Advertisement|Remove ads.

Michael Saylor Hints At Fresh Bitcoin Purchases, While Peter Schiff Questions How Strategy Will Pay

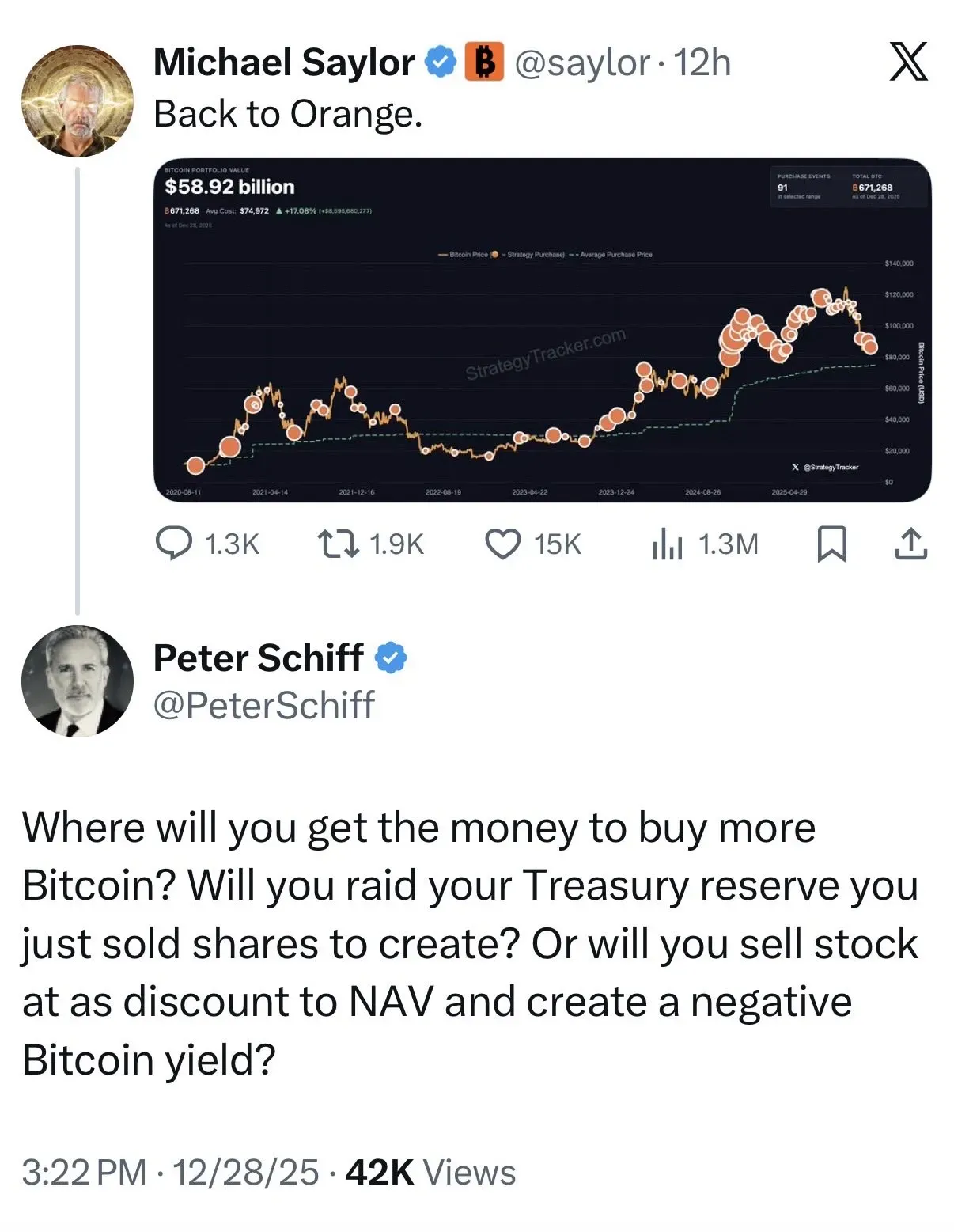

- Michael Saylor’s latest ‘orange dots’ post is widely interpreted as a signal of an impending Bitcoin purchase.

- The company recently established a dollar reserve, raising questions about whether it will be used to fund Bitcoin accumulation.

- MSTR shares slipped slightly after hours, while Bitcoin rebounded above $90,000.

Strategy (MSTR) executive chairman Michael Saylor on Sunday shared another ‘orange dots’ post on X, signaling the firm is planning on buying more Bitcoin (BTC) come Monday rather than stocking up on its recently set up dollar reserve.

Bitcoin critic Peter Schiff challenged the signal, questioning how Strategy plans to fund additional purchases. In a post on X, Schiff argued that Strategy’s latest “we’ll buy more Bitcoin” signal is financially inconsistent because the stock is now trading near its Bitcoin net asset value (mNAV) and the company just built a big cash buffer from equity issuance earlier this month.

MSTR’s stock edged 0.42% lower in after-hours trade on Sunday. On Stocktwits, retail sentiment around the company remained in ‘bearish’ territory over the past day, accompanied by ‘low’ levels of chatter.

Meanwhile, Bitcoin’s price climbed back above $90,000 on Sunday night – gaining nearly 3% in the last 24 hours. Retail sentiment on Stocktwits around the apex cryptocurrency was also in the ‘bearish’ zone over the past day, with ‘low’ levels of chatter.

Orange Dot, Green Dot

Saylor, who has been posting a string of ‘orange dot’ and ‘green dot’ posts on X this month ahead of Strategy’s weekly buys, has been using orange dots to signify more Bitcoin purchases and green dots to indicate adding to the firm’s USD reserve.

Strategy currently holds more than 600,000 Bitcoin on its balance sheet as the largest corporate holder of the asset. However, its mNAV has slipped to roughly 1.05 amid recent Bitcoin price volatility.

Schiff has argued that under these conditions, additional Bitcoin buys funded through new share issuance risk eroding shareholder value rather than enhancing it. He reiterated earlier comments from December, when he described Strategy’s shift toward a USD reserve as the “beginning of the end” of its Bitcoin-centric capital strategy.

“So far that's been an accurate post. MSTR has fallen another 8% since then,” he said, noting that the stock hit a new 52-week low on Friday. “Bitcoin has basically traded flat as gold and silver blasted to new record highs,” he added.

Silver prices hit a new intra-day high of over $83 per ounce on Sunday night before paring gains. The iShares Silver Trust (SLV) was among the top trending tickers on the site at the time of writing, edging 0.68% higher in after-hours trade. Retail sentiment around SLV remained in ‘extremely bullish’ territory over the past day as chatter trended at ‘extremely high’ levels.

Read also: MSTR, BMNR, And Other Crypto-Linked Stocks Slip While Bitcoin, Ethereum Post Weekend Gains

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)