Advertisement|Remove ads.

Qualcomm Stock Rises Ahead of Earnings Despite Smartphone Revenue Concerns, Retail Remains Bullish

Qualcomm ($QCOM) shares were up over 1% ahead of markets opening on Wednesday with the chip-maker scheduled to report its fourth-quarter earnings after the bell.

Wall Street forecasts Qualcomm to report earnings of $2.56 per share on revenue of $9.9 billion.

JPMorgan has lowered its price target on the stock ahead of the earnings to $194 from $210 while maintaining an ‘Overweight’ rating. According to the brokerage, the lack of recovery in the smartphone is likely to weigh on Qualcomm’s fourth-quarter results.

However, despite a weaker outlook for Qualcomm’s specific markets, JPMorgan believes its "conservative" short-term forecasts remain largely unaffected.

While Qualcomm is largely known for making chips for smartphones, it has also diversified into making chips for the Internet of Things (IoT) segment and the automotive industry.

Investors will be on the lookout for developments on both fronts given that Qualcomm’s revenue from smartphone chips, which accounted for 65% of its total revenue in the last year, may reduce in the coming quarters.

Reports suggest that Apple ($AAPL), a key client of Qualcomm, is seeking to reduce its reliance on Qualcomm's 5G chips for its iPhones. It has been trying to design its own 5G chips since 2019 and may finally be ready to use those chips in its upcoming iPhones.

Bernstein analyst Stacey Rasgon estimates that Apple accounted for nearly one-fifth of Qualcomm’s revenue in the first three quarters. She forecasts that 80% of those sales could be gone by the end of fiscal 2026.

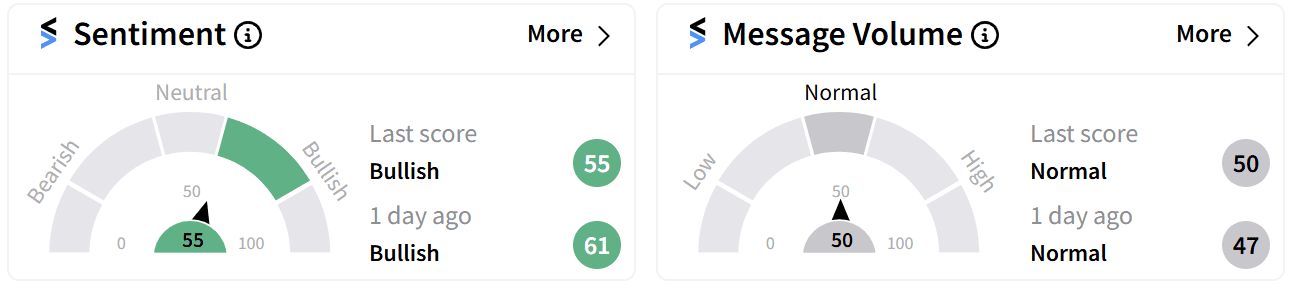

Retail sentiment around Qualcomm has been consistently ‘bullish’ (55/100) in the run-up to its earnings despite concerns around its splintering partnership with Arm Holdings ($ARM).

Qualcomm has been locked in an escalating legal battle with Arm over a critical architectural license agreement. This conflict stems from Qualcomm’s acquisition of Nuvia and the subsequent use of its designs in Snapdragon chips.

If unresolved, this could jeopardize Qualcomm’s ability to produce key processors for Android smartphones and significantly impact its revenue.

The two are expected to face each other in court in December.

Qualcomm has gained 20% so far this year.

For updates and corrections email newsroom@stocktwits.com.

Read more: US Election 2024: Trump Media, Phunware, Rumble Stocks Soar Post-Election — But Retail Is Divided

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)