Advertisement|Remove ads.

AI Play SoundHound Tumbles 41% In 2025 As Heavy Short Interest Builds: Is Retail Investor Patience Wearing Thin?

- Shares lag AI peers in 2025, weighed down by slowing revenue growth, losses, and negative free cash flow.

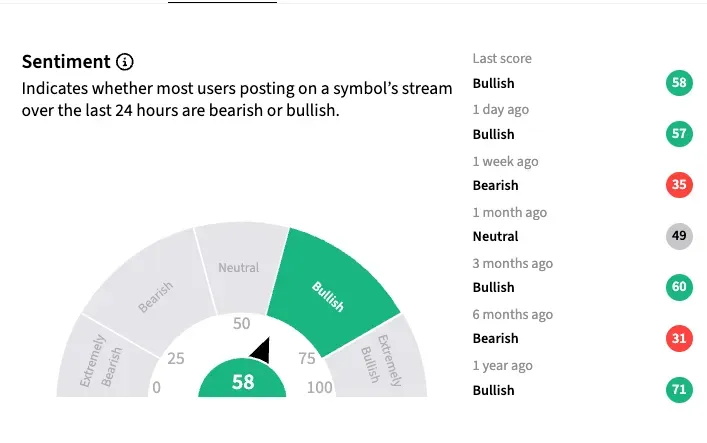

- Retail interest remains strong, with Stocktwits followers up 60% over the past year, and sentiment remains upbeat.

- High short interest and rising analyst price targets point to potential upside if execution improves.

Artificial intelligence (AI)-leveraged stocks came under selling pressure in November as skeptics raised concerns about a bubble waiting to burst, but they have recovered since then. However, shares of conversational AI stock SoundHound AI, Inc. (SOUN) continue to languish.

But SoundHound stock has a substantial retail following, as evidenced by the follower count on Stocktwits, which has spiked by 60% this year.

