Moderately green gains across the board today, with hints of incoming bullish volume as the ‘regular’ markets closed for the week. 🟢

Will it last? Weekends and holidays are notorious for generating massive volatility and wild price action.

On deck today: why the XRP vs. SEC decision could be just weeks away, China’s crypto ‘oops’ on Commie TV, and a shift in devs from $ETH to $BTC due to Ordinals.

And in today’s Technically Speaking, we’re looking at $XRP and $ADA.

Here’s how the market looked at the end of the trading day:

| XRP (XRP) | $0.463 | 3.12% |

| Litecoin (LTC) | $87.10 | 2.66% |

| Polygon (MATIC) | $0.906 | 2.20% |

| Ethereum Classic (ETC) |

$18.05

|

1.94% |

| Stellar (XLM) |

$0.088

|

1.77% |

| Cardano (ADA) | $0.362 | 1.23% |

| Avalanche (AVAX) | $14.25 | 1.18% |

| Bitcoin Cash (BCH) | $113.02 | 1.16% |

| OKB (OKB) | $46.73 | 1.14% |

| Ethereum (ETH) |

$1,825

|

1.08% |

| Altcoin Market Cap |

$565 Billion

|

0.81% |

| Total Market Cap | $1.082 Trillion | 0.81% |

Resolution In Ripple Vs. SEC Weeks Away?

Ripple Labs’ ($XRP) CEO Brad Garlinghouse is anticipating a decision on its ongoing legal battle with the SEC within the next few weeks. 😱

Recent developments in the case, particularly regarding the SEC’s former Director of Corporate Finance William Hinman and his comments about Ethereum ($ETH), have led Garlinghouse to expect a swift resolution.

Garlinghouse mentioned in a recent interview with SCB 10X that Judge Torres’ ruling against the SEC to redact certain information – the Hinman speech – puts the timeline of a resolution in weeks, not months.

Another win for transparency! Unredacted Hinman emails to be publicly available soon – stay tuned as the lawyers work through the mechanics to make that happen. https://t.co/o6puPypRHd https://t.co/qmaLVeQaP8

— Brad Garlinghouse (@bgarlinghouse) May 16, 2023

The e-mails associated with the Hinman speech will be made public on June 13th.

The outcome of this case is predicted to have significant ramifications on the broader cryptocurrency industry. 🔥

Ripple Hasn’t Stopped Expanding

The ongoing lawsuit, however, has not dampened Ripple’s global growth ambitions. The company has been vocal about its plans to expand through acquisitions and recently acquired shares in the European crypto exchange Bitstamp.

The transaction was revealed in Galaxy Digital’s latest quarterly report, which confirmed advising crypto hedge fund Pantera Capital on the sale of Bitstamp shares to Ripple.

The acquisition aligns with Ripple’s international expansion strategy, particularly in regions like the UAE and Switzerland that provide a clear regulatory environment for crypto-based businesses. Notably, this move has sparked industry speculation about Ripple’s plans, with conjectures around whether it intends to develop further its On-Demand Liquidity (ODL) offering or focus on its Liquidity Hub (LH) solution.

The company continues to hire predominantly outside the US and is actively leveraging its billion-dollar reserves to fuel growth. 🪙

In a recent turn of events, China’s state-backed media outlet, CCTV, aired a video discussing cryptocurrency, which was subsequently taken down. 🕵️♂️

#BTC #cryptocurrency #ckb if you are not buying now, what are you waiting for? China official news network is pushing crypto in Hong Kong.

— apltang.bit (@apltang) May 24, 2023

It even caught CZ’s attention:

CCTV (China Central Television) just broadcasted crypto. It's a big deal. The Chinese speaking communities are buzzing. Historically, coverages like these led to bull runs.

Not saying past predicts the future. And not financial advice.https://t.co/2wcArnPI93

— CZ 🔶 Binance (@cz_binance) May 24, 2023

Most of the excitement and hoopla is tied to Hong Kong’s recent announcement permitting licensed virtual asset platforms to offer services to retail traders.

However, the Securities and Futures Commission has not yet greenlit any crypto platforms to provide these services. CZ’s emphasis on the importance of CCTV discussing cryptocurrency stems from China’s complete ban on cryptocurrency activities in 2021.

With Hong Kong—a special administrative region of China—showing positive developments towards cryptocurrency, speculation about China’s stance on crypto has been reignited. 👀

At the Bitcoin 2023 conference in Miami last week, $ETH developers showed a keen interest in Ordinals, a protocol that has gained popularity within the $BTC community. 🥳

One notable startup, OrdinalSafe, a self-custodial Bitcoin wallet, participated in the conference’s “Pitch Day” and secured second place in the infrastructure category. OrdinalSafe’s CEO, Esad Yusuf Atik, described the experience as memorable and noted the warm reception from the Bitcoin community.

