Advertisement|Remove ads.

Apple’s $100B US Investment Pledge Drives This Rare Earth Miner Higher After-Hours, Retail Starts To Find ‘Pot Of Gold’

MP Materials (MP) stock gained 7.8% in extended trading on Wednesday after Apple CEO Tim Cook mentioned the importance of the rare earth firm in the supply chain for the iPhone maker.

“We are committed to buying American-made advanced rare earth magnets, developed by MP Materials, which will become part of Apple devices shipped around the world,” Cook said at the White House after unveiling $100 billion in additional investments in the U.S.

The tech giant has invested $500 million in MP, the sole operator of a rare earths mine in the U.S., which is rapidly expanding its domestic production capacity amid concerns over the supply of the critical minerals, produced mainly in China.

“MP is the only fully-integrated rare earth producer in the United States,” Cook added before adding that Apple’s tie-up with the company will help MP expand its flagship facility in Fort Worth, Texas, and a recycling facility in California.

Retail sentiment on Stocktwits about MP was still in the ‘bearish’ territory at the time of writing.

However, positive messages about the stock began to flood in the evening. “It’s been a long road since the SPAC days, but we knew the pot of gold was somewhere on that road,” one user said.

All-Time Highs, With Room To Grow

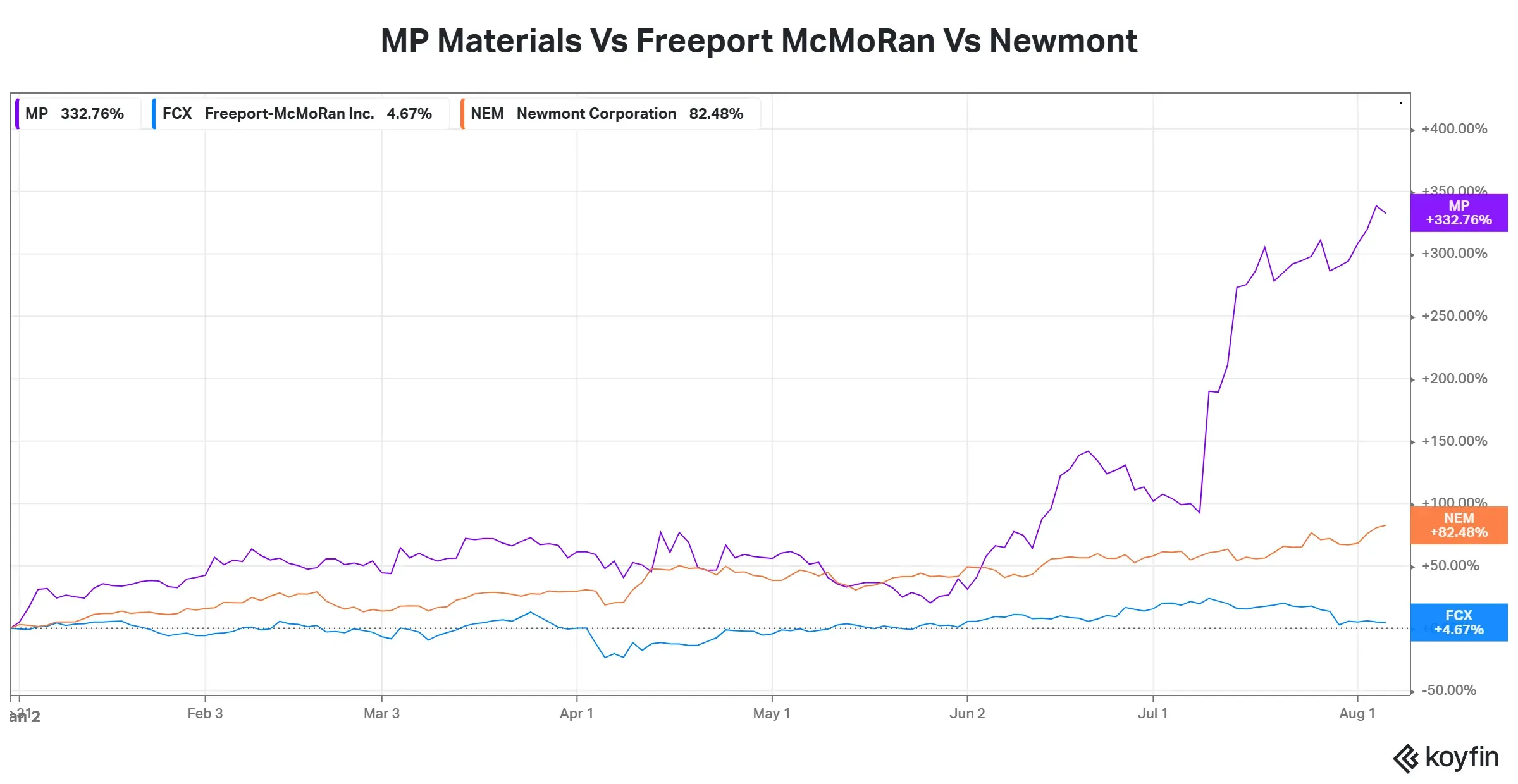

MP Materials stock has more than quadrupled this year, compared with just 4.7% gains of the top copper miner, Freeport-McMoRan stock. It has even outpaced the 82.8% rise in Newmont’s share prices, the top gold miner.

Apart from the agreement with Apple, MP also inked a multi-billion-dollar deal with the U.S. Department of Defense last month, which made the Pentagon its biggest shareholder. The stock has already touched its all-time high in the past few days, with analysts projecting further upside.

According to TheFly, earlier this week, BofA raised the price target for MP stock to $78 from $42. The brokerage reportedly raised its earnings estimates for the company significantly, due to its partnership with the Pentagon as well as higher prices for rare earth magnets.

The stock closed at $67.51 on Wednesday, already higher than the consensus price target of $60.30, as per Fiscal.ai data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203271662_jpg_17b2d32174.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)