SoundHound Stock

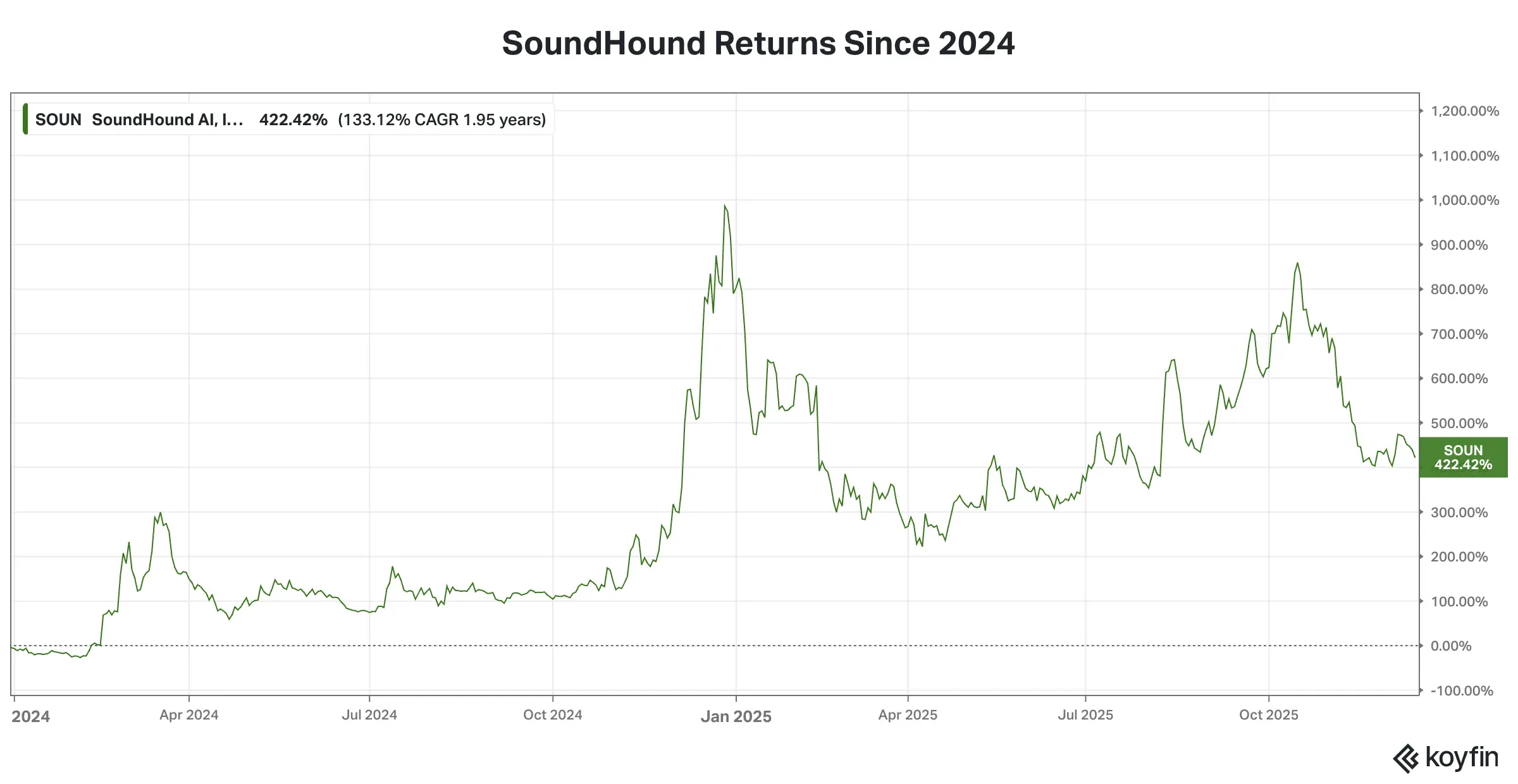

SoundHound’s stock has failed to replicate the late-year rally it witnessed in 2024, when it gained nearly 790%. Much of the gains were made on the back of the deal momentum. The company announced partnerships with companies such as Nvidia and Stellantis, among others. The stock's 41% negative return has trimmed the 2-year return to 422%.

Source: Koyfin

Fundamentals Weighing Down?

