Advertisement|Remove ads.

American Airlines Sparks Investor Debate After Q2 Beat, Cautious Outlook: Retail’s On Buying Spree

American Airlines Group Inc. (AAL) reported better-than-expected second-quarter (Q2) earnings on Thursday, but issued a cautious outlook for the third quarter (Q3), sending the stock into a downward spiral.

Following the Q2 earnings, American Airlines stock traded over 7% lower on Thursday morning.

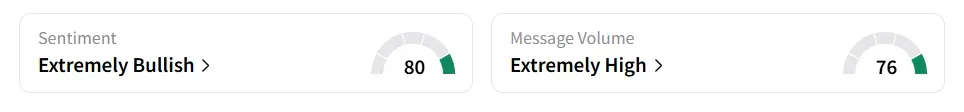

However, on Stocktwits, retail sentiment toward the stock improved to ‘extremely bullish’ (80/100) from ‘bullish’ territory the previous day. Message volume jumped to ‘extremely high’ (76/100) from ‘normal’ levels in 24 hours.

American Airlines experienced a 150% surge in user message count in the last 24 hours.

Some Stocktwits users considered the fall in stock price as an opportunity to buy.

Another user expressed skepticism about the firm.

The company’s revenue remained almost flat at $14.392 billion, exceeding the analysts’ consensus estimate of $14.293 billion, as per Fiscal AI data. The earnings per share (EPS) of $0.91 also surpassed the estimate of $0.77.

The company strengthened its balance sheet significantly in the first half of 2025, generating $3.4 billion in operating cash flow and $2.5 billion in free cash flow.

American Airlines ended the quarter with $12 billion in total liquidity, supported by both cash reserves and available credit lines. However, total debt stands at $38 billion, with net debt at $29 billion at the end of Q2.

For Q3, the company is projecting an adjusted loss per share between $0.10 and $0.60, below the estimate of a loss of $0.01.

For the full year, the company anticipates adjusted EPS to land between a loss of $0.20 and a gain of $0.80.

Management noted that the higher end of the range is feasible if U.S. demand holds steady, but macroeconomic headwinds could push results to the lower bound.

According to a Bloomberg report, CEO Robert Isom strongly criticized the use of artificial intelligence in airline pricing, arguing that it risks misleading passengers.

His remarks align with concerns raised by members of Congress, who are pressing Delta Air Lines Inc. (DAL) for details on its AI-driven pricing strategy.

American Airlines stock has lost 33% in 2025 and has gained over 14% in the past 12 months.

Also See: ServiceNow Stock Surges After Blowout Quarter, Bullish Retail Buzz Hits New High

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)