds and enter new contracts. The decision aligns with Bybit’s commitment to comply with local laws and regulations, mirroring actions taken by exchanges such as Binance in response to Canada’s increasingly stringent regulatory environment for crypto companies, including obligatory approval by the Canadian Securities Administrators (CSA).

🪙 Digital Euro incoming? The EU, via Eurosystem, has prototyped a digital euro through a settlement engine, N€XT, which is based on Unspent Transaction Output (UTXO) model, commonly utilized in Bitcoin ($BTC) and Cardano ($ADA). Testing revealed that the UTXO model could support efficient transaction validation and multiple transaction types and safeguard user privacy. N€XT was tested over eight months alongside five front-end prototypes for potential use cases, like person-to-person and e-commerce payments. Despite resemblances to Bitcoin’s architecture, N€XT would be centrally governed, contrasting Bitcoin’s decentralized consensus mechanism. The ECB will decide in fall 2023 whether to continue developing a potential digital euro.

⛏️ Mining tax avoid. The upcoming U.S. House of Representatives debt ceiling deal does not include the proposed 30% excise tax on energy usage by cryptocurrency mining or the application of wash trading tax rules to digital assets. These crypto-related tax measures were initially proposed by the Biden administration in March, intending to increase federal revenue. However, the present debt deal, aiming to raise the U.S. debt ceiling and cap non-defense federal spending, omits these measures. In addition, while the energy usage tax was intended to curb the environmental impact of crypto mining, its estimated revenue contribution of $3.5 billion over ten years is marginal compared to current U.S. debt levels and expected government spending.

🏦 Binance is reportedly exploring a proposal to allow certain institutional clients to hold their trading collateral at a bank rather than on the exchange. The proposed setup would enable clients to use bank deposits as collateral for margin trading in spot and derivatives, potentially involving Swiss-based FlowBank and Lichtenstein-based Bank Frick as intermediaries. This discussion emerges amidst regulatory scrutiny concerning the risks and conflicts of interest inherent in crypto exchanges combining custody, brokering, and lending services.

Here is some of what’s inside today’s curated NFT news collection:

Qwan is set to launch on Ethereum, Japan’s largest airline initiates an NFT marketplace, PancakeSwap expands into GameFi, and the BRC-721E token standard offers Ethereum to Bitcoin NFT conversions.

Links

Links That Don’t Suck:

🫥 Nansen slashes 30% of headcount in bid to cut costs

🎮 NVIDIA surpasses $1 trillion market cap

⛓️ Solana’s blockchain may become ‘Apple of crypto’, says co-founder

🆘 US regulator issues warning for firms providing clearings services for crypto

🔥 Diablo 4 review: darker equals better in this intrinsically addictive reinvention of hell