Advertisement|Remove ads.

Bitcoin Investors Hit Panic Button, Unleash 2025’s Largest Loss-Making Sell-Off Worth $7B – Retail’s Skeptical

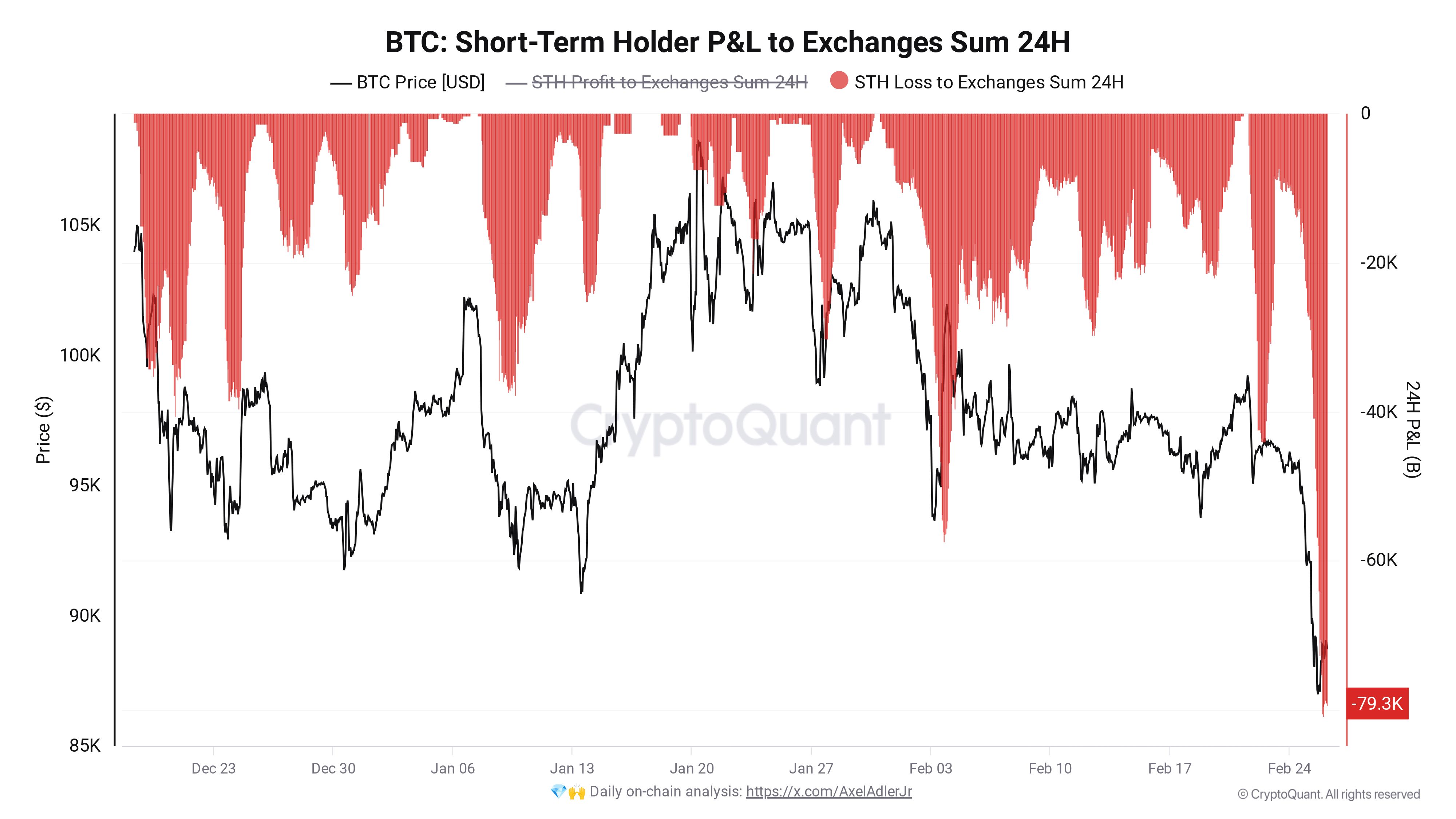

Bitcoin (BTC) continued to trade below the $90,000 threshold in early U.S. market hours on Wednesday, with data from CryptoQuant indicating that Tuesday’s sell-off marked the largest loss-making sell-off of the year.

