Advertisement|Remove ads.

Why Is Aerospace Supplier Woodward Stock Gaining 6% Premarket?

- Its aerospace unit rose nearly 20% to $661 million, while the industrial segment sales rose 10% to $334 million.

- The company experienced higher-than-planned legacy engine maintenance, repair, and overhaul volume, along with the expected increase in LEAP and GTF engine component demand.

- For the fiscal year 2026, Woodward expects net sales growth to be between 7% and 12%

Woodward Inc. (WWD) stock rose over 6% in premarket trading on Tuesday after the firm topped Wall Street’s estimates of fourth-quarter earnings.

On an adjusted basis, the company reported net income of $2.09 per share for the quarter ended Sept. 30, while analysts expected $1.89 per share, according to fiscal.ai data. Its net sales were $995 million, compared with analysts’ expectations of $941 million.

What Drove Its Earnings?

Its aerospace unit rose nearly 20% to $661 million, while the industrial segment sales rose 10% to $334 million. The company experienced higher-than-planned legacy engine maintenance, repair, and overhaul volume, along with the expected increase in LEAP and GTF engine component demand. It also expects LEAP and GTF repair revenue to surpass legacy repair revenue in late calendar 2026 or early 2027.

“Aerospace delivered substantial sales and margin expansion supported by high aircraft utilization and robust defense activity, while Industrial achieved double-digit growth across power generation and oil & gas markets,” said CEO Chip Blankenship. The company counts GE Aerospace and Boeing among its customers.

What Are Stocktwits Users Thinking?

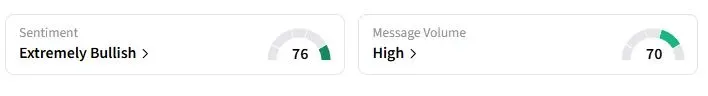

Retail sentiment on Stocktwits about Woodward was in the ‘extremely bullish’ territory at the time of writing.

“In Aerospace, we are prepared for increased OEM orders as the aircraft manufacturers stabilize and increase production rates and as defense customers continue to signal strong demand,” Blankenship said during a call with analysts.

For the fiscal year 2026, Woodward expects net sales growth to be between 7% and 12%. It projected aerospace sales growth of 9% to 15% and industrial sales growth of 5% to 9%.

Woodward stock has gained over 55% this year.

Also See: Why Is Amentum Stock Rising Over 9% Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)