Advertisement|Remove ads.

Arm Shares Rise Pre-Earnings, But Retail Worries Stock May Be Overvalued

Shares of Arm Holdings Plc. ($ARM) were up as much as 2% during early trading hours on Wednesday with the chip-design company scheduled to report its second-quarter earnings after the bell.

Wall Street is expecting earnings per share (EPS) of $0.26 on revenue of $810.03 million, according to Stocktwits data.

Arm’s stock has nearly doubled in value this year so far with gains of 108%. While retail sentiment is bullish, some industry watchers are concerned that Arm’s share-price jump won’t be reflected in its earnings.

“At the end of the day, Arm is a company with multiple far surpassing Nvidia, without anything like a Nvidia-esque growth rate,” Senior Portfolio Manager at Synovus Trust, Dan Morgan, told Bloomberg.

Last week, Bernstein downgraded Arm’s stock to ‘Underperform’ from ‘Market Perform’ while maintaining its price target of $100.

The brokerage said it’s struggling to find any upside for the stock from its current share levels even as the long-term equity story “remains very appealing.”

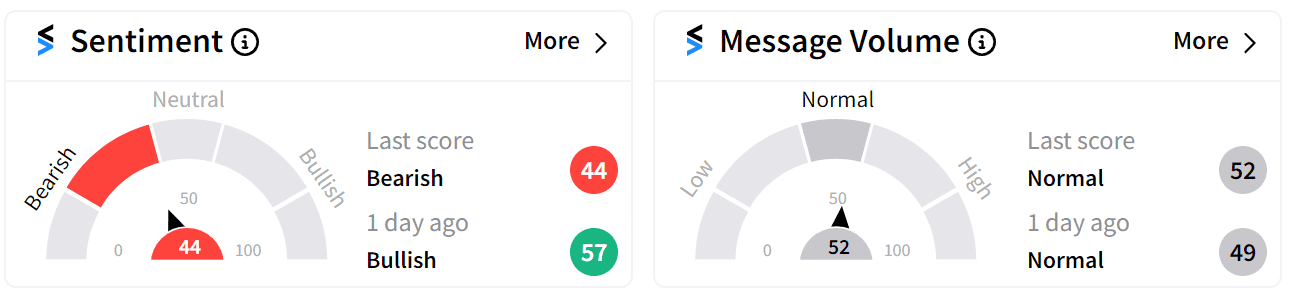

Retail sentiment on Stocktwits reflected similar concerns, flipping into ‘bearish’ (44/100) territory from ‘bullish’ a day ago despite Arm’s consistent outperformance of estimates over the past four quarters.

Meanwhile, Arm has been embroiled in an escalating legal dispute with one of its largest clients, Qualcomm ($QCOM), which is also scheduled to report its earnings after the bell on Wednesday.

Last month, Arm gave Qualcomm a 60-day notice for the cancellation of its architectural chip design license. This was the company’s latest move, a legal battle that began in 2022 when Arm sued Qualcomm for breach of contract and trademark after Qualcomm acquired Nuvia.

Arm claims that Qualcomm is violating its licensing agreement by using Nuvia’s designs in its new PC processors and Snapdragon smartphone chits. Qualcomm has countered saying that its existing agreement covers Nuvia’s developments and it is acting within its rights.

For updates and corrections email newsroom@stocktwits.com.

Read more: Qualcomm Stock Rises Ahead of Earnings Despite Smartphone Revenue Concerns, Retail Remains Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)