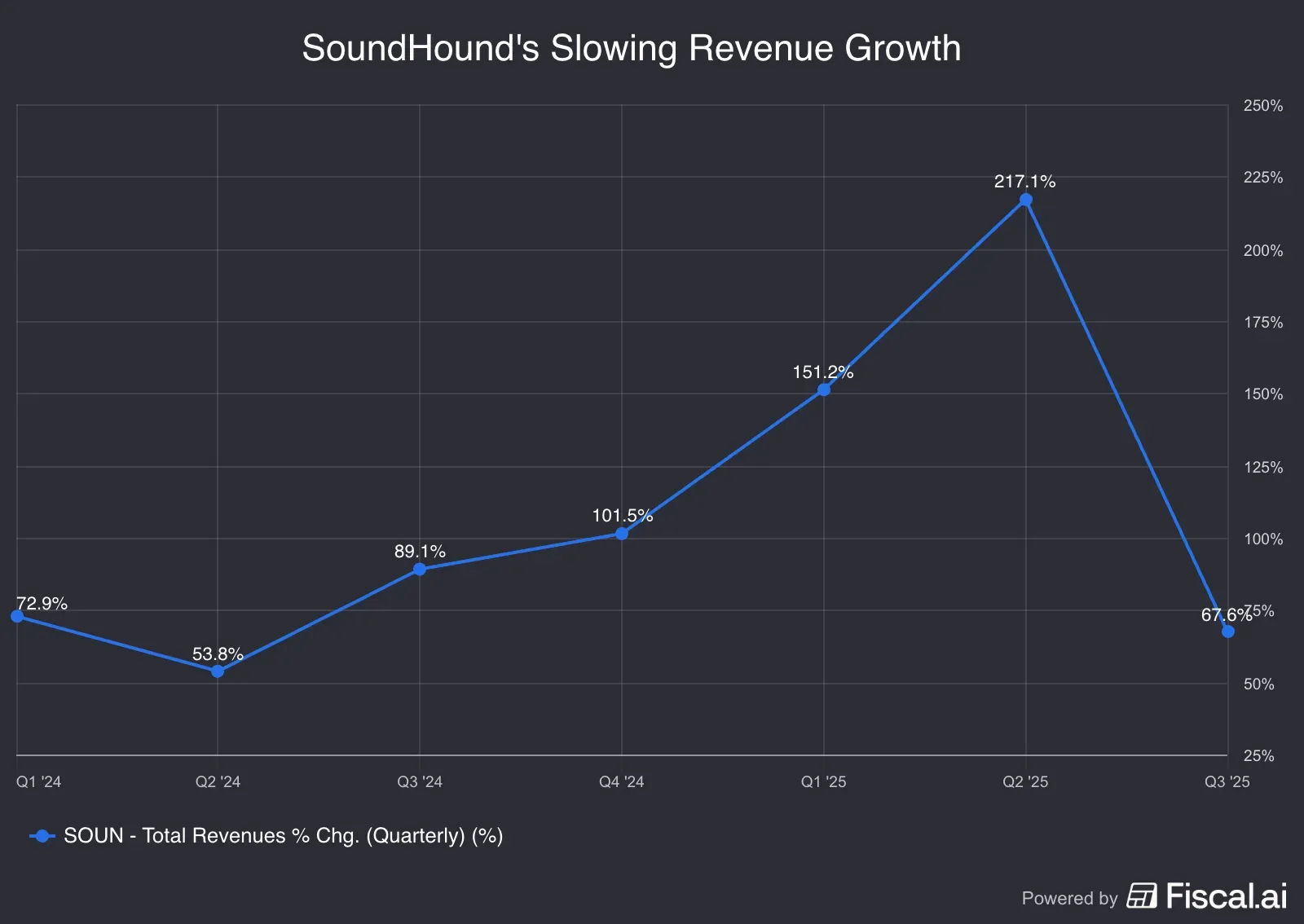

SoundHound’s quarterly revenue growth, which has accelerated since the third quarter of 2024, showed a deceleration in the third quarter this year.