Discussions at the conference highlighted the debate surrounding Ordinals’ acceptance within the Bitcoin community. Critics argued that experimental BRC-20 tokens built using Ordinals strained Bitcoin’s network and caused higher transaction fees.

Concerns were raised about the potential impact of Ordinals on Bitcoin miners and the introduction of maximal extractable value (MEV) practices, which could lead to centralization and censorship.

Despite the debates, Bitcoin 2023 showcased the integration of Web3 concepts into the Bitcoin community. Additionally, other developers with Ethereum backgrounds, such as Subjective Labs, developed tools to track Ordinals collections and BRC-20 tokens on Bitcoin.

The conference reflected a growing culture of experimentation and collaboration between Ethereum and Bitcoin developers.

We’re going to revisit two of our previous Technically Speaking articles and evaluate how they’ve performed since their date of publishing. Call me a big nerd, but it’s fun to track the market’s progression and how it does or doesn’t follow the technical analysis theories applied.

The especially interesting aspects are the theories underpinning technical analysis—some of which have their roots more than a century ago—were conceived long before cryptocurrencies even made their debut on a candlestick chart. This offers us an extraordinary opportunity to transpose these time-tested theories onto a new market and to observe first-hand how they function and manifest. This is precisely what we will be doing in our discussion today.

Also – if you’d like to know more about the Ichimoku System, check out our Intro to Ichimoku here.

