Advertisement|Remove ads.

AstraZeneca Bets Big On America With $50B Investment, New Virginia Hub Plans Amid Pharma Tariff Jitters

AstraZeneca Plc. announced on Monday that it plans to invest $50 billion in the U.S. by 2030, with a focus on expanding drug manufacturing and research across the country.

The move comes as President Donald Trump threatens to impose sweeping 200% tariffs on all pharmaceutical imports, which could significantly hit global drugmakers that manufacture much of their supply outside the U.S.

At the center of the company’s plan is a new, multi-billion-dollar manufacturing facility in Virginia. The site will produce drug substances for AstraZeneca’s expanding pipeline of weight loss and metabolic treatments, including next-generation oral GLP-1 therapies, baxdrostat, oral PCSK9, and other small-molecule drugs.

AstraZeneca stated that the Virginia site would represent its largest single manufacturing investment globally, with AI, automation, and data analytics integrated to enhance productivity.

The broader investment also includes:

- Expanded R&D hubs in Gaithersburg, MD and Cambridge, MA

- New cell therapy manufacturing facilities in Rockville, MD and Tarzana, CA

- Upgrades to production sites in Mount Vernon, IN and Coppell, TX

- New clinical trial supply sites

The company expects the investment to help create tens of thousands of skilled jobs and support its goal of reaching $80 billion in revenue by 2030, with roughly half of the revenue coming from the U.S. market.

This announcement follows AstraZeneca’s earlier $3.5 billion commitment to the U.S., unveiled in late 2024, and underscores growing confidence in America as a biopharma manufacturing hub.

AstraZeneca joins a wave of major pharmaceutical companies, including Roche Holding AG, Eli Lilly, Novartis, Sanofi, and Johnson & Johnson, in ramping up U.S. investments following Trump’s tariff threats.

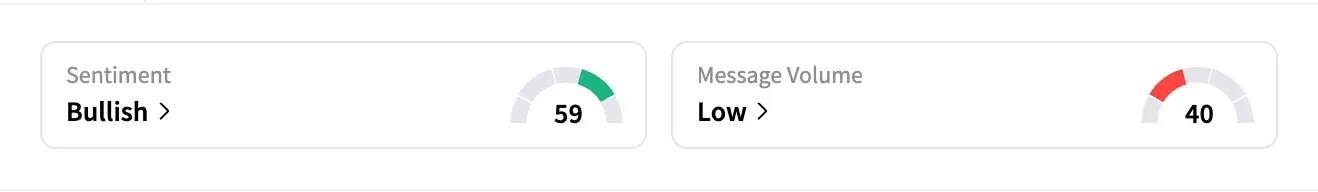

Retail sentiment on Stocktwits turned ‘bullish’ on Monday after AstraZeneca said its Tagrisso-based combination therapy showed a significant improvement in overall survival for patients with advanced EGFR-mutated non-small cell lung cancer, according to final results from a Phase 3 trial.

The combination, being studied as a first-line treatment for locally advanced or metastatic EGFR-mutant lung cancer, had previously delivered the longest-ever progression-free survival in this patient group, which includes many non-smokers and people of East Asian descent.

AstraZeneca’s stock has risen over 4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Sarepta Pauses Shipments Of DMD Drug Elevidys Amid FDA Label Review

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)