Advertisement|Remove ads.

Arrowhead Pharma Expects Sarepta Therapeutics To Continue Meeting Financial Obligations: Retail Cheers The Announcement

Arrowhead Pharmaceuticals, Inc. (ARWR) announced on Wednesday that it expects its licensing partner, Sarepta Therapeutics (SRPT), to continue meeting its required financial obligations to the company despite recent setbacks.

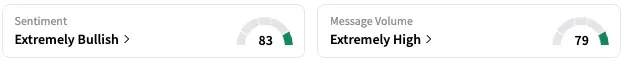

On Stocktwits, retail sentiment around Arrowhead jumped from ‘bullish’ to ‘extremely bullish’ over the past 24 hours, while message volume remained at ‘extremely high’ levels.

Retail chatter around Arrowhead increased by 83% over the past seven days.

Arrowhead has an ongoing exclusive license and collaboration agreement with Sarepta, including four clinical-stage drug candidates and three pre-clinical programs.

The company stated on Wednesday that it continues to conduct clinical and non-clinical studies as stipulated in the agreement and that Sarepta has provided no indication of any intention to fail to fulfill its obligations. Furthermore, Sarepta has experienced setbacks in products and programs unrelated to those licensed from Arrowhead, the company noted.

However, if Sarepta fails to meet its financial obligations, there are clear termination provisions that would cause assets and associated intellectual property to be returned to Arrowhead, the company stated. Arrowhead would further have no obligation to return any consideration Sarepta had already paid, it noted.

Upon closing the agreement with Sarepta in February, Arrowhead received a $500 million upfront payment and an additional $325 million through Sarepta's purchase of Arrowhead common stock. As per the terms of the agreement, Arrowhead will also receive $250 million, payable in annual installments of $50 million over five years, and is eligible to receive $300 million in near-term payments associated with certain milestones.

Arrowhead believes it is on track to earn the first $100 million soon and the remaining $200 million by year-end.

A Stocktwits user applauded the “tone and positioning” of Arrowhead’s announcement.

Earlier this week, Sarepta announced a voluntary halt to U.S. shipments of its Duchenne muscular dystrophy (DMD) gene therapy, Elevidys.

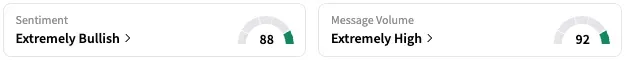

On Stocktwits, retail sentiment around Sarepta trended in the ‘extremely bullish’ territory, coupled with ‘extremely high’ message volume. The message count around Sarepta has surged 595% over the past seven days.

A Stocktwits user expressed optimism for Sarepta’s Elevidys to be reintroduced to the market.

At the time of writing, ARWR stock was trading 11% higher, while SRPT stock had risen by 2%.

SRPT stock, however, has fallen by about 89% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)