Advertisement|Remove ads.

Coinbase’s Armstrong Says Banning USDC Rewards Would Boost Profits, But Hurt US Customers

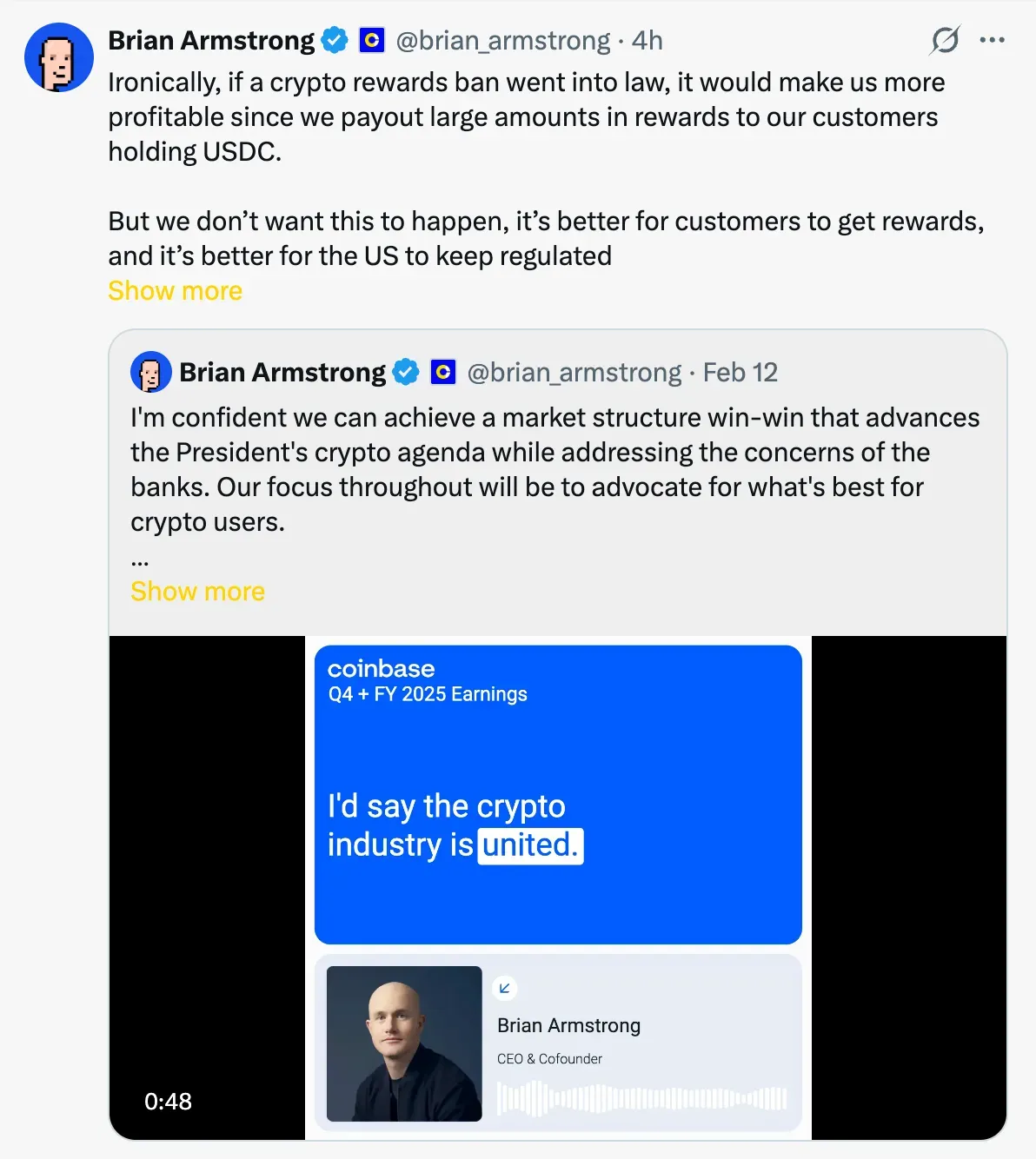

- Coinbase CEO Brian Armstrong said on Friday that a stablecoin yield ban would ironically make Coinbase more profitable, but hurt American consumers.

- The comments followed Coinbase’s Q4 earnings miss and a $667 million loss reported Thursday.

- He expressed optimism that U.S. lawmakers could pass constructive crypto legislation, including progress tied to the CLARITY Act.

Coinbase (COIN) CEO Brian Armstrong said on Friday that a potential US ban on crypto rewards would make the “everything exchange” more profitable, but warned it would ultimately hurt customers and America’s competitiveness.

Taking to X, Armstrong wrote that “if a crypto rewards ban went into law, it would make [Coinbase] more profitable since we payout large amounts in rewards to our customers holding USDC.” However, he reiterated that he does not want to take that path since “customers should get rewards, and it’s better for the U.S. to keep regulated stablecoins competitive on a global stage.”

He cited the fourth quarter and full 2025 earnings call attended by Emily Choi, Paul Grewal, and Armstrong himself, where the executives outlined a 2026 roadmap for what they called the “everything exchange," saying he believes lawmakers can achieve a “market structure win-win” that advances President Trump’s crypto agenda while addressing concerns from banks.

Coinbase (COIN) was trading at $166, up 1.02% after hours. The stock closed at $164.02 on Thursday. On Stockwits, the retail sentiment around COIN remained in the ‘extremely bullish’ territory as chatter levels around it moved from ‘extremely low’ to ‘extremely high’ over the past day.

Coinbase reported its fourth-quarter earnings, which fell short of analysts' expectations. On the call, Armstrong stated he was more “bullish than ever” and struck an optimistic tone on regulation, “I’m actually quite optimistic that we’ll get something through here in the next few months,” Armstrong said, adding that Coinbase had participated in recent White House meetings and that the industry remains aligned on key priorities.

Regulatory Push And The CLARITY Act

Armstrong pointed to ongoing efforts to establish clearer market structure rules for digital assets. The proposed CLARITY Act seeks to define oversight boundaries between regulators and provide a more predictable framework for crypto firms. Speaking on the CLARITY Act, Armstrong had previously advocated for policies that preserve consumer benefits, such as stablecoin rewards, while ensuring a level playing field, which stalled the markup on the bill in late January.

Read also: Ethereum Co-founder Joseph Lubin Warns US Banking System Could Face A ‘Greek-Style’ Reckoning

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)