Advertisement|Remove ads.

Apple Reportedly Challenges ESPN For F1 Coverage: Retail’s Skeptical

Apple Inc. (AAPL) is reportedly pursuing the U.S. broadcast rights for Formula 1, intensifying its push into live sports following the success of its recent F1-themed film.

A Financial Times report stated that the move marks the tech giant’s continued effort to expand the reach and appeal of its Apple TV+ streaming platform with premium sports content.

Following the report, Apple stock traded 0.04% lower in Wednesday’s premarket.

Walt Disney Co.’s (DIS) ESPN, which currently holds the U.S. broadcasting contract for Formula 1, may face stiff competition when the rights come up for grabs next year.

The window of exclusivity for ESPN to renegotiate its contract has closed, opening the door for rivals. According to a report from The Athletic, streaming giant Netflix Inc. (NFLX) is also said to be considering bidding for the F1 broadcasting rights.

‘F1: The Movie’ starring Brad Pitt, has become Apple’s highest-grossing movie to date, earning $293 million globally within its first 10 days in theaters.

The collection has surpassed the total worldwide box office earnings of the tech behemoth’s previous releases, Killers of the Flower Moon ($158 million) and Napoleon ($221 million), according to a report from Variety.

Formula 1’s U.S.-based owner, Liberty Media, has prioritized the American market in recent years, betting on pop culture to draw new audiences.

Apple has increasingly been making live sports a central focus of its streaming efforts. Back in 2022, the tech giant inked agreements with Major League Baseball and Major League Soccer to showcase specific matchups, underscoring its broader goal of establishing a strong presence in the sports media landscape.

F1 currently earns about $85 million annually from its U.S. broadcast partnership with ESPN. U.S. F1 viewership has surged under ESPN’s coverage, with audience numbers more than doubling since 2018.

Formula 1 has traditionally partnered with major U.S. television networks, having previously teamed up with Fox and NBC before ESPN secured the rights to air its races.

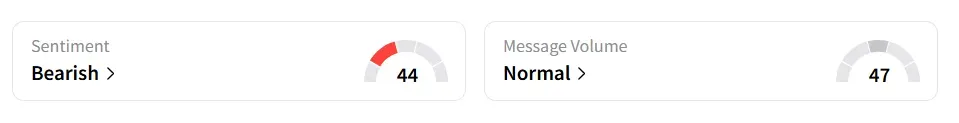

On Stocktwits, retail sentiment around Apple changed to ‘bearish’ from ‘bullish’ territory the previous day amid ‘normal’ message volume levels.

Apple stock has lost over 16% in 2025 and over 8% in the last 12 months.

Also See: China Eyes Procuring Over 100,000 Nvidia Chips To Power Remote AI Hub In Gobi Desert: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)