Advertisement|Remove ads.

Bitcoin Crashing Prompts Binance To Add 1,300 BTC To Its $1 Billion Safety Fund

- Binance added 1,315 Bitcoin worth about $100.7 million to its SAFU insurance fund.

- Binance announced last week that it plans to convert $1 billion in SAFU reserves from stablecoins into Bitcoin.

- The move comes after Bitcoin’s price crashed to around $74,000 over the weekend before rebounding on Monday morning.

Binance (BNB) on Monday added 1,315 Bitcoin (BTC) worth about $100.7 million to its SAFU insurance fund, marking the fund’s first Bitcoin purchase in nearly two years.

The firm announced last week that it would convert its $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin over the next 30 days. Data on Arkham, spotted by LookOnChain, shows that the fund just made its first move with the Bitcoin buy.

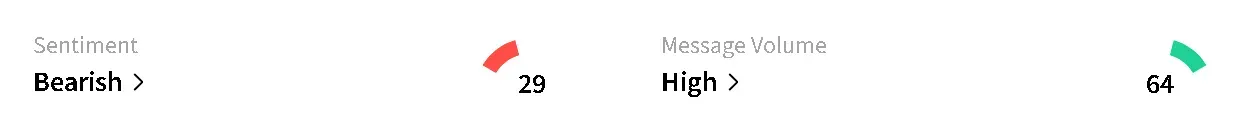

Over the weekend, Bitcoin’s price crashed to November lows of around $74,000. The apex cryptocurrency recovered to around $76,800 at the time of writing, still down 2.5% in the last 24 hours. On Stocktwits, retail sentiment around BTC dropped to ‘extremely bearish’ from ‘bearish’ territory over the past day as chatter remained at ‘extremely high’ levels.

Why Is Binance Buying Bitcoin?

SAFU was created by Binance in 2018 to protect users from losses caused by unexpected events, such as hacks or operational failures. "If the fund's market value falls below $800 million due to BTC price fluctuations, Binance will rebalance the fund to restore its value to $1 billion," the exchange wrote last week.

The crypto exchange's purchase of more Bitcoin likely means the fund’s value dipped below $1 billion, and Binance is shoring up reserves. It did not indicate whether additional Bitcoin purchases would follow immediately, though it previously said the full $1 billion conversion would be completed over the coming weeks.

The latest purchase marks SAFU’s first Bitcoin buy since 2023, according to on-chain data. The fund had largely remained static during the past two years while Binance relied more heavily on stablecoins to preserve capital and limit exposure to price swings.

BNB Takes A Hit Amid Crypto Crash

BNB’s price fell in tandem with Bitcoin, down 2.7% in the last 24 hours. On Stocktwits, retail sentiment around the token remained in ‘bearish’ territory with chatter at ‘high’ levels over the past day.

Some users blamed the exchange for Bitcoin’s price drop, citing market manipulation by Binance.

The overall cryptocurrency market fell more than 3% in the last 24 hours to $2.66 trillion. According to CoinGlass data, the market saw nearly $800 million in liquidations over the past day.

Read also: Why Crypto Is Crashing Has More To Do With Gold Than Binance Or ETFs, Raoul Pal Says

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)