Advertisement|Remove ads.

American Outdoor Posts Strong Q4 Sales, Surprise Profit: Shares, Retail Sentiment Rise

American Outdoor Brands' (AOUT) shares climbed 11% in premarket trading on Friday, a day after it reported quarterly results that surpassed Wall Street expectations. Retail sentiment also jumped higher.

The company, which sells gear for outdoor activities such as hunting and fishing, reported that net sales increased to $61.9 million in its fiscal fourth quarter, up from $46.3 million in the same period a year ago. Two analysts surveyed by FactSet expected $48.5 million.

It reported adjusted earnings of $0.13 per share, compared with breakeven EPS a year earlier. Two analysts polled by FactSet expected a loss of $0.11 per share.

American Outdoor, however, suspended its fiscal 2026 sales guidance, citing a "dynamic" macroeconomic environment resulting from tariff policies and uneven consumer behavior.

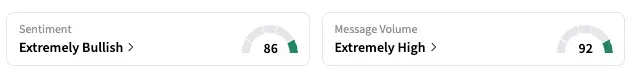

On Stocktwits, the retail sentiment for the company shifted to 'extremely bullish' as of early Friday from 'bullish' the previous day. American Outdoor shares are down 21.5% year-to-date.

"Fiscal 2025 was a landmark year for American Outdoor Brands, as we exceeded our expectations across the board," CEO Brian Murphy said.

Murphy noted that the company's innovation in new products and retail partnerships was the key driver behind its performance.

For the full fiscal year 2025, American Outdoor Brands reported net sales of $222.3 million, up 10.6% from the previous year. Adjusted net income for the year reached $10.0 million, or $0.76 per diluted share, compared to $4.3 million, or $0.32 per diluted share, in fiscal 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)