Advertisement|Remove ads.

AppLovin Stock Crashes After Edwin Dorsey’s Bear Cave Alleges Potential ‘Advertising Fraud’ – Retail Mood Stays Deflated

AppLovin Corp. (APP) shares tumbled on Thursday after short-seller Edwin Dorsey flagged a potential advertising fraud at the company in his “Bear Cave” substack newsletter and the broader market experienced a pullback.

Palo Alto, California-based AppLovin is an app marketing platform.

Dorsey said in the report that he believes AppLovin’s rapid rise, marked by 750% stock price appreciation from a year ago, is fueled by low-quality revenue growth from “ads that are deceptive, predatory, and at times unreadable or unclickable.”

The findings are based on Bear Cave’s investigation, which involved spending dozens of hours playing mobile games in the AppLovin ecosystem.

Dorsey noted that AppLovin stock traded at around 35 times its revenue

He added that AppLovin, run by founder, Chairman, and CEO Adam Foroughi, is sometimes described as “opaque and difficult to understand.”

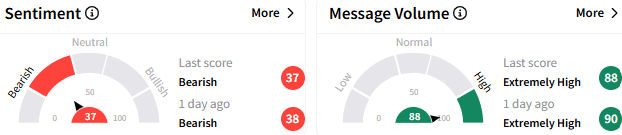

On Stocktwits, retail sentiment toward AppLovin stock stayed ‘bearish’ (37/100), and the message volume remained ‘extremely high.’

A retail watcher said Thursday’s plunge marked a “bubble burst.”

Even before the Bear Cave report, another user branded the company as the “most overvalued stock” in the market.

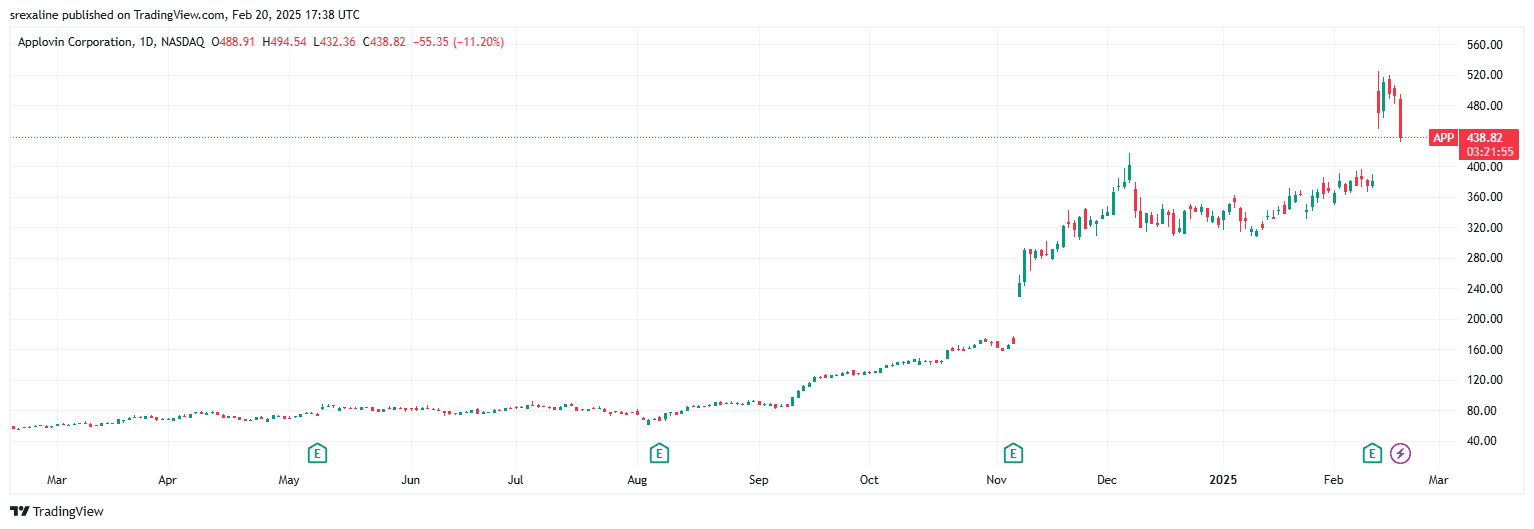

After being rangebound since its listing in April 2021, AppLovin’s stock moved out of the range in mid-September 2024. It gapped notably higher in early November after the company reported third-quarter earnings and revenue above expectations, thanks to substantial platform revenue.

After topping out in early December, the stock was rangebound again, before the fourth-quarter results fueled another strong rally, taking the stock past the $500 mark.

AppLovin stock slumped 11.46% to $437.56 by Thursday afternoon, with the pullback accompanied by slightly above-average volume.

Sell-side analysts are bullish on the stock. The average analysts’ price target for the stock is $539.88, according to TipRanks, offering scope for over 9% upside potential. Of the 18 analysts rating the stock, 14 have ‘Buy’ recommendations, and four have ‘Neutral’ ratings.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_shopify_signage_resized_a95ee6ba6d.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)