XRP

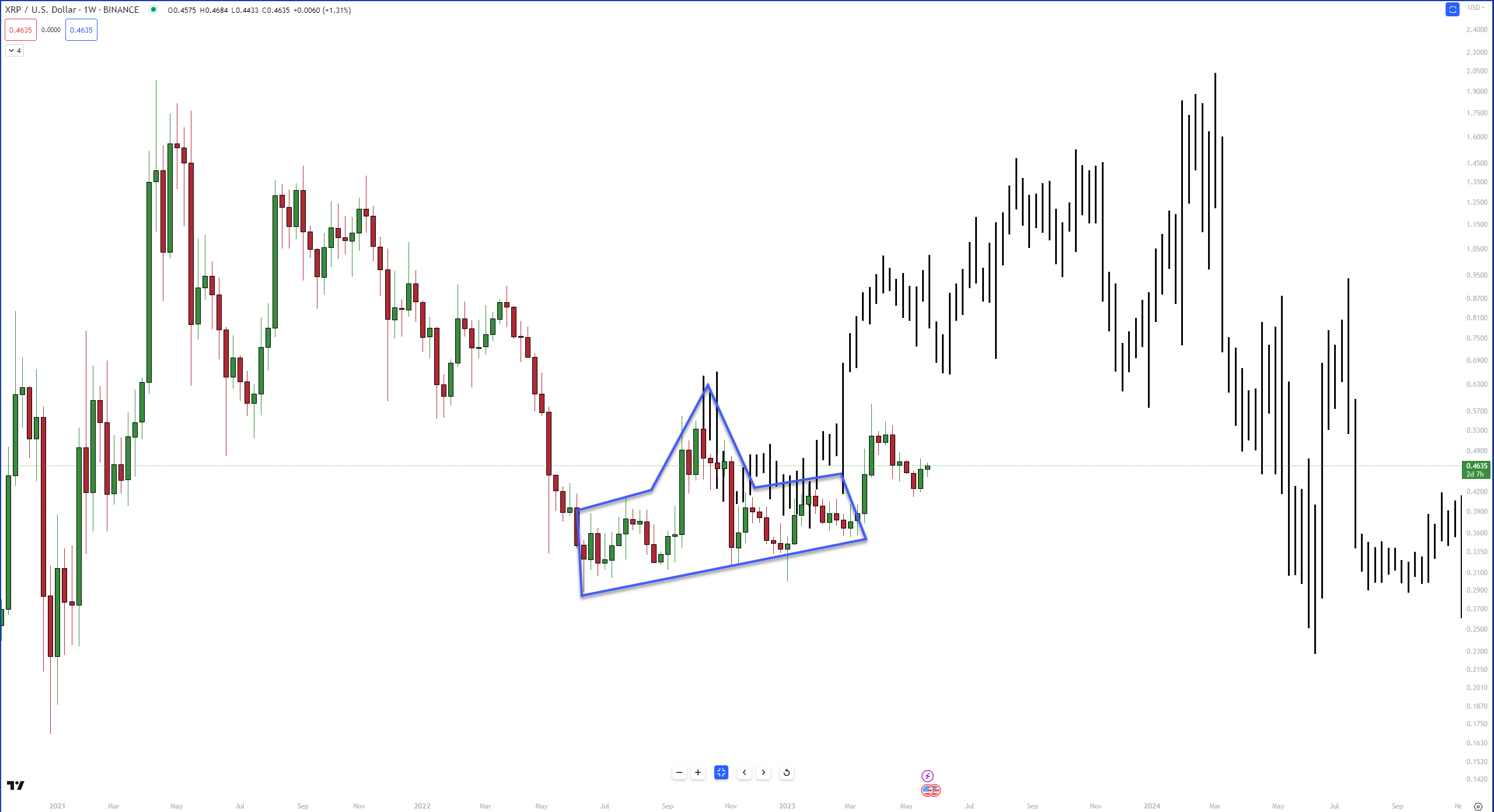

The first chart we will look at is $XRP‘s weekly chart from the February 17, 2023, Technically Speaking article about a pattern in Gann Analysis known as a Foldback.

The Foldback Theory tells us that we should expect to see the same swing structure repeat in the future.

Fast forward to the current weekly chart, and it looks like XRP continues to follow the prior swing structure.

Make sure you click on the February 17, 2023, link above to learn more about how Foldback patterns work.

Cardano

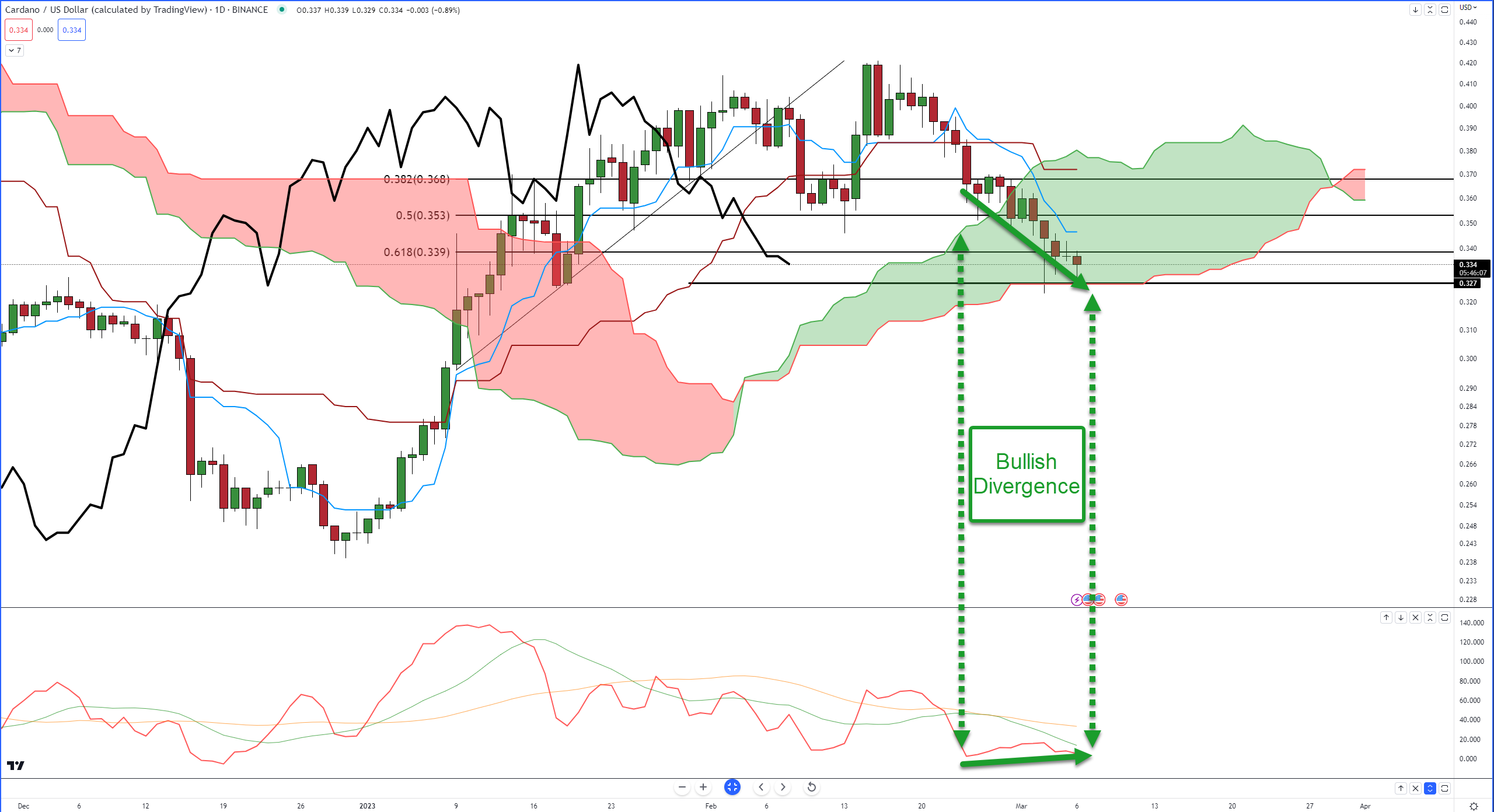

For $ADA‘s look-back, we’re going back almost two months to March 6, 2023:

