Advertisement|Remove ads.

Altcoins With ETF And DAT Access Have A ‘Better Chance’ Of Surviving Long-Term, Says CryptoQuant Founder

- The total crypto market value fell more than 6% in 24 hours to below $3 trillion, with altcoins down 4.5%.

- According to CryptoQuant founder Ki Young Ju, altcoin projects with access to ETFs or digital asset treasuries are better positioned for resilience.

- He pointed to ETFs for Ethereum and Ripple’s native token XRP, as well as public company holdings such as Coinbase for ETH.

CryptoQuant founder Ki Young Ju flagged on Monday that altcoin liquidity is shrinking amid the cryptocurrency market sell-off.

The total cryptocurrency market value has fallen nearly 5% in the past 24 hours to around $3 trillion, pressured by rising Japanese bond yields and shrinking global funds. The market cap, excluding Bitcoin (BTC), is down 4.5% in the last 24 hours.

Altcoins Need Institutional Backing

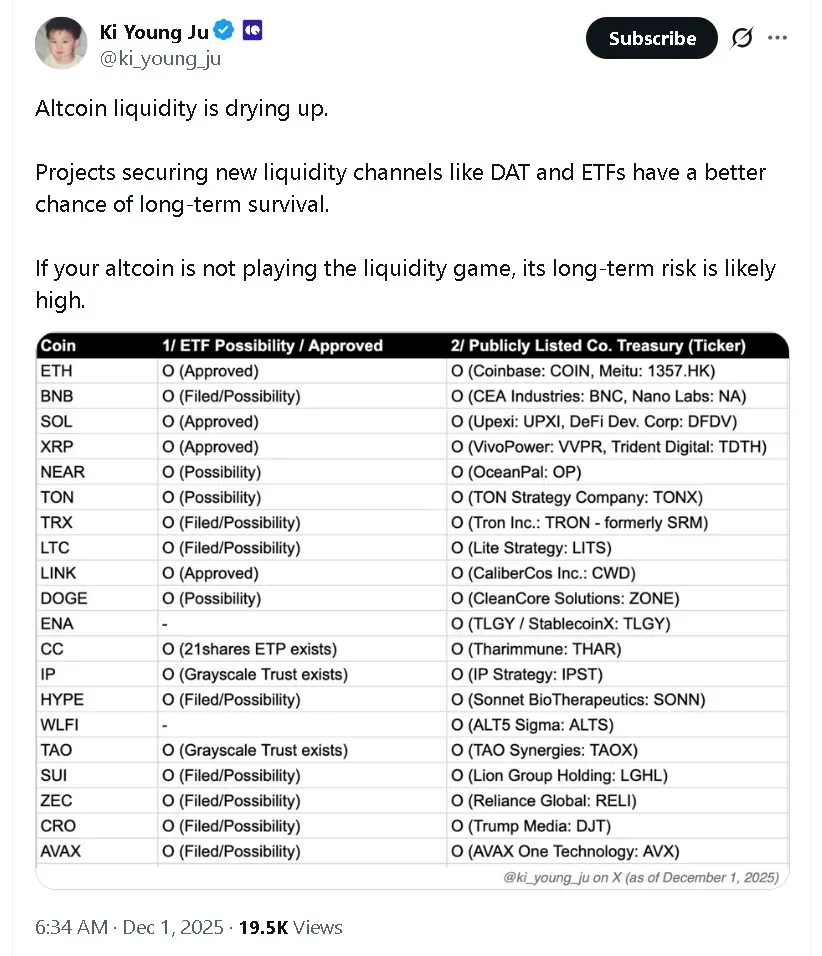

In a post on X, Ju noted that projects with access to new liquidity channels, like digital asset treasuries (DATs) and exchange-traded funds (ETFs), have a better chance of surviving long-term.

He pointed to approved ETFs for Ethereum (ETH) and Ripple’s native token XRP (XRP), as well as public company holdings such as Coinbase (COIN) for ETH, which could strengthen these assets’ prospects compared with others lacking such support.

His comments echo prior on-chain analyses showing bearish signals for Bitcoin and emphasize that altcoin projects should focus on institutional inflows, such as ETFs, rather than relying on volatile retail investors.

The market cap, excluding Bitcoin (BTC), was down 4.5% in the last 24 hours. Among the top 10 altcoins by market capitalization, Cardano (ADA) led the slide. ADA’s price plummeted more than 10%, followed by Dogecoin (DOGE), which fell 9.2%. Solana (SOL) and Ripple’s native token XRP (XRP) both fell around 8% each.

Ethereum (ETH), the leading altcoin, dropped 6.7% in the last 24 hours. On Stocktwits, retail sentiment fell to ‘extremely bearish’ from ‘bearish’ territory over the past day.

Read also: Peter Schiff Counters Musk-Saylor Bitcoin Claims – ‘You Turn Valuable Energy Into Nothing’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_ishares_OG_jpg_61ef2b2562.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Mojtaba_Khamenei_jpg_d2c198ccb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)