With the S&P 500 bouncing from support, investors wonder whether the recent stock decline is officially over. And if so, which stocks will lead the market higher? 🤔

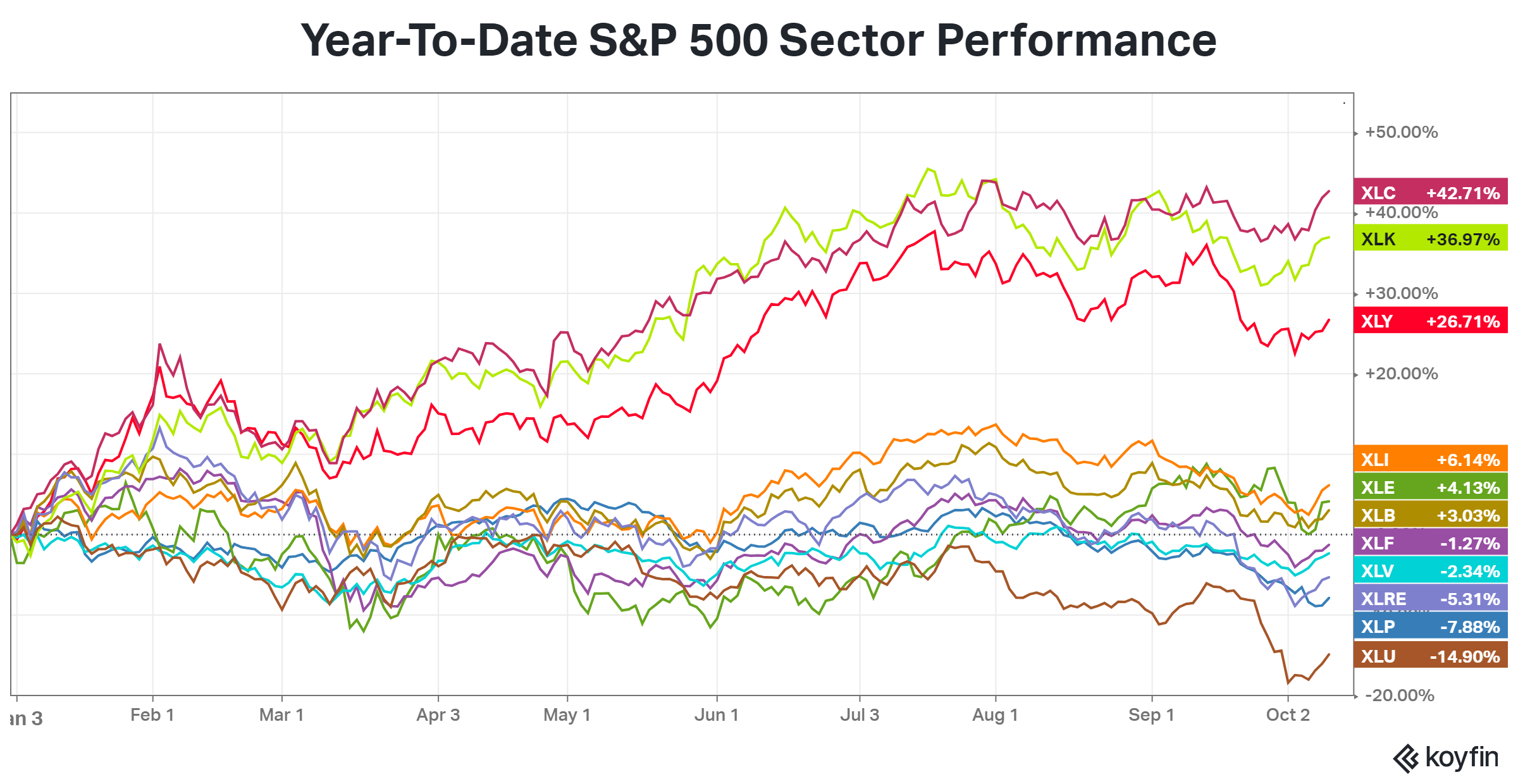

So far, leadership this year has been pretty thin, with the communication services, technology, and consumer discretionary sectors leading with double-digit gains. However, the rest of the sectors have seen lackluster performance, gaining single digits (and nearly half down for the year).

The last week has seen a bounce back in the entire market, but notably, the leadership sectors from earlier in the year are back in charge. Do they have enough juice left to push the S&P 500 and Nasdaq 100 indexes back to all-time highs? Or is the weakness in other sectors a bearish omen of further stock market weakness to come? 🔮

That remains the key question investors are looking to answer as we head into year-end. With the S&P 500 and Nasdaq 100 both up double-digits, there are likely to be a lot of portfolio managers chasing performance to close the gap before they need to report year-end results. And if the market starts to rally again from here, the chase will officially be on. 🏃