And here’s the analysis we looked at:

- $0.327 is the most powerful support/resistance level in the Ichimoku Kinko Hyo system (Senkou Span B).

- Bullish divergence.

- Today is the 17th day from the prior swing high. In the Ichimoku Time Principle, the number 17 is a primary number used to identify when major/minor turns could occur.

Now, let’s look at the current chart:

How did the analysis play out? It didn’t!

While price action did, eventually (4 days later), play out positively for the bulls, it didn’t find support against the Kijun-Sen, the bullish divergence didn’t play out, and the Time Principle didn’t work out either.

Why show failed analysis? Because it happens, and that’s normal.

One piece of analysis playing out is the Chikou Span’s behavior. The Chikou Span essentially serves as an additional candlestick within the chart, possessing the same propensity to respond to support and resistance levels as the present candlestick.

And just a heads up: there’s a Kumo Twist that occurs on June 2 – if ADA is trading flat or continues south around that date, there’s an increased likelihood that Cardano could bounce.

If, instead, Cardano starts to move up, then the Kumo Twist could signal a top – but if price moves through/above the Kumo Twist itself, then that would be an exceptionally bullish event. Keep your eyes open!

Bullets

Bullets From The Day:

🐶 Elon Musk still hearts $DOGE. Despite a sea of new memecoins flooding the crypto market, billionaire Elon Musk holds Dogecoin close to his heart, cementing its status as his preferred digital asset. In a recent Wall Street Journal interview, Musk showered praise on Dogecoin for its humor and canine-inspired branding. In addition, he conveyed his fascination for the idea of a currency created as a joke potentially becoming a global currency, adding to the irony and appeal of the crypto space. While Musk’s vocal support for Dogecoin has often stirred up the market – even leading to a lawsuit alleging illegal price manipulation – he remains unwavering in his adoration for the original memecoin.

⤵️ The stablecoin market capitalization in the cryptocurrency sector hit its lowest level since September 2021. It declined for the fourteenth consecutive month to $130 billion as of May 23. Stablecoin trading volumes also fell, recording the lowest monthly volume since December 2022. Despite the decline, stablecoins’ dominance within the crypto space rose to 11.1%. TrueUSD stood out with trading volumes of $29 billion, making it the second-largest stablecoin.

🔄 Peter Smith, the head honcho at Blockchain.com, warned that any potential U.S. debt default could cause a temporary stumble in the crypto market but assured a swift recovery and an upward rally. Smith maintained a bullish stance on the long-term crypto outlook, considering a U.S. debt default might fuel the crypto fire. In a striking prediction, Smith pointed towards 2024 as a golden year for crypto, hinging this on cyclical market patterns and the scheduled halving of Bitcoin’s total supply. Despite short-term market hiccups, Smith affirmed his conviction in the crypto market’s future dominance.

🌡️ From Celsius to Fahrenheit. In a significant twist to the Celsius Network’s bankruptcy saga, the crypto lender has found its white knight in Fahrenheit, a consortium of crypto firms. Set to inject new life into the beleaguered Celsius, Fahrenheit will create a new entity, endearingly dubbed NewCo. NewCo will manage Celsius’ illiquid assets and create a new board appointed by creditors to oversee its operations. The account holders of Celsius are set to own 100% of the equity in NewCo. The newly forged entity will have a hefty $500 million in liquid cryptocurrency, DeFi crypto assets, private equity, venture fund investments, and mining assets. Pending bankruptcy court approval, an agreement between Celsius and Fahrenheit will be publicly filed in the coming weeks.

Here is some of what’s inside today’s curated NFT news collection:

Rabbids, NFT lending from Binance, Penguins, Blend’s massive share of NFT lending, and Cosmos

Links

Links That Don’t Suck:

🇭🇰 Hong Kong is world’s most crypto-ready jurisdiction, new study claims

🎮 PlayStation Showcase 2023: all the news from Sony’s big gaming event

🌾 ‘Neighbour orders I stop toddler watching her cut grass – she says he’s a creep’

💬 WhatsApp to allow users to edit messages within 15 minutes

💰 Norwegian Central Bank wants government to get serious about crypto regulation