Advertisement|Remove ads.

Bitcoin Miners CLSK, RIOT, BTDR Could Help Stabilize US Power Grids During Severe Winter Weather

- Bitcoin miners with demand-response agreements may curtail operations during U.S. winter storms.

- CLSK, RIOT, and BTDR operate facilities tied to grid flexibility programs, including the TVA.

- Analysts say the model can support grid stability without disrupting mining economics.

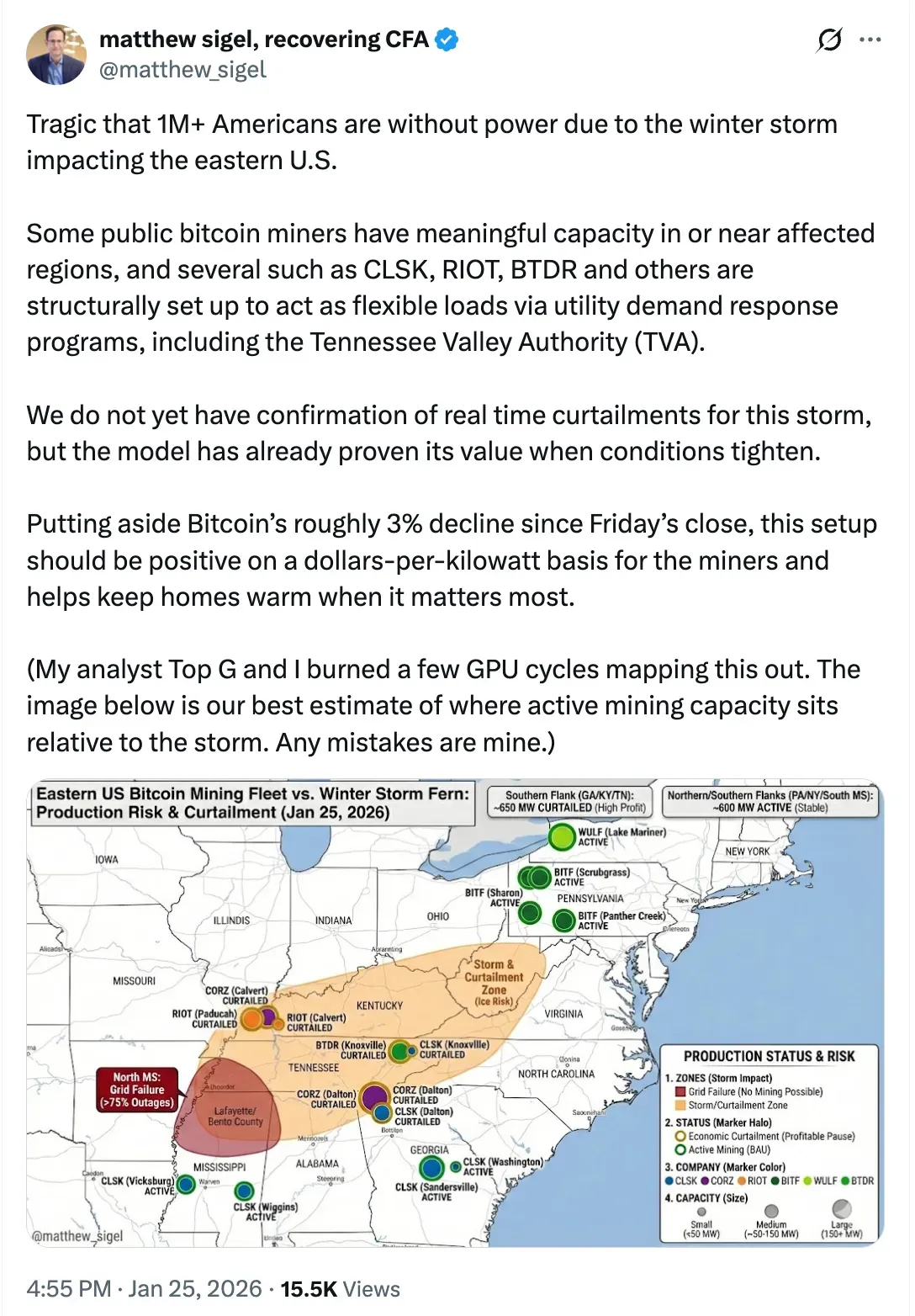

U.S. winter storms are throwing the spotlight on how Bitcoin miners interact with power grids during peak demand. VanEck Head of Digital Assets Research Matthew Sigel highlighted that several publicly traded Bitcoin miners operate under a demand-response agreement that allows utilities to pay them to temporarily shut down during periods of grid stress, thereby supporting power reliability. This comes as a severe winter storm knocked out power to more than one million Americans over the weekend.

On Monday, the National Weather Service warned that conditions from Texas to New England were "life-threatening,” as more than one million Americans were left without power over the weekend due to a severe winter storm sweeping across parts of the eastern United States.

On Sunday, Sigel said on X that several publicly listed Bitcoin miners, including CleanSpark (CLSK), Riot Platforms (RIOT), and Bitdeer (BTDR), have meaningful capacity in affected regions and are structurally positioned to support grid stability through demand-response programs. He cited arrangements with utilities like the Tennessee Valley Authority (TVA), which incentivize large power users to reduce consumption during periods of peak stress.

As of Sunday morning, Riot Platforms (RIOT) was trading at $17.26, down by 0.12% in the aftermarket hours. On Friday, it closed at $17.28. On Stockwits, retail sentiment around RIOT remained in ‘neutral’ territory, as chatter levels around it dropped from ‘high’ to ‘normal’ over the past day.

Cleanspark (CLSK) traded at $13.71 and was flat in the aftermarket hours. On Stocktwits, retail sentiment around Cleanspark also remained in the ‘neutral’ territory, as chatter around it stayed at ‘normal’ levels over the past day.

Bitdeer Technologies (BTDR) traded at $14.50, down 0.21% in after-hours trading. On Friday, it closed at $14.53. On Stockwits, retail sentiment around BDTR remained in the ‘bearish’ territory, as chatter levels around it

Demand Response And Grid Stability

Sigel said that, setting aside Bitcoin’s roughly 3% price decline since Friday, the setup can remain economically favorable for miners on a dollars-per-kilowatt basis, while supporting grid reliability when demand spikes.

Shares of U.S.-listed Bitcoin miners have increasingly been evaluated not only on hash rate and balance sheet strength, but also on their integration with regional power markets and grid operators. The winter storm has renewed focus on how energy-intensive industries, including Bitcoin mining, interact with public infrastructure during periods of stress.

Read also: South Dakota Lawmakers Move To Rein In Crypto ATM Scams With New 2026 Bill

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)