Advertisement|Remove ads.

Solana Drops To 4-Month Low As Bitcoin Crash Ripples Through Market – Retail Sentiment Hits Year-Low

The price of Solana’s native token (SOL) tumbled more than 12% in the past 24 hours, reaching a four-month low as Bitcoin’s sharp decline sent shockwaves through the broader crypto market.

The latest drop extends a series of setbacks for Solana. In recent weeks, the blockchain has faced mounting challenges, particularly within its ecosystem of meme coins.

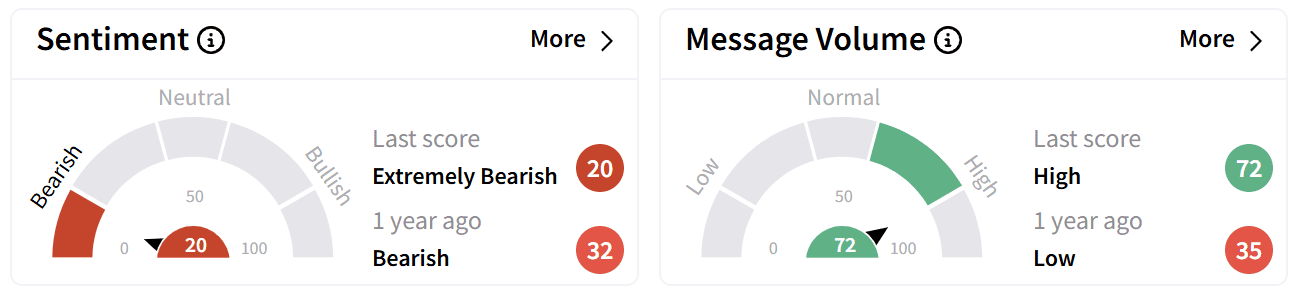

Retail chatter surged as sentiment on Stocktwits hit a year low.

In late January, the Official Trump (TRUMP) token – hosted on the Solana blockchain – soared more than 300% overnight before plunging over 75% in the following days.

The rapid decline drew scrutiny, with critics raising concerns about conflicts of interest and former President Donald Trump potentially benefiting from the token’s meteoric rise.

TRUMP’s price has yet to recover. It is trading 82% below its Jan. 19 peak and has been down 13% in the past 24 hours.

The turbulence in Solana’s meme coin sector continued last week with the collapse of the LIBRA token, which investors widely criticized as a “rug pull.” The incident underscored growing concerns about the blockchain’s vulnerability to speculative trading schemes.

Adding to Solana’s troubles, the $1.46 billion Bybit hack exposed further risks in its ecosystem.

On-chain investigator ZachXBT linked wallets involved in the Bybit breach to scams operating on Solana’s Pump.fun, a meme coin launching platform.

The same wallets were also tied to the $29 million Phemex (PT) hack in January, suggesting repeated misuse of Solana’s infrastructure for fraudulent activity.

On Stocktwits, retail sentiment around Solana’s token dipped to a year-low in the ‘extremely bearish’ (20/100) territory even as chatter surged to ‘high’ from ‘low’ levels a day ago.

The pessimistic stance could be seen in the comments from traders relieved about selling off their holdings earlier.

SOL has fallen more than 47% in February alone, sliding from its Jan. 19 peak of $295.

The token saw similar volatility in 2021, when Solana’s price hit an all-time high of $260 but crashed to $10 by November 2022.

Retail investors on Stocktwits expect Solana's upcoming token unlock worth $2 billion, scheduled on March 1, from the FTX bankruptcy auction to create further selling pressure.

The unlock represents approximately 2.29% of Solana’s circulating supply, raising concerns that an influx of discounted tokens into the market could lower prices.

A rapid sell-off could increase supply and push prices down further, though past unlock events have not always resulted in crashes.

Much will depend on how institutional holders manage their newly unlocked tokens, particularly in an already fragile market for SOL.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)