Short-term holders offloaded nearly 80,000 BTC at a loss as Bitcoin’s price hit a three-month low, sliding to $86,000.

According to CryptoQuant, speculators moved 79,300 BTC – worth roughly $7 billion – to exchange wallets within a 24-hour period.

“This is the largest Bitcoin sell-off of 2025,” CryptoQuant contributing analyst Axel Adler Jr. wrote in a post on X.

The apex cryptocurrency's price continues to slide on Wednesday, down 1.3% for the day at around $87,700.

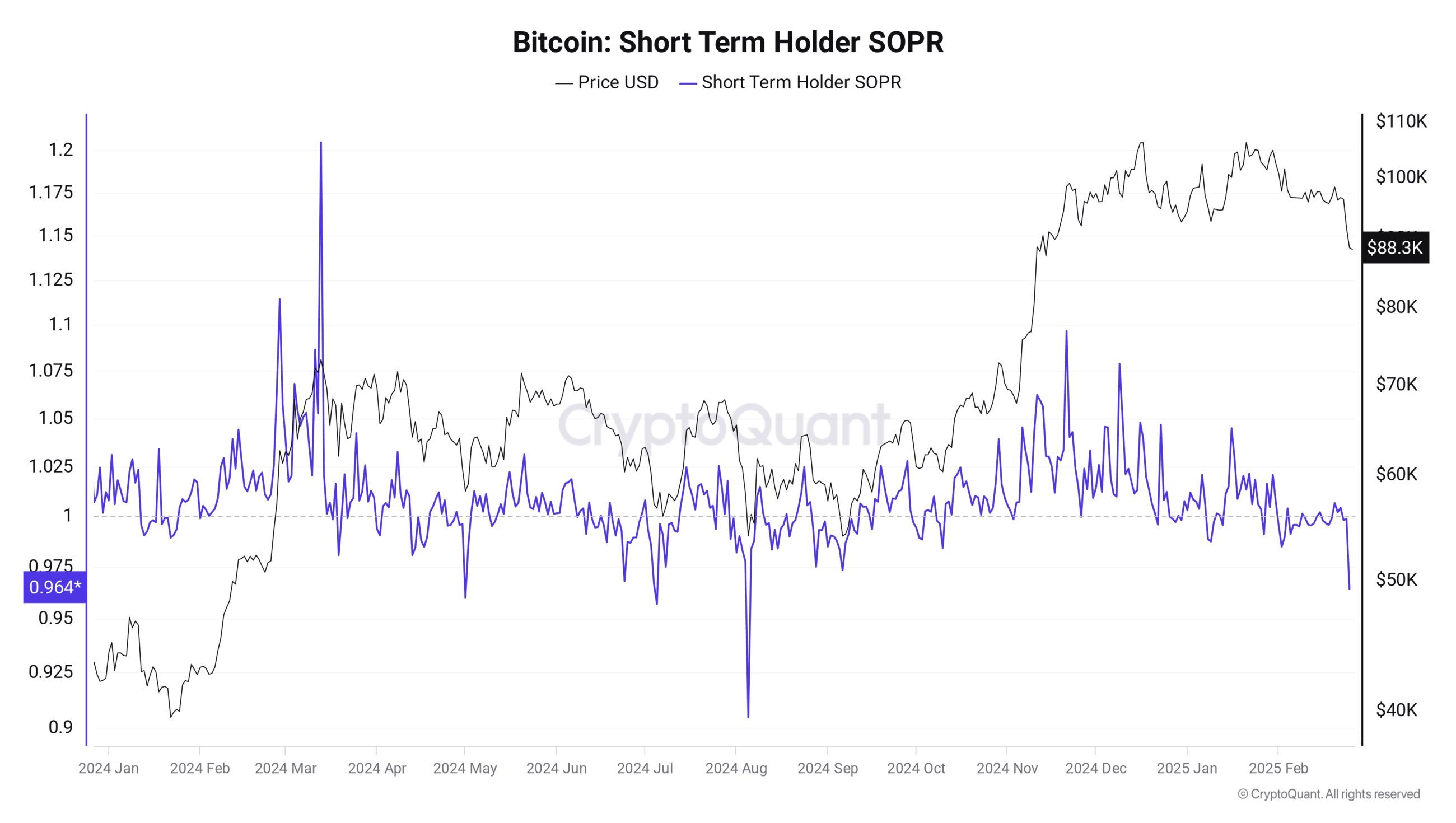

According to CryptoQuant’s blog post, data shows that short-term investors are selling at a loss. The post notes that Bitcoin’s price drop likely triggered panic selling, and if further corrections occur, similar behavior could reemerge.

The data shows that rolling 24-hour loss-making transactions have surpassed any other period in 2025. While the figures do not confirm that all BTC transferred to exchanges was immediately sold, the spike in exchange inflows underscores uncertainty among newer market participants.

