Advertisement|Remove ads.

Adani Energy Posts Steady Q1 Earnings: SEBI RA Sees Fresh Rally If ₹780 Holds Firm

Adani Energy Solutions reported solid June quarter (Q1 FY26) results just before the markets closed. Net profit came in at ₹538 crore, compared to a loss of ₹1,190.66 crore in the same period last year. The absence of exceptional losses this quarter resulted in the bottom-line recovery.

The company saw a 27% increase in consolidated revenue to ₹6,819.28 crore. EBITDA grew 3.1% to ₹2,315 crore, but margins narrowed to 34% from 42% a year ago.

Adani Energy shares closed 1.66% lower at ₹848.20 on Thursday.

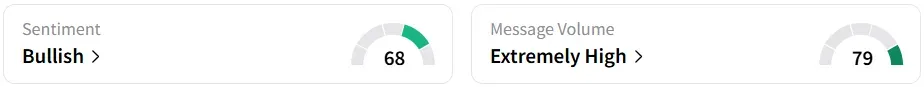

Retail sentiment on Stocktwits shifted to ‘bullish’ amid ‘extremely high’ message volumes. It was ‘bearish’ a day ago. Adani Energy was among the top three trending stocks on the platform.

Technically, Adani Energy Solutions shares continue to trade in a sideways zone after an 80% slump from their peak of ₹4,236 in September 2022, said SEBI-registered analyst Rohit Mehta.

The stock currently has strong support in the ₹780 - ₹640 zone, Mehta added. The consolidation phase follows a prolonged downtrend, and a sustained move above ₹780 could attract fresh accumulation.

However, any breakdown below ₹640 might trigger further downside pressure. The stock has fallen over 3% in the past five days.

Fundamentally, the company boasts a 5-year profit CAGR of 25.7% and long-term sales strength.

However, concerns over its 4.75x book value, lack of dividends, and ROE of just 11.2% continue to dampen investor sentiment. The interest coverage ratio remains weak, and the effective tax rate looks unsustainably low, the analyst added.

Recent shareholding data shows promoters' stake rose from 69.94% in March 2025 to 71.19% in June 2025. At the same time, FIIs reduced their holdings from 17.58% to 15.85%, while DIIs marginally raised theirs from 6.33% to 6.89%.

Year-to-date, the stock has gained 5.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)