Advertisement|Remove ads.

Activist Interest Sparks Meme-Driven Rally, Retail Buzz In OpenDoor Technologies

Opendoor Technologies (OPEN) stock experienced an impressive rally this week following interest from an activist investor, which fueled a growing online narrative that the online real estate platform could replicate the stunning market performance of Carvana (CVNA).

The penny stock gained 43.3% to $1.49 on Wednesday, taking the gains so far this week to over 90%, after public comments from EMJ Capital founder Eric Jackson.

Jackson, who led activist campaigns at Yahoo and Viacom a decade ago, said on X that he is open to wearing the activist hat again and suggested changes at Opendoor to take the company's stock as high as $82.

"If standing between a 50¢ stock and an $82 one is what it takes — and shareholders want it — I'll saddle up again for OPEN," he posted.

In a series of posts, Jackson called for a stronger operational focus at the company and urged the return of Opendoor's co-founder, Keith Rabois.

He urged CEO Carrie Wheeler to boost investor confidence by purchasing company stock, pointing to similar actions taken by Carvana CEO Ernest Garcia III.

Jackson drew comparisons to Carvana, an early pioneer in online used car sales, which had once navigated a comparable downturn. Jackson was also an early investor in Carvana.

Amid the comments, OPEN stock was "trending on" X, Reddit, and PennyStocks.com, according to a Stocktwits user.

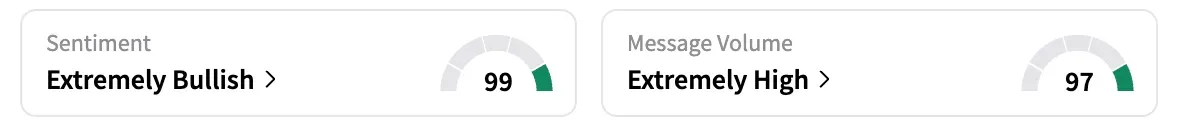

On the platform, the retail sentiment for the company held in the 'extremely bullish' territory, unchanged from a month ago.

A user said people misunderstand the company's business, and the "opportunity here is huge."

Another said, "Carvana took car buying online and went up 2500%. Opendoor is taking home buying online. If it goes up 2500% from its IPO price it would be $250+. $82 incoming," this person said.

Opendoor’s business has struggled in recent years, in part due to a sluggish U.S. housing market. Despite the recent surge, the company's stock is down about 94% since its initial public offering in February 2021.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)