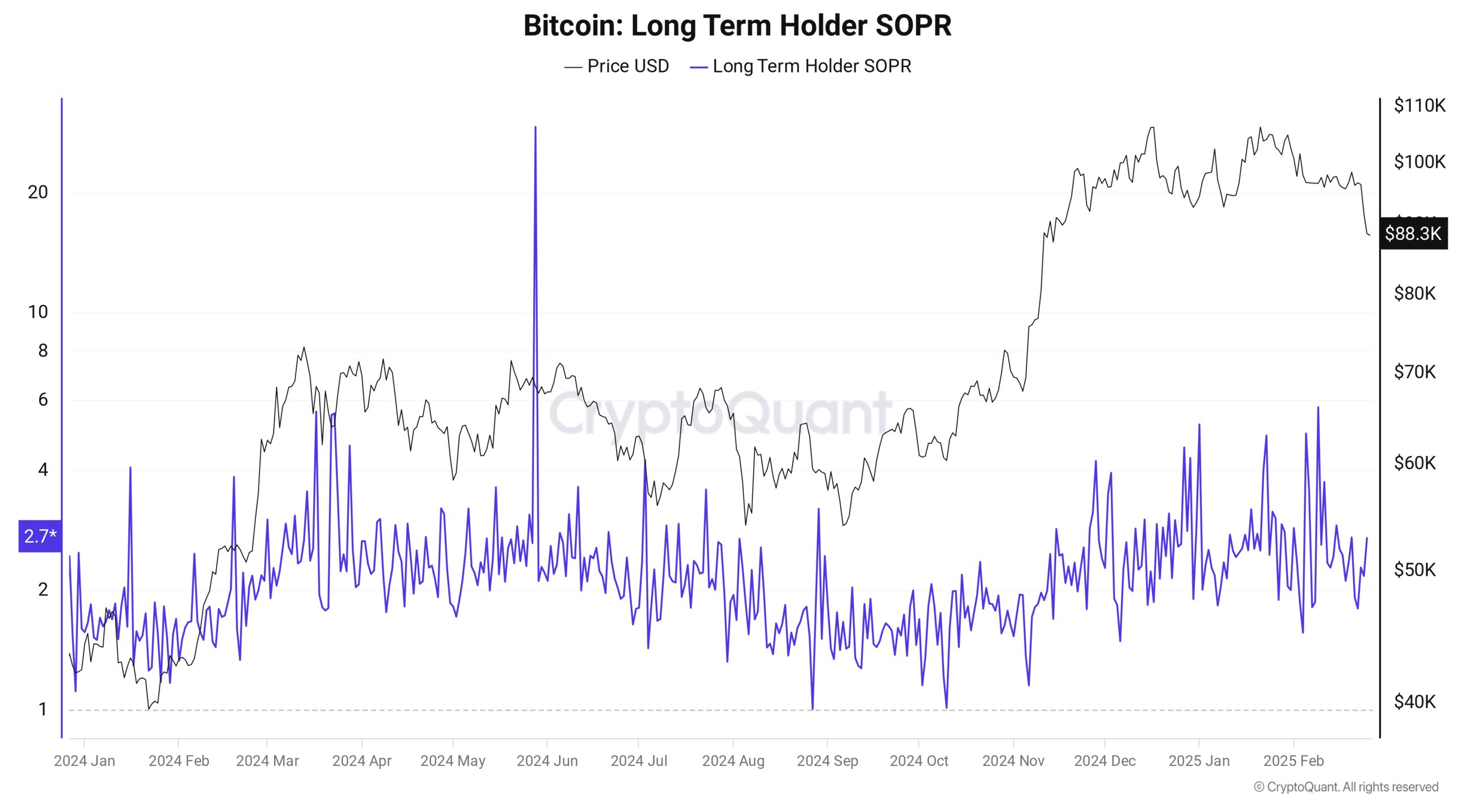

In contrast, long-term investors have remained largely unaffected by the recent decline, continuing to hold their positions and preventing deeper losses.

“Since this period extends back to September, when Bitcoin was trading around $60K, these investors are likely those who have been in the market for a much longer time. The lack of significant selling pressure from them suggests they are maintaining a holding strategy,” said the report.

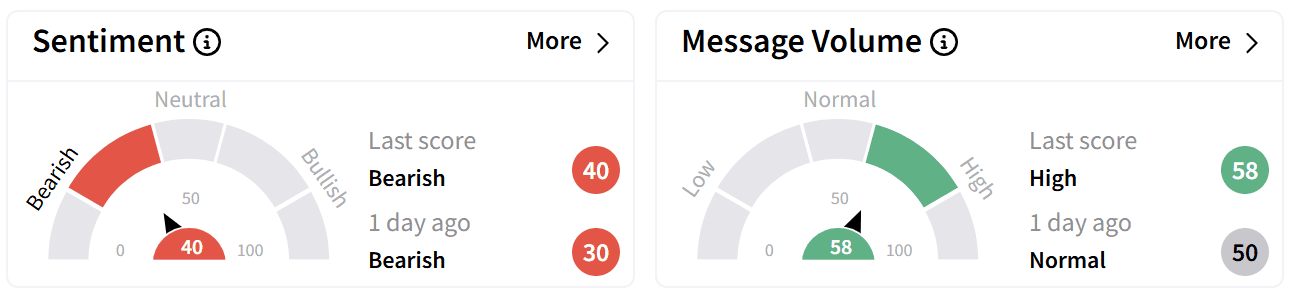

On Stocktwits, retail sentiment around Bitcoin remained in the ‘bearish’ territory (40/100), albeit with a higher score. Chatter increased to ‘high’ levels as users debated Bitcoin’s next move.

Some users expressed confidence in Bitcoin’s fundamentals, dismissing short-term holders as sources of fear, uncertainty, and doubt.

Others debated whether the price could stage a rebound or face further downside pressure.

SoSoValue’s live tracker also shows that net outflows from spot Bitcoin ETFs crossed $1 billion at the time of writing, marking the largest single-day redemption since the funds debuted in January 2024.

In a post on X, Arthur Hayes, the co-founder of BitMEX, warned that this pattern could push Bitcoin’s price as low as $70,000.

Bitcoin's price is currently trading 18% below its all-time high of nearly $109,000, reached on Jan. 20, according to CoinGecko.

The cryptocurrency is down nearly 10% for the month but remains up 73% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)