Advertisement|Remove ads.

Amazon Stock Posts Worst Day In 2 Months As It Falls Behind 'Mag 7' Peers In The New Year

- Amazon shares declined amid a broad sell-off in the Nasdaq and S&P 500.

- Unlike some other stocks that dropped amid market pressure, Amazon remained in the red in after-hours trading.

- After a weak run in 2025, the three-day drop is worrying retail investors.

Amazon.com, Inc.’s shares declined 2.5% on Wednesday, their worst performance in nearly two months, amid a broad-based sell-off in the Nasdaq. The stock slipped further in after-hours trading.

The Nasdaq declined 1.1%, while the S&P 500 shed 0.5%, triggered by soft results from Wells Fargo and Citigroup.

Market pressure weighed on stocks across most sectors, but Amazon's drop drew increased attention amid heavier trading than usual.

Amazon fell for the third straight day, losing about 4.4% cumulatively in this period. Shares gained a mere 5.2% over 2025, the lowest among the "Magnificent Seven” group.

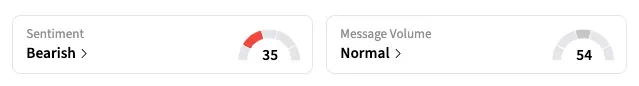

Investors have been patient for a long time, but some might be losing confidence. Unlike some of the other stocks pressured on Wednesday, where dips raised buy calls in the retail crowd, Amazon’s Stocktwits sentiment remained in the ‘bearish’ zone.

“Still not understanding why Amazon was this far down as others recovered?” a user posted on the Amazon stream on Stocktwits. AMZN was marginally lower in the after-market session.

In the past year, Amazon investors have expressed concern about growth in its cloud unit, which is significantly larger than the nearest rival, Microsoft’s Azure. The company posted strong growth in the unit in October, alongside upbeat overall results. However, the stock rally following the earnings release fizzled quickly.

Analysts, however, are overwhelmingly bullish. Currently, 63 of the 67 analysts covering the stock rate it ‘Buy’ or higher, and four rate it ‘Hold,’ according to Koyfin. Their average price target of $295.46 implies a 25% upside to the stock’s last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212049822_jpg_4efc5f756c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)