Source: Fiscal.ai

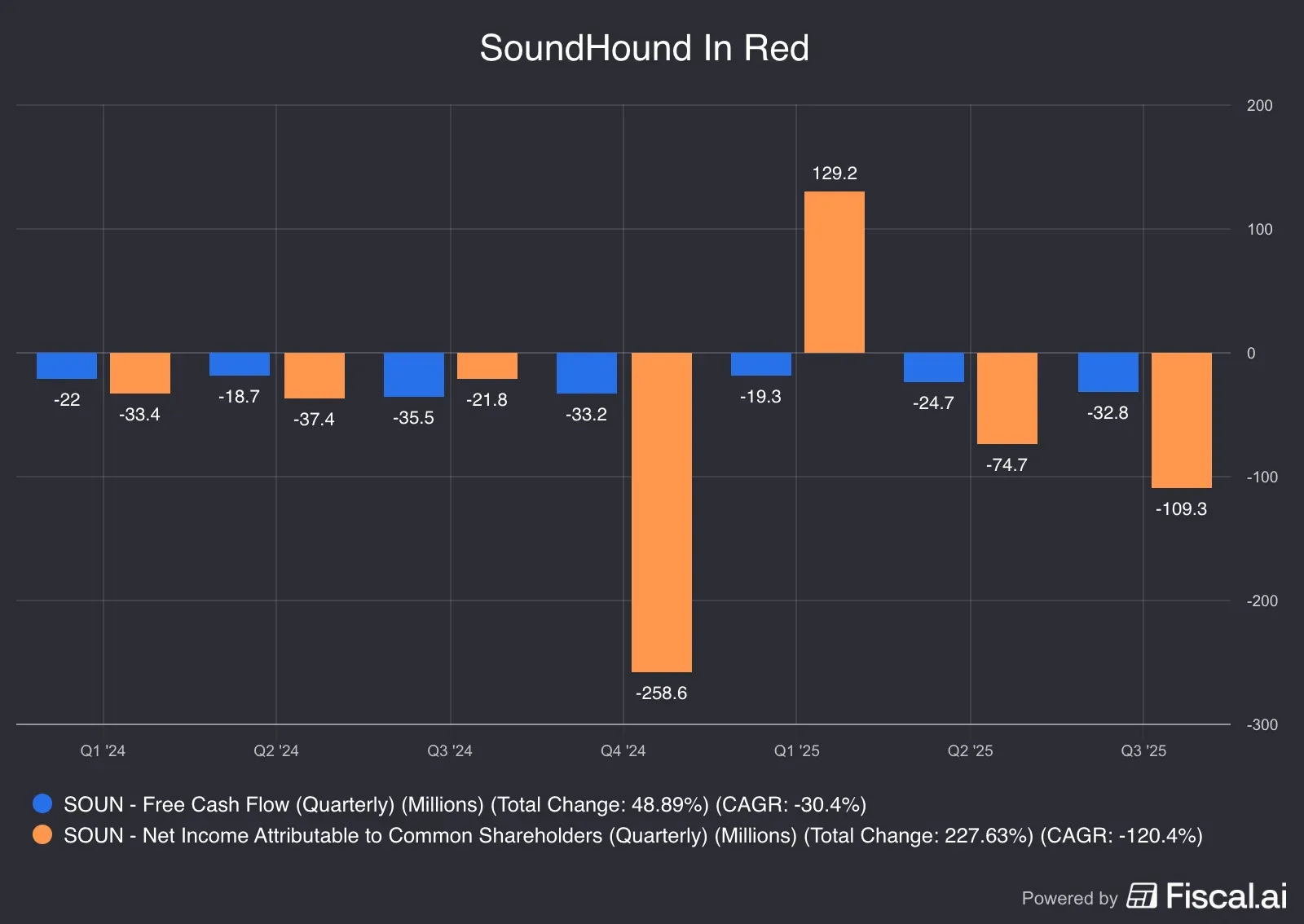

Barring the first quarter of 2025, the company has reported losses since 2024. Free cash flow, which refers to the cash the company has left after spending on operations and investments, has also been negative.

Source: Fiscal.ai

Retail Upbeat

The Stocktwits retail community isn’t ready to give up on this AI play. Sentiment toward the stock was upbeat as of early Monday.

A bullish watcher expressed optimism about the company's opportunity. “SoundHound AI combines audio recognition technology with generative AI to produce AI agents that can replace humans in interactions that aren't usually done face-to-face,” they said.

Another pointed to analysts turning more positive recently. “It appears many of the analysts in the media are starting to become more bullish on Sound again! I’m sure some of them own some too!”

