Advertisement|Remove ads.

Deal Street: Retail Goes Crazy Over This Pet Wellness Stock After Firm Gets Acquired At Massive Premium

Shares of PetIQ (PETQ) soared over 79% on Wednesday after the firm disclosed that Bansk Group will acquire all of its outstanding shares of common stock for $31 per share, in an all-cash transaction. The deal values the firm at approximately $1.50 billion.

Bansk Group is a New York-based private investment firm focused on investing in and building distinctive consumer brands.

PetIQ said its board of directors has approved the agreement, which represents a premium of approximately 41% to the 30-day volume-weighted average stock price as of August 06, 2024. Notably, shares of the firm closed near the $20 mark on Tuesday and the agreement value left an upside potential of over 50%.

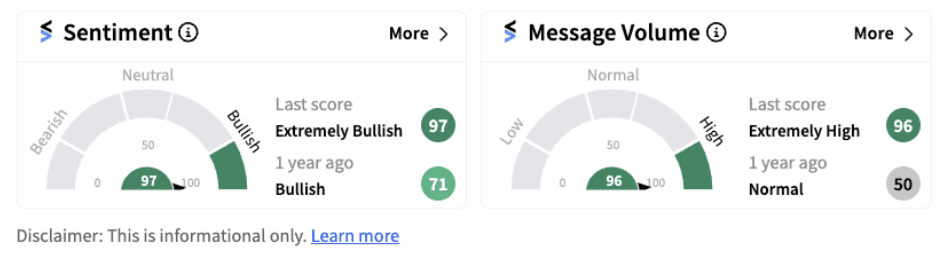

Following the announcement, retail sentiment on the stock flipped into the ‘extremely bullish’ territory (97/100) from the ‘bullish’ zone a day ago, accompanied by huge message volume.

Cord Christensen, Founder, Chairman and CEO of PetIQ pointed out that the firm will utilize Bank’s extensive operational and brand-building experience, including their direct expertise of managing consumer health products for over four decades. “This transaction provides us with an incredible opportunity to continue to execute on our strategy of providing pet parents convenient access to affordable pet healthcare while accelerating many longer-term growth initiatives,” Christensen said.

The transaction is expected to close in the fourth quarter of 2024 and upon completion, PetIQ’s common stock will no longer be listed on the Nasdaq. PetIQ will be privately held and continue to be operated independently by the firm’s executive team, the company said in a release.

Photo Courtesy: Kristin O Karlsen on Unsplash

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)