Advertisement|Remove ads.

BTC, ETH Take A Backseat As Retail Investors Plan To Chase Big Gains With Altcoin Rotation in 2025

Altcoins are taking center stage as retail investors shift focus from traditional crypto blue chips like Bitcoin and Ethereum to lesser-known tokens with explosive growth potential.

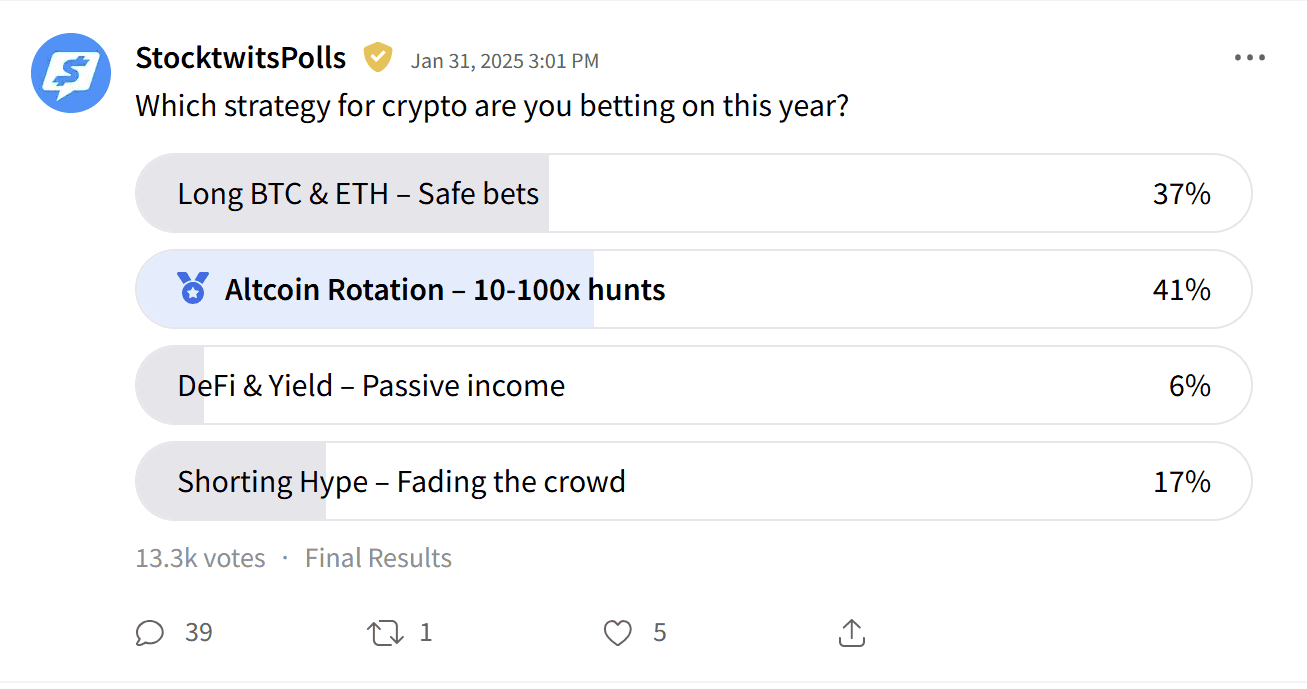

According to a recent Stocktwits poll, 'Altcoin Rotation' is the leading investment strategy for crypto traders in 2025, with 41% of retail investors betting on altcoins targeting returns between 10x and 100x.

This strategy involves cycling investments through emerging altcoins to catch short-term price surges driven by hype cycles, project announcements, or speculative interest.

Traders seek out 10x to 100x returns, often leveraging technical analysis and social sentiment to identify opportunities.

However, the volatility of altcoins, including meme coins, means significant risk, with many projects struggling to sustain long-term growth.

Despite the growing interest in altcoins, Bitcoin and Ethereum remain the backbone of many portfolios, with 37% of investors preferring the relative safety of long positions in Bitcoin and Ethereum.

This traditional approach relies on the established dominance of these assets, underpinned by strong institutional interest, regulatory clarity, and proven use cases.

For these investors, BTC and ETH continue to serve as the foundational pillars of the crypto ecosystem, offering steady growth potential as adoption continues to grow globally.

Meanwhile, 17% of investors are adopting contrarian strategies, shorting overhyped tokens to profit from inevitable market corrections.

This involves identifying tokens that have surged on speculation rather than fundamentals and then betting against them as the market cools.

It requires careful timing and a deep understanding of market psychology, as mistiming shorts can lead to significant losses during extended bull runs.

At the lower end, only 6% of respondents favor DeFi and yield farming strategies.

These investors seek passive income by providing liquidity or staking assets within decentralized finance protocols.

While offering steady returns, this approach has lost some appeal due to risks like smart contract vulnerabilities, regulatory crackdowns, and fluctuating yields in bear markets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: BTC, ETH, XRP Crash Wipes Out January Gains After Tariff Shock: Retail Lashes Out At Trump

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rocket_companies_logo_resized_jpg_1cfb06fa99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corcept_therapeutics_jpg_0778e9d4e5.webp)