Advertisement|Remove ads.

Autodesk Ends PTC Pursuit, Sharpens Focus On Organic Growth: Retail’s Buoyant

Autodesk Inc. (ADSK) has dropped its plans to acquire PTC Inc. (PTC), ending what would have been one of the largest acquisition deals this year.

In a business update issued on Monday, the software designer said it remains firmly aligned with its ongoing objectives, which include boosting margins through streamlined sales and marketing efforts and funding smaller, targeted acquisitions.

Following the statement, Autodesk stock traded over 3% higher on Monday morning.

The company also reiterated its commitment to long-term shareholder value through strategic investments in cloud infrastructure, platform innovation, and artificial intelligence.

“We are confident in our plans to drive long-term shareholder value and remain focused on executing our established strategic priorities in cloud, platform, and AI; optimizing our sales and marketing to drive higher margins; and allocating capital to organic investment, targeted and tuck-in acquisitions, and continuing our share repurchase program as our free cash flow grows”.

On July 10, reports suggested that Autodesk was exploring a potential takeover bid for engineering software provider PTC. The merger would have marked a consolidation in the industrial-software sector amid rising demand fueled by artificial intelligence adoption.

Established in the 1980s, PTC provides design software used in sectors like aerospace, computing, and medical devices.

Autodesk has been facing pressure to make changes in its management. Earlier in the year, activist investor Starboard Value took a stake in Autodesk and began advocating for board changes, expressing concern over the company’s financial performance and its approach to addressing accounting matters.

The company anticipates fiscal year 2026 revenue of $6.925 billion - $6.995 billion, within the analysts' consensus estimate of $6.97 billion as per Finchat data.

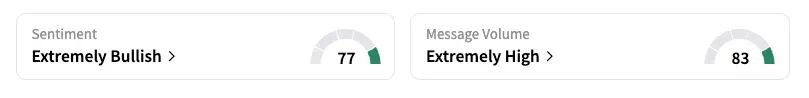

On Stocktwits, retail sentiment toward Autodesk remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Autodesk stock has shed over 1% year-to-date and has gained over 15% in the last 12 months.

Also See: BIT Mining Expands Ethiopian Crypto Footprint With Data Center Buyout: Retail Stays Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dominos_resized_jpg_f70082df7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1198350622_jpg_c4fc77e19d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)