Advertisement|Remove ads.

Apple Most Under-Owned Mega-Cap Tech Name Exiting Q4: Morgan Stanley Positive About Stock Trajectory

Apple, Inc. (AAPL) is the most under-owned mega-cap tech stock, exiting the fourth quarter, according to Morgan Stanley’s analysis of 13F reports. The firm said the mega-cap group per se has been the most under-owned in over 16 years.

The criteria for gauging ownership interest is the spread between institutional ownership and a stock's S&P 500 weighting.

Morgan Stanley noted that, on average, the spread for the largest tech companies, namely Apple, Amazon, Inc. (AMZN), Alphabet, Inc. (GOOGL) (GOOG), Meta Platforms, Inc. (META), Microsoft Corp. (MSFT) and Nvidia Corp (NVDA), was 124 basis point (bps) exiting the fourth quarter. It added that this marked a widening from 96 bps at the end of the third quarter.

The brokerage called it the “widest” mega-cap tech under-ownership spread since it began collecting this data in 2008.

Morgan Stanley noted that Apple’s spread widened by 38 bps sequentially to -2.23%

Explaining what it means for the stock, the firm said its quant analysis of historical ownership data showed that, on average, after adjusting for market cap and earnings beats, there is a significant relationship between low active ownership relative to the S&P 500 Index and future stock performance.

“On average, stocks appear to experience a technical pull higher when active ownership is much lower than the market, and vice versa,” the firm added.

Laying out its thesis for Apple, Morgan Stanley said, “Apple Intelligence is a clear catalyst for a multi-year product upgrade cycle that creates a positively skewed risk/reward over the next 12 months.”

The optimistic view is premised on the record 1.4 billion+ iPhone installed device basis and the replacement cycle that has never been so extended.

The firm expects Apple to benefit from a multi-year iPhone refresh, consistent double-digit Services growth, and strong gross margins.

Not all analysts are that upbeat. BofA Securities analyst Wamsi Mohan said in a recent note that Apple may have to raise prices by about 9% on its hardware products to offset any impact from President Donald Trump’s 10% tariffs on goods imported from China, CNBC reported.

Mohan said if Apple keeps prices unchanged in the U.S., its bottom line will be dented by $0.26 per share in calendar year 2026. According to the analyst, a 3% price hike will still result in a $ 0.21-per-share drop in earnings.

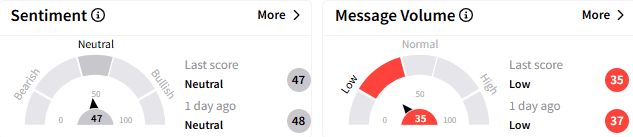

On Stocktwits, sentiment toward Apple stock remained ‘neutral’ (47/100), with the message volume at a ‘low’ level.

Apple stock traded up 0.22% at $245.37 on Thursday afternoon. The launch of the affordable iPhone 16e model has done little to improve sentiment as the stock trades down over 2% this year

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)