Advertisement|Remove ads.

Amazon Wins Wall Street Votes Of Confidence As Tariff Fears Mount, Retail Smells A Bargain

Amazon.com, Inc (AMZN) has received backing from Goldman Sachs and Cathie Wood, who expect the company to weather the fallout from Donald Trump's trade war.

In a recent note, Goldman Sachs said the e-commerce giant has multiple levers that it could turn, including raising prices and adjusting its product and vendor mix, to mitigate the impact, according to Investing.com.

Amazon is also expected to benefit after a "de minimis" loophole, which exempts certain low-cost shipments from import duties, closes on May 2. That policy is widely believed to have favored Chinese e-commerce platforms Shein and Temu.

Goldman Sachs cited an in-house study showing that Amazon's worldwide merchandise margin remained stable during policy changes in Trump's first term in 2016.

The research firm maintained its 'Buy' rating and a price target of $255 on Amazon shares, although it flagged some pressure on the company's operating income.

Oppenheimer reportedly believes Amazon's revenue might be more tariff-proof than Meta's (META) or Google's (GOOGL), as the e-commerce giant is also the top biller for cloud services.

Meanwhile, Cathie Wood's Ark Investment Management bought nearly 17,000 shares of Amazon on Monday.

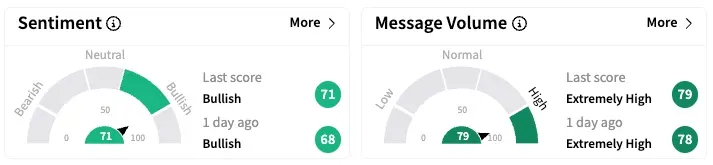

On Stocktwits, retail sentiment rose a few notches to 'bullish' while message volume jumped 170% from a day earlier.

Several users said Wood's purchase of Amazon shares is a buying signal.

A bearish watcher, however, suggested otherwise, noting that the impact of tariffs on firms, including Amazon, might not show for several months.

Shares of AMZN are down 20.1% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)