Advertisement|Remove ads.

Peter Schiff Dismisses Bitcoin's Venezuela-Inspired Rally As 'Hype' – But Arthur Hayes Sees Oil-Fueled Upside

- Arthur Hayes said that the U.S.’s control of Venezuela’s oil supply is good news for Bitcoin and the rest of the cryptocurrency market.

- He justified that if gas prices stayed low, politicians could print more money, spend more and boost the economy without angering voters because cheap oil is likely to keep inflation down.

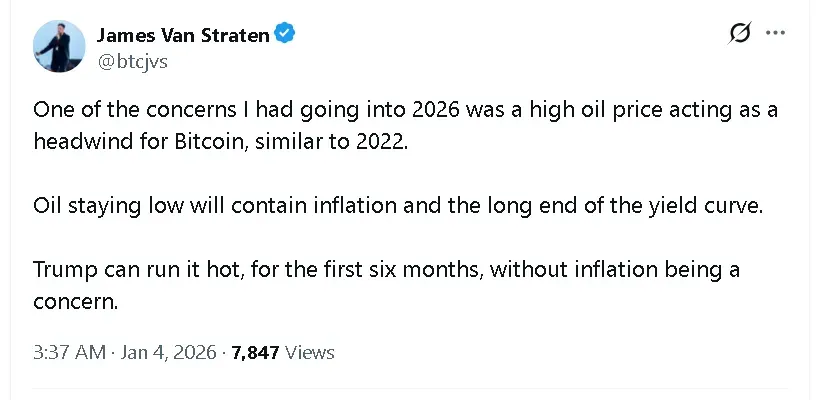

- CoinDesk analyst James van Straten echoed that view, saying low oil prices could limit long-term yields and reduce macro headwinds for Bitcoin.

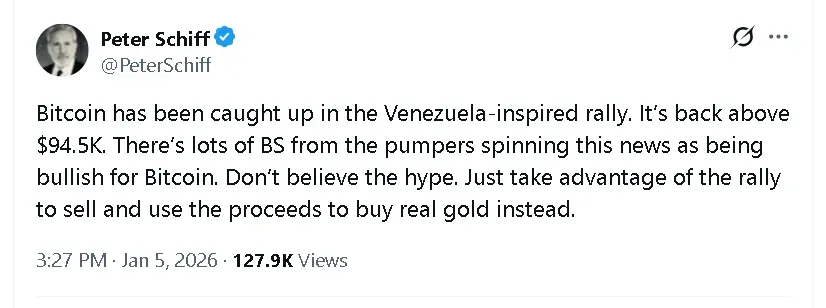

Gold bull Peter Schiff said on Monday that Bitcoin’s (BTC) ‘Venezuela-inspired’ rally is unlikely to last despite the apex cryptocurrency testing $94,000.

“Just take advantage of the rally to sell and use the proceeds to buy real gold instead,” Schiff said in a post on X. He stated that news around how the developments between the U.S. and Venezuela would be good for Bitcoin is just “hype.”

Bitcoin’s price rose 0.8% in the last 24 hours to around $93,200 after crossing $94,000 earlier in the day. On Stocktwits, retail sentiment around the coin trended in ‘extremely bullish’ territory over the past day as chatter rose to ‘high’ from ‘normal’ levels.

Gold’s price was trading at around $4,400 per ounce at the time of writing, up 0.41% on the day. The SPDR Gold Shares ETF (GLD), meanwhile, edged 0.21% lower in after-hours trade after gaining 2.63% in regular trading. Retail sentiment around the fund on Stocktwits fell to ‘bearish’ from ‘neutral’ over the past day, while chatter remained at ‘high’ levels.

Arthur Hayes Disagrees

According to Maelstrom founder Arthur Hayes, the U.S. military operation in Venezuela could be good for Bitcoin. Speculation indicates that the U.S. may be looking to control oil supply by offering to rebuild Venezuela’s energy resources.

In a Substack post on Monday, Hayes stated the U.S. wants cheap oil because high gasoline prices hurt voters and cost politicians elections. He justified that if gas prices stayed low, politicians could print more money, spend more, and boost the economy without angering voters because cheap oil is likely to keep inflation down.

Hayes added that the U.S. wants Venezuelan oil to control gas prices. Whether or not it actually works doesn’t really matter, he said, as long as the politicians believe that it will help so that they act more aggressively with spending and money creation.

CoinDesk analyst James van Straten had a similar take. In a post on X, he stated that high oil prices are unlikely to be a headwind for Bitcoin this year. “Oil staying low will contain inflation and the long end of the yield curve,” he wrote. “Trump can run it hot, for the first six months, without inflation being a concern.”

WTI Crude Oil fell 0.15% on the day to around $58.21 per barrel, at the time of writing, while Brent Crude edged 0.13% lower to around $61 per barrel. The United States Oil Fund (USO) edged 0.07% lower in after hours after a gain of 1.83% in regular trading. On Stocktwits, retail sentiment around the fund trended in ‘extremely bullish’ territory with chatter at ‘extremely high’ levels.

Venezuela’s $60 Billion Bitcoin Reserve

There are also reports that Venezuela may be sitting on $60 billion in Bitcoin. Nicolas Maduro, Venezuela’s former president, who was arrested by the U.S. military over the weekend, allegedly siphoned off billions in oil revenue, gold reserves, and state assets. According to Whale Hunting, most of those gains were converted into Bitcoin.

If true, Maduro’s stash of Bitcoin would rival Strategy’s (MSTR) Bitcoin reserve, currently valued at around $64 billion and potentially even be greater than El Salvador’s national reserve.

Traders are now speculating whether Bitcoin has been lost forever or if the U.S. can confiscate those funds and add them to its own coffers.

Read also: The First US Crypto Fund To Pay Staking Rewards Is Also Staring At $5 Billion In Outflows

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)