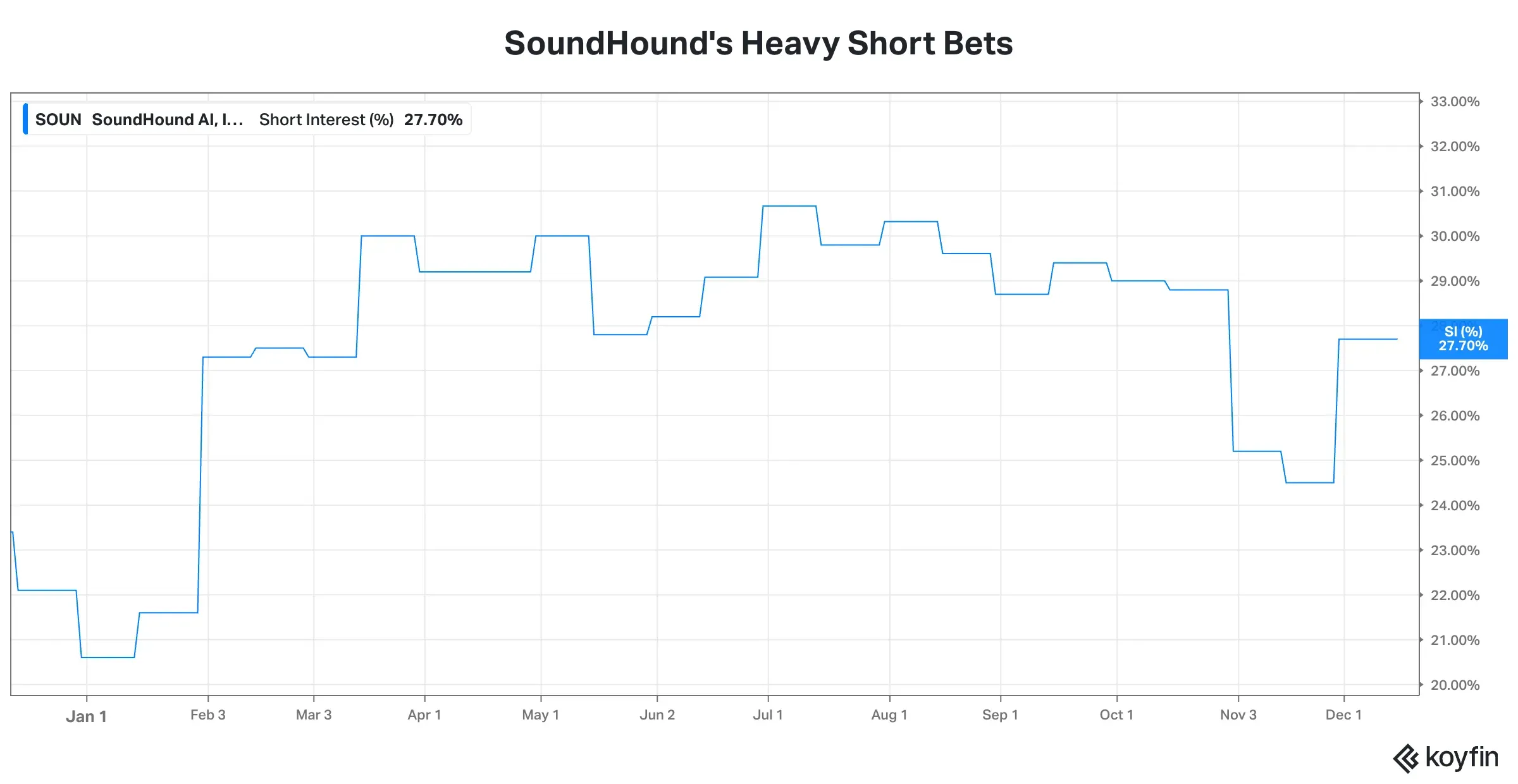

SoundHound is among the stocks with elevated short interest, according to Koyfin. Nearly 28% of the total outstanding shares are shorted, although this percentage has come off from the 30%+ level seen in July.

Source: Koyfin

Source: Koyfin

Analysts See Opportunity

After the negative stock performance this year, analysts have turned bullish. Following the company’s quarterly results in early November, Piper Sandler upped the stock price target to $15 from $12, while remaining ‘Neutral,’ the Fly reported. The firm highlighted a significant IoT win as an interesting development and expressed optimism about the company’s improved traction in APAC.

Last Friday, Cantor Fitzgerald upgraded SoundHound stock to ‘Overweight’ from ‘Neutral,’ and raised the price target to $15 from $13.The firm recommends taking advantage of the recent pullback in the shares. The firm based its bullishness on its view that SoundHound has executed "very well" by cross-selling and upselling voice and conversational artificial intelligence services to its installed base. The firm said expectations are relatively low heading into 2026, considering its view that conversational AI and voice AI are meaningful beneficiaries of secular AI growth trends.

The Koyfin-compiled analyst average price target of $17.19 implies about 50% upside for the stock.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)