Advertisement|Remove ads.

Aehr Stock Slumps 20% Premarket After CEO Flags Tariff-Induced Order Delays — Retail Clings To Bullish Stance

Aehr Test Systems, Inc. (AEHR) shares fell over 20% in Wednesday’s early premarket session after the small-cap semiconductor testing solutions company announced mixed quarterly results and flagged a potential slowdown in the first quarter due to tariffs.

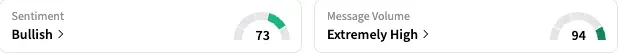

On Stocktwits, retail sentiment toward Aehr stock tempered to ‘bullish’ (73/100) by early Wednesday, from the ‘extremely bullish’ stance seen a day ago. The message volume continued to be ‘extremely high.’

A bullish watcher suggested they would buy the dip.

Another user shrugged off the near-term headwinds, expressing confidence over a new hyperscaler customer the company announced.

Fremont, California-based Aehr reported an adjusted loss per share of $0.01 for the fourth quarter of the fiscal year 2025, reversing from earnings per share (EPS) of $0.84. The company clarified that the year-ago’s bottom-line results included a tax benefit.

The bottom-line result was in line with the Finchat-compiled consensus estimate.

Quarterly revenue fell to $14.1 million from $16.6 million in the fourth quarter of 2024, slightly below the $14.82-million consensus estimate.

Bookings totaled $11.1 million, and backlog stood at $15.2 million as of May 30.

Aehr CEO Gayn Erickson said, “Fiscal 2025 was a transformative year for Aehr Test Systems, marked by significant progress on our strategic initiatives to expand our total addressable market, diversify our customer base, and enhance our product portfolio.”

“A major milestone was the successful launch and adoption of our first production wafer-level burn-in (WLBI) system specifically for artificial intelligence (AI) processors."

Erickson also disclosed that one of the leading processor companies has requested to proceed with an evaluation for wafer-level testing of one of its current high-volume processors.

The executive expressed confidence that nearly all the opportunities and market verticals Aehr serves will experience order growth in fiscal year 2026. However, he warned that the silicon carbide market could see an order decline, as customer forecasts are back-half loaded, with stronger growth expected in fiscal year 2027.

Erickson also said tariffs will likely impact performance in the near term. “While we remain confident in Aehr’s long-term growth prospects, we continue to experience some timing-related delays in order placements due to tariff-related uncertainty, particularly in our first quarter,” he said, adding that the company would not reinstate specific guidance beyond what it had already stated.

Aehr stock has lost about 9% year-to-date, underperforming the broader market and the tech sector.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Dollar Climbs Off Multi-Year Lows As Report Unpacks Bessent’s Influence On Trump Tariff Timeline

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)