Advertisement|Remove ads.

Allegiant Stock Flies Premarket After Q1 Profit Beat, Firm Says Demand Is Stabilizing: Retail’s Still Bearish

Allegiant Travel Co (ALGT) stock rose 7.5% in premarket trading on Wednesday after the company’s first-quarter earnings topped Wall Street’s estimates.

According to Koyfin data, Allegiant Air's parent company reported adjusted earnings of $1.81 per share, while analysts expected it to post $1.55 per share.

The company’s first-quarter operating revenue of $699.1 million topped estimates of $695 million.

It withdrew its 2025 forecast and removed 7.5% of capacity growth from May through August.

“Heightened volatility is impacting domestic demand. Consequently, it is challenging to predict near-term demand,” CEO Gregory Anderson.

The company joined its peers, such as Delta, Frontier, and Southwest Airlines, in pulling their annual forecasts due to the unpredictability surrounding demand.

Analysts fear customers would cut down on air travel if recession fears persist due to a tariff-driven trade war.

However, Anderson said booking trends over the past few weeks suggest a stabilizing demand environment, with indications of improvement observed over the past few days. The company would remain solidly profitable, he added.

Bloomberg reported that the company cut about 10% of its corporate workers over the past few months and trimmed departments’ budgets, citing Anderson.

The report also said that tariffs on Airbus planes have not affected Allegiant as its new aircraft orders come from Boeing.

The company said its confidence in Boeing's ability to deliver aircraft on time is growing. It expects 12 737 MAX deliveries during 2025, three higher than prior estimates.

Allegiant expects second-quarter earnings of up to $1 per share.

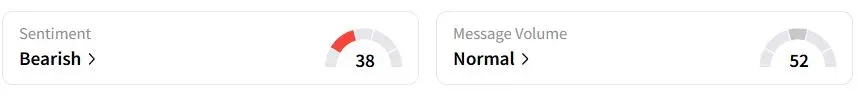

Retail sentiment on Stocktwits was in the ‘bearish’ (38/100) territory, while retail chatter was ‘normal.’

Allegiant stock has fallen 48% year to date (YTD).

Also See: Constellation Energy Extends Gains On Potential Long-Term Power Supply Agreements: Retail’s Elated

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)