Advertisement|Remove ads.

Amex GBT Reportedly Mulls Potential Sale, Retail Turns Bullish

- The Bloomberg News report stated that the company’s deliberations are ongoing and there’s no certainty that the efforts will lead to a deal.

- The stock closed higher at $7.32 on Monday, giving it a market capitalization of over $3.7 billion.

- For the third quarter, the firm’s revenue rose 13% to $674 million, with travel segment revenue increasing 10% due to the CWT Travels acquisition.

Global Business Travel Group is expected to draw retail attention on Tuesday after a report said that the business-travel platform is weighing a sale.

The firm, which spun out of American Express, is working with advisers on a sale that would likely draw the interest from other corporate-focused travel platforms and private equity firms, Bloomberg News reported, citing people familiar with the matter.

The report further stated that the company’s deliberations are ongoing and there’s no certainty that the efforts will lead to a deal. The firm, known as Amex GBT, could even choose to remain independent.

What Are Stocktwits Users Thinking?

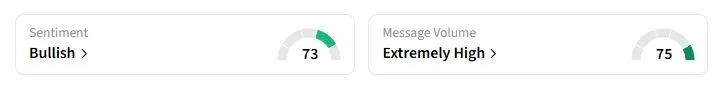

Retail sentiment on Stocktwits about Amex GBT moved to ‘bullish’ territory from ‘neutral’ a day ago, while retail chatter jumped to ‘extremely high.’

Takeover Talks Emerge Amid Stock Underperformance

Amex GBT’s shares have fallen by over 21.4% this year. The stock closed higher at $7.32 on Monday, giving it a market capitalization of over $3.7 billion. Amex GBT’s separation from American Express began in 2014, when the U.S. payments giant sold a stake in the business to a group that included Certares. The report stated that American Express remains Amex GBT’s largest shareholder, holding a 30.1% stake.

The New York-based firm went public through a special-purpose acquisition company backed by Apollo Global Management. In September, the firm acquired rival CWT Travels for $540 million, a deal that invited scrutiny from the U.S. and UK antitrust regulators.

For the third quarter, the firm’s revenue rose 13% to $674 million, with travel segment revenue increasing 10% due to the CWT acquisition.

Also See: Why Is Aerospace Supplier Woodward Stock Gaining 6